Pound-to-Dollar Rate Forecast for the Week Ahead: Support Beckons

- GBP/USD is approaching a tough chart floor which it may struggle to break below

- The main release for the Pound in the week ahead is PMI data

- The Dollar's key releases are inflation, ISM Manufacturing, Payrolls and the meeting of the Federal Reserve

© Nazli Sart, Adobe Stock

Pound Sterling has fallen beneath the psychological 1.40 level against the US Dollar as UK and US interest rates diverge.

One Pound buys 1.3774 Dollars at the time of writing, a substantial decline from the previous week's levels that were seen above 1.4000.

From a technical perspective, our studies note the Pound-to-Dollar exchange rate is nearing a support zone (orange hatching) in the 1.36/37 region made up of a major trendline, a monthly pivot and the March lows at 1.3704.

These three levels are expected to act as a 'marble floor' preventing further downside.

Only a clear break and close below the trendline at circa 1.3660 would signal a fresh bout of downside.

To be clear a close below 1.3660 or a break below 1.3630 would almost certainly confirm further downside to a target at 1.3530 at the level of the 200-day moving average (MA).

Large moving averages are difficult to overcome as they are the locations of increased supply or demand due to more trading activity because they are popular indicators amongst investors.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Data and Events to Watch for the Dollar

It is a relatively busy week for the US Dollar given the economic schedule includes the May FOMC meeting on Wednesday, Non-Farm Payrolls on Friday, Inflation data on Monday and ISM Manufacturing on Tuesday - all big-hitting data releases with the potential to move markets.

Possibly the most important release is US Personal Consumption Expenditure (PCE), which is the Federal Reserve's favoured inflation gauge.

Core PCE is the one to watch, released at 13.30 on Monday, April 30, and is expected to show a strong rise to 1.9% in March from 1.6% in February.

Given the importance of rising bond yields as a factor in the strengthening Dollar, PCE has the potential to fuel further gains since yields reflect investor compensation for inflation.

The Dollar could gain a lift, especially if PCE comes out higher, for example, at 2.0% which would be slap bang at the level of the Fed's inflation target.

Higher inflation encourages the Fed to raise interest rates which leads to a stronger Dollar, because higher rates draw more capital inflows from foreign investors seeking a lucrative place to park their money, and this increases demand for Dollars.

"US inflation numbers are likely to be of even greater importance. The recent pick-up in US inflation has helped boost the 10y yield in recent months and has also provided tailwinds for the USD," says Andreas Steno Larsen, an FX and FI strategist at Nordea Bank.

To some extent, Monday's inflation result has the potential to impact on the Federal Open Market Committee (FOMC) meeting on Wednesday, at 19.00. The Fed sets interest rates according to its inflation expectations but as things stand at the moment it is not expected to make any changes to its forward guidance or change the interest rate at this particular meeting.

"With no press conference or forecast updates, the May FOMC meeting should be a relatively quiet affair. We expect no significant changes to the statement language, with a small risk that a more upbeat inflation outlook ends up sounding hawkish," says TD Securities.

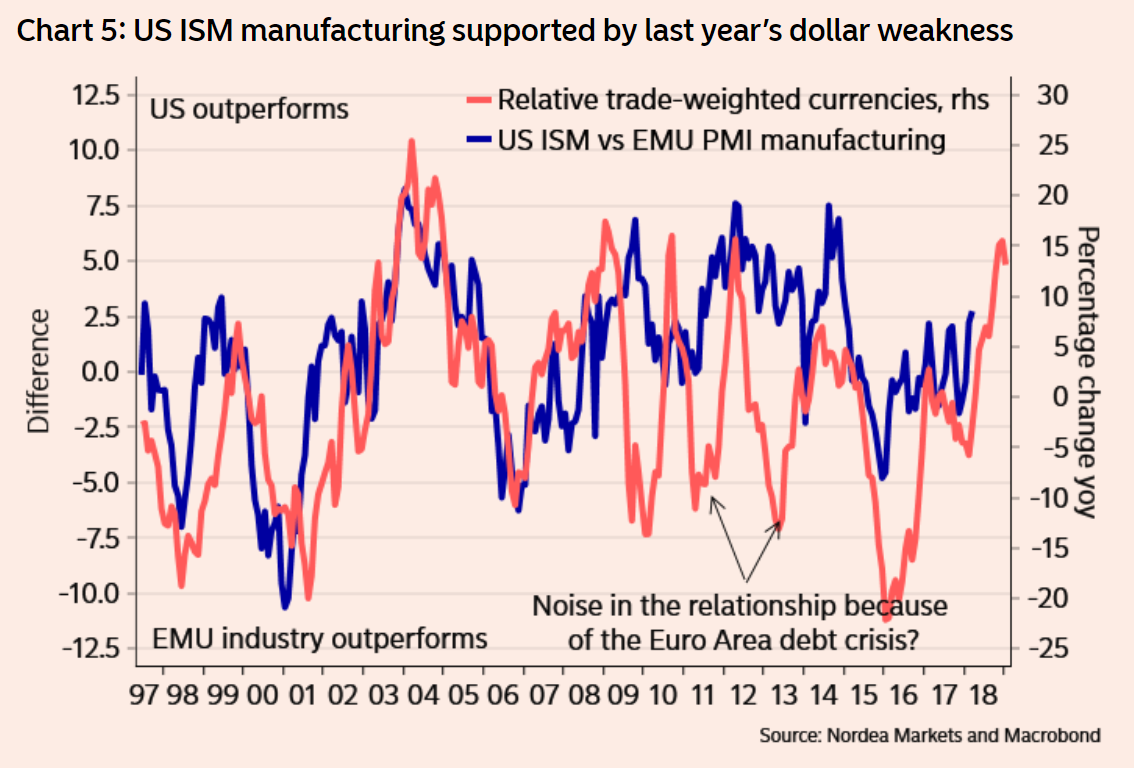

Another key release for the Dollar is the Manufacturing ISM, out on Tuesday at 15.00.

The consensus expectation is for the ISM to slow slightly to 58.6 in April from 59.3 previously.

"The coming week’s sentiment indicators, such as China PMI (Monday) and US ISM manufacturing (Tuesday), might thus help fuel further gains of the trade-weighted dollar," says Andreas Steno Larsen, strategist at Nordea bank, adding, "US ISM is quite likely to stay at a lofty level, as US sentiment is currently getting a boost from the US tax reform as well as from dollar weakness."

The fairly close correlation between the Dollar and ISM is shown in the chart below:

Finally, US Labour data, out at 13.30 on Friday is forecast to show Non-Farm Payrolls (NFPs) recover to 195k in April from a shockingly low 103k reported in March. Another key release within the labour data bundle is average hourly earnings as this has a more direct influence on inflation.

Data and Events to Watch for the Pound

The main data release for the Pound in the week ahead will be the release of April Service and Manufacturing PMIs out at 9.30 on Thursday and Tuesday respectively.

PMI is short for Purchasing Manager Index, and PMIs are survey-based indicators which are seen as useful forward-indicators of economic activity. The market consensus appears to be for expecting a rebound in Services in April after the drop in March, which was put down, mainly to bad weather. Services PMI in April is expected to rise to 53.5 from 51.7 and Manufacturing to 54.8 from 55.1.

The Pound may be especially sensitive to the results this week owing to the lazer-like focus currency markets are currently placing on UK economic data.

Sterling fell by over a percent against both the Euro and US Dollar in the wake of economic growth data which revealed the UK economy grew a mere 0.1% in the first three months of 2018, growth that has virtually killed any prospect of an interest rate rise being delivered by the Bank of England in May.

"UK Q1 GDP disappointed Friday by growing only 0.1% q/q - the worst quarterly growth rate since 2012 - casting doubt whether the Bank of England is going to hike next week, as almost all expected just a few weeks ago. We think it is a close call now and think the PMIs for April are going to be extremely important for the Bank of England's decision," says Kristoffer Kjær Lomholt, Senior Analyst with Danske Bank.

Will the incoming data surveys point to a pick-up in activity, or will they suggest the economic slowdown is more entrenched?

From the market expecting a hike with almost 100% certainty a few weeks ago, the probabilities have now fallen to circa 50% after comments from the governor of the BoE suggested there might be a delay owing to the downturn in data.

The possibility of a delay in raising rates led to a drop in the Pound which is highly sensitive to interest rate expectations.

Expectations of higher rates tends to lift the Pound and vice versa for the lower rates. This is because higher rates tend to attract greater inflows of foreign capital drawn by the promise of higher returns and this increases demand for the Pound.

"We may see an outsized market reaction from any surprises, as they tilt markets toward or away from a May BoE hike," says Canadian investment bank TD Securities in their note on the week ahead.

The bullish market forecasts for Manufacturing are not shared by some, including Philip Shaw, an analyst at Investec, who sees risks to April's figure both from the sharp appreciation in the Pound and the heightened talk of a trade war in early April.

Shaw does, however, share the market's more upbeat forecast for Services, which he expects to rebound by three points to 54.7 due to the temporary impact of bad weather dissipating.

More generally the lack of market-moving data besides PMIs means the weak could be a slow one for the Pound.

"Domestically, next week may represent a lull before the storm provided by the 10 May Bank of England Inflation Report and MPC announcement," says Shaw. "Bearing in mind Mark Carney’s comments last week about mixed data, the decision may be more finely balanced than we had envisaged."

"But we judge that the MPC will believe that the tight labour market will override the softer than expected short-term inflation environment," concludes the analyst.

The other major event in the week ahead for the Pound is the UK local elections on Thursday, May 3 at 1.00 GMT.

The main way it could impact is via Brexit expectations, such as for example if there is a surprise outsized vote for the anti-Brexit liberal democrats, which might be Sterling positive.

If the Conservatives win a larger-than-expected majority it could impact on Sterling in two ways depending on how investors interpret the result.

It could be negative for Sterling because the Conservative party is probably the party most in favour of the 'harder' forms of Brexit.

At the same time is could be positive for the Pound if it is interpreted as showing increased confidence in Theresa May's leadership, suggesting a reduction in the influence of the far right within the party, and therefore more likely to deliver a pragmatic rather than ideologically driven Brexit solution.

A Labour landslide would be negative for Sterling, according to TD Securities.

"While polls have consistently been pointing toward big Labour wins/Conservative losses at next week's local elections, with GBP being vulnerable to political developments, we may see a negative market reaction to any "Labour landslide" headlines. Vote counting only begins on Friday, so results should trickle out later that day," say TD Securities.

It is not unusual for voters to use the local elections to express dissatisfaction with the reigning government so a labour victory would not be particularly surprising or necessarily especially indicative of future voting patterns.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.