Pound-to-Dollar Rate Rebound Stalls Before Key Chartline

© kasto, Adobe Stock

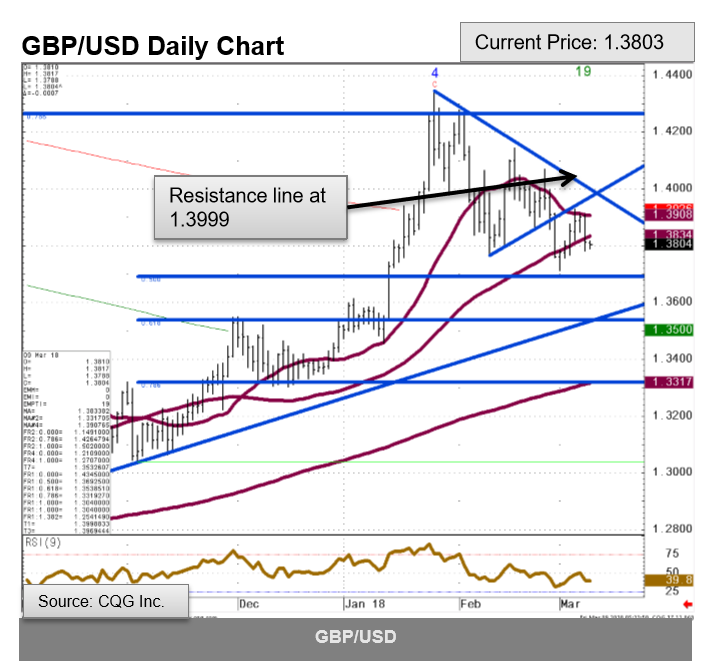

Cable retreats just ahead of chartline capping upside at circa 1.4000.

The GBP/USD pair has lost ground ahead of a glass-ceiling level at about 1.4000 where a trendline drawn down from the January highs is located.

After achieving highs of 1.3909 the exchange rate lost ground, falling to lows of 1.3781 on Thursday (circled on the chart below).

Commerzbank analyst Karen Jones noted how the pair failed at the 20-day moving average on Thursday - moving averages are often major turning points for the exchange rate.

"GBP/USD has failed to clear the 20-day ma at 1.3908 and near-term risks have shifted to the downside. While capped by the resistance line at 1.3999 a negative bias remains entrenched," she says.

From here she sees more downside to the next initial step support level at the 1.3658 "September peak".

Capping Gains

The trendline 'A' was expected to cap gains going forward and probably even reverse the short-term recovery.

In the event of a touch, analysts were unanimous in expecting the initial reaction to be bearish.

Lloyds Commercial Banking, cross-asset strategist, Robin Wilkins, for example, says:

"Prices are trading just under resistance at 1.3980, having bounced from 1.3712," and adds that he sees deeper declines on the horizon, "we ideally still look for a move at least back into the 1.3650-1.3450 region."

Commerzbank analyst Karen Jones was sceptical in her note yesterday, saying she did not think the pair could break above the trendline:

"GBP/USD is seeing a near-term rebound, but it will shortly encounter the resistance line at 1.4010 and we have our doubts that the market will be able to sustain a break higher at this juncture," she said, adding:

"While capped here, the outlook stays negative. We have partially covered our long position and raised the stop for the remainder."

Online bank Swissquote's head of market strategy, Peter Rosenstreich, added further fuel to the bearish bonfire:

"The GBP/USD recovery phase is ended. The pair is weakening and heading for the 1.38 range."

According to Rosentriech, the pair will probably fall to initial hourly support at 1.3678, the 12/01/2018 low.

Despite the bearish chorus, the medium-term trend is up and there is a chance the pair could still break higher too, although it would encounter tough resistance above.

This would come from the 50-month moving average (MA), at 1.4466, where the exchange rate would be expected to stall, pull-back or be completely repulsed.

Large moving averages act as obstacles to the trend as many investors make trading decisions depending on whether the price is above or below the MA.

This changes to supply and demand dynamics around the MA. Short-term technical traders also enter the market riding the moves, increasing supply due to their trading, which further enhances the resistance characteristics of the MA.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.