The US Dollar Doesn't Like Trump's Budget for 2019

© The White House

The proposed Budget for the U.S. Government in 2019 has been released by the Office of Management and Budget and as expected it contains a committment to expanded spending to a degree that will help baloon the U.S. budget deficit.

The Dollar's lacklustre response to the plans are down to two issues: 1) The market does not believe they will pass congress and 2) the widening budget deficit poses significant headwinds to the economy in the future.

On balance, a credible fiscal expansion plan that sees money spent in the right areas would be good for the Dollar as it would be expected to deliver an acceleration in economic growth. Indeed, the Dollar rose on Trump's victory as the narrative was that the U.S. was getting a president who would open the Treasury doors to a programme of infrastructure improvement projects.

Unfortunately for the Dollar and Trump the market is voting that the money is not being spent on areas that will improve U.S. productivity and increase consumption. Instead, it is increasingly looking as though the budget deficit will widen and there will be no acceleration in economic growth to show for this hefty cost.

The 2019 budget plan comes after a new budget deal was voted through the Senate and Congress last week and signed off by the President on Monday; the deal already promises to increase the U.S. debt limit and increase spending caps on Federal budgets by an expected $300bn.

Taken together with the recent tax cuts which are estimated to cost $1.5tr over the next decade, the new spending proposals will add a further $7.1tr in debt by 2028, according to analyst Derek Halpenny at MUFG who says the plans are "far from reality".

One potential source of weakness for the Dollar could be from political instability posed by the inevitable wrangling over the proposals that are likely to occur as the increased spending and lower taxes are expected to dent the Republican's reputation for prudence and fiscal responsibility.

"The Republican Party – always seen as fiscally conservative – is eroding what it is supposed to stand for and that could have consequences at the mid-term elections in November," says Halpenny. The Republicans are therefore likely to be Trump's biggest roadblock.

"The increased political uncertainty that might create along with the increased investor concerns over the ‘twin deficits’ is not a good backdrop for the Dollar," adds Halpenny.

By 'twin deficit' Halpenny is alluding to research which indicates that it is bad a for a currency when it's country has both a budget and current account deficit simultaneously as the U.S. does. The current account deficit refers to the inbalance derived from the fact that the U.S. imports more than it exports, creating a negative balance in its account with the rest of the world.

To balance the books the U.S. therefore relies on the inflow of trillions of Dollars worth of inward investment.

In actual fact, the US has had a twin deficit for quite some time but it seems the worst impact on the currency comes during periods when both the deficits are widening, as is the case now.

If the U.S. were to now be judged by international investors - who fund the current account deficit - is also seen as a profligate spender, they might be less inclined to invest.

This profligacy is signalled by the rocketing budget deficit and it could therefore makes it more difficult and expensive for the U.S. to secure credit from international investors in the future.

"Regarding the Trump budget, the announcement offered little new information. Still, the re-emergence of the twin deficit should send shivers down the Dollar's spine. The IMF has shown a 1% rise in the budget deficit is worth about a 0.6% increase in the current account deficit, suggesting a twin deficit in excess of 7% of GDP by the end of the decade. Those numbers do not bode well for the greenback in the medium-term," says Mark McCormich, North American Head of FX Strategy with TD Securities.

Fiscal Expansion

But not all analysts are as sceptical about the outlook for the Dollar due to America's penchant for cutting taxes and spending.

Commerzbank's Ulrich Leuchtmann is positive about the Dollar due to higher interest rate expectations from a more 'activist' central bank.

His argument is that rising inflation is leading to a monetary policy regime characteristic of the pre-crisis "good old days".

This saw central banks take more active control of inflation by being more proactive in moving interest rates up and down.

"In those days the inflation expectations were more or less fixed - as everyone trusted the central bank’s ability to control inflation," says Leuchtmann.

"They had to keep inflation expectations constant (something that used to be called “credible monetary policy”) with the help of an activist interest rate policy (i.e. with large fluctuations in nominal interest rates)," adds the analyst.

This appears to herald a period where the Federal Reserve may be a lot more aggressive in putting up rates than the market currently expects.

"In the US (and only there!) we seem to be returning to these “good old days” (chart below). If that were true the Fed might well become much more activist than the market is currently pricing in (with an expected key rate of a meagre 2.3% for year-end 2019)," says Leuchtmann.

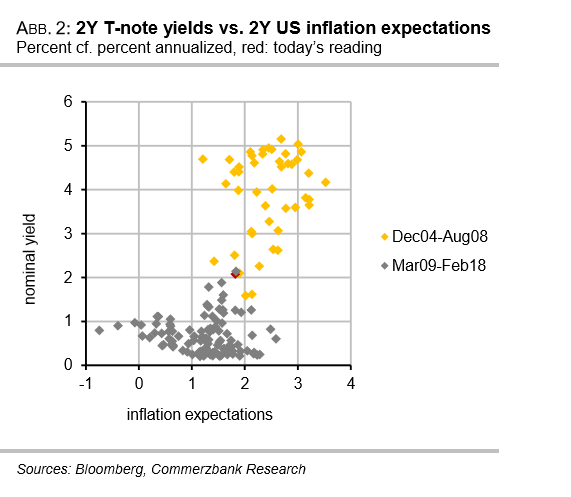

Indeed, if we analyse the chart below provided by Leuchtmann we note how during the most recent period from Mar '09 to Feb '18 represented by the grey dots bondholders have scarcely been adequately compensated for expected inflation erosion.

This contrasts with the "Good Old Days" represented by the orange dots when treasury bond yields more than compensated bondholders from expected inflation.

The red dot in the centre seems to indicate the market is moving towards that of the good old days.

If so then it leads to higher 'real' yields - that is the margin of yield above inflation.

Since rising real yield is a major draw for international investors weighing up where to park their capital, a rise in the US will lead to greater capital inflows, higher demand for the US Dollar and a stronger currency.

"With the exception of a few jitters the fear of the “good old days” is a strong USD-positive argument," concludes the analyst.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.