New Dollar Indicator Signals 1.0% Decline Per Quarter in 2018

© jcomp, Adobe Stock

The US Dollar is facing a 1.0% depreciation per quarter in 2018, says investment bank who have developed a hybrid indicator.

Toronto-based investment bank BMO Capital Markets has developed a useful indicator to warn of turns in the value of the Dollar, using what economists call the twin deficit model.

The basic idea is that it is not positive for a currency when a country is running both a budget and a current account deficit at the same time.

BMO has combined the two variables into a hybrid indicator by summing and averaging them into - a 'twin sin score' as it calls it.

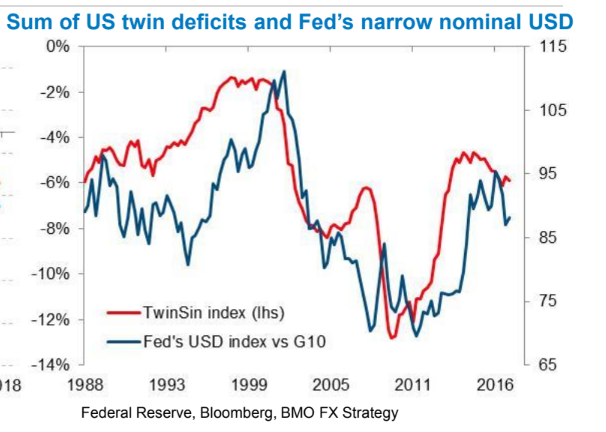

If overlaid on the chart of the Dollar index as shown below it tends to indicate turns in the index quite well.

"The ‘Twin Sin Score’ is computed by summing the US deficits (computed as a percentage of GDP). Past turns in the Twin Sin Score have preceded turns in the USD by 1-4 years," says BMO global head of strategy Greg Anderson.

A budget deficit occurs when a government spends more than it earns in tax revenue and a current account deficit when it imports more than it exports - or receives more income than it has to pay out.

If a country just has a current account deficit on its own, no problemo, it can borrow from lenders abroad to make up the shortfall.

If a country has a budget deficit as well, however, it becomes increasingly more difficult to borrow, since - just as people with a bad credit history struggle to find a loan - so countries can also struggle if they are seen as profligate spenders or 'bad' traders; or they may need to pay high rates of interest to get a loan or even in the worst cases, run the risk of being 'blacklisted'.

Not only that but the US's deficits are set to get worse.

The current account balance also includes exports of US financial products and these have been selling very well recently due to the bullish US stock market which lots of foreigners have wanted to buy into.

US government bonds or Treasury Bonds or Bills as they are called also sold well because of their 'safe-as-houses' reputation.

Yet the market may now be fully 'bought in' to this US financials' trade and the risk now is more of a sell-off occurring, as both the

US bond market and equity markets appear potentially past their peak.

So, without the extra income from selling its financial assets overseas, the US could be at risk of seeing its current account deficit get even wider.

As far as the budget or 'fiscal' deficit, as some call it, goes, the problem is the government's new tax cuts have reduced revenue and it is still not clear whether they will generate enough offsetting growth to make up for the losses. Given the market is a cynic, it may decide they won't, and the budget deficit will widen.

Thus it seems the outlook for the 'twin sin score' is negative, and for the Dollar too.

RoW, RoW, RoW your boat...

The twin sin score is not the only reason BMO Capital's Greg Anderson is negative the Dollar; he also happens to be a devotee of RoW.

RoW stands for 'Rest of the World' and conveys the view that the world is catching up with America and in currency terms that the world's currencies are catching up with the Dollar.

The view is based on the surge in global growth recorded in 2017 and the expectations that this is a trend which will continue.

Further, it is based on the idea that the greatest upside for currencies is during the early stages of a recovery, a stage which RoW is entering just as the US is leaving.

History shows that after about the third interest rate hike in a tightening cycle the currency becomes desensitized to further rises.

This was showed at the Federal Reserve meeting in December 2017 when despite raising interest rates for the third time that year the Dollar fell after the news.

Last years strong global growth was not a one-off but probably the start of a new cycle which could last for several years, according to BMO's Anderson:

"The global economy is cyclical. Growth tends to be above average for 4-7 years and then below average for 2-5 years."

There is also a clear negative correlation between global growth and the US Dollar:

"The USD tends to decline when global growth is above average. Vigorous growth pushes up commodity and equity prices, which pushes up LM currencies and central bank FX reserves, which leads central banks to buy EUR and other G10 currencies," says the strategist.

Overall the two factors outlined above of the twin deficit and RoW are expected to lead to an overall -1.0% depreciation in the Dollar per quarter in 2018, says BMO, whose forecasts are shown in more detail in the table below:

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.