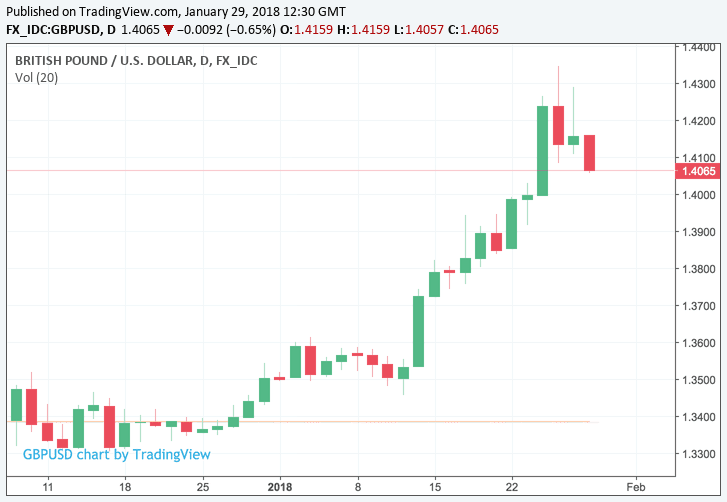

British Pound Falls below 1.40 vs. US Dollar but Remains a 'Buy on Dips' with one Trader

The Pound-to-Dollar exchange rate has fallen below the key 1.40 level but remains a 'buy on dips' according to one strategist we follow.

Foreign exchange analysts have been warning for some time that the recent rush higher in the Pound-to-Dollar exchange rate left the pair looking overbought.

The exchange rate raced to a multi-month high of 1.4346 but is quoted at 1.3986 at the time of writing with the turn in fortunes being largely the result of a rejuvenated US Dollar which is the best-performing major currency heading into month-end. The Dollar's recent decline left it looking oversold and therefore the threat of a correction higher became increasingly likely. Markets are obliging at the moment.

We have warned in some of our own in-house pieces of analysis of late that Sterling was now starting to look overcooked against the Dollar and that the GBP/USD might have reached a ceiling as a result. Others confirm this assessment.

"Bullish momentum on daily chart remains intact though stochastics is showing signs of falling from overbought conditions," says a note from the foreign exchange analysis team at Maybank.

"The accelerating bull run of the middle of last week seems to have receded now as the steam has come out of the move with a couple of negative candlesticks. The move is now beginning to put pressure on the daily momentum indicators which are threatening to roll over," says Richard Perry, an analyst with Hantec Markets.

Perry notes that the RSI (a technical signal traders observe to identify where momentum lies) has been over 70 now for two weeks but is close now to falling back below, "whilst the Stochastics are close to posting a near term sell signal too". In short, all the signs are there fore an overbought Pound to give back ground.

The question now becomes, just how deep does the pullback go, and is this the end of the rally?

There are further signs identified by Perry that Sterling could be about to suffer a deeper bout of decline:

"Friday’s 'inside day' trading session reflects a loss of drive, whilst support at $1.4107 will be watched as Cable has not traded below the previous day’s low since 11th January. The hourly chart is already creaking with the hourly MACD lines now more negatively configured, whilst the support of the rising 89 hour moving average which had been in place for the past two weeks has now been lost."

The political background music in the UK is also a concern with some analysts suggesting the increased pressure being felt by Prime Minister Theresa May over the stance she adopts in upcoming Brexit negotiations is a potential source of instability.

The thinking is that ultimately her own party will force a new leadership election if she is deemed to be doing a poor job of negotiating Brexit.

"There is speculation some Conservative party lawmakers are poised to trigger a no confidence vote against UK Prime Minister Theresa May," notes Elias Haddad, a currency strategist with CBA in Sydney.

However, "we believe any leadership challenge will not result in increased government instability. As such GBP/USD will continue to lift reflecting our expectation of USD weakness and an eventual EU‑UK trade agreement," says Haddad.

We agree with Haddad's assessment and go a step further and suggest there will be no leadership challenge believing the jockeying of various factions within the Conservative party is an attempt to forward their perferred version of Brexit at this critical juncture in the talks.

Ultimately, politicians know that if they bring down May's government they invite early elections, losing to the socialist Labour party and losing all say in Brexit negotiations. Therefore, we hesitate to suggest the decline in Sterling is because of Brexit; we have no new fundamental information at hand regarding Brexit to fix onto the Pound's pullback.

Talk of a leak of Brexit economic forecasts from the UK treasury have everyone in a spin on Tuesday, January 30 - but we ask - what do these forecasts tell us that a plethora of other forecasts already have not? If anything, the more negative the forecasts, the more softer the Brexit outcome is likely to be, which is ultimately better for the Pound. So saying Sterling is falling because of a new set of negative forecasts to us appears counterintuitive and just the kind of thing the tabloids lap up.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Pain to be Temporary

Analyst Robin Wilkins with Lloyds Bank notes Sterling has broken below some key levels against the US Dollar, but importantly, the uptrend remains alive.

"Prices are sliding through 1.4025 support adding conviction to our short-term charts looking for a broader pullback. 1.3880 to 1.3715 is the main daily trend support region, which we expect to hold for now, while a move through there would confirm a more significant top did develop at 1.4345. While this support holds the trend remains intact," says Wilkin in a noted dated January 30.

So there is still some breathing space yet before the Pound enters a downtrend.

Despite the slide in GBP/USD, Maybank also suggest that the decline is likely to be temporary in nature and they maintain a "bias to buy on dips," with regards to the GBP/USD going forward.

Indeed, Maybank note the recent rise in GBP above 1.40-handle apparently did not seem to create any discomfort with policymakers and they think this could be due to increase in policymakers’ tolerance to arrest rising prices.

Furthermore, recent positive developments on Brexit have Maybank confident any weakness suffered by Sterling will be short-term, they cite the following as being reasons to be optimistic - Spain and Netherlands’ preference for soft Brexit, influential lawmakers in EU parliament reportedly considering watering down legislative proposals relating to clearing houses, helps to dissipate fears of negative impact on London’s financial centre.

"We expect GBP to remain a buy on dips," say Maybank, "this is especially so in the environment of USD weakness which could amplify GBP strength."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here