Pound Vs Dollar Resumes Downtrend After Key Technical Rotation

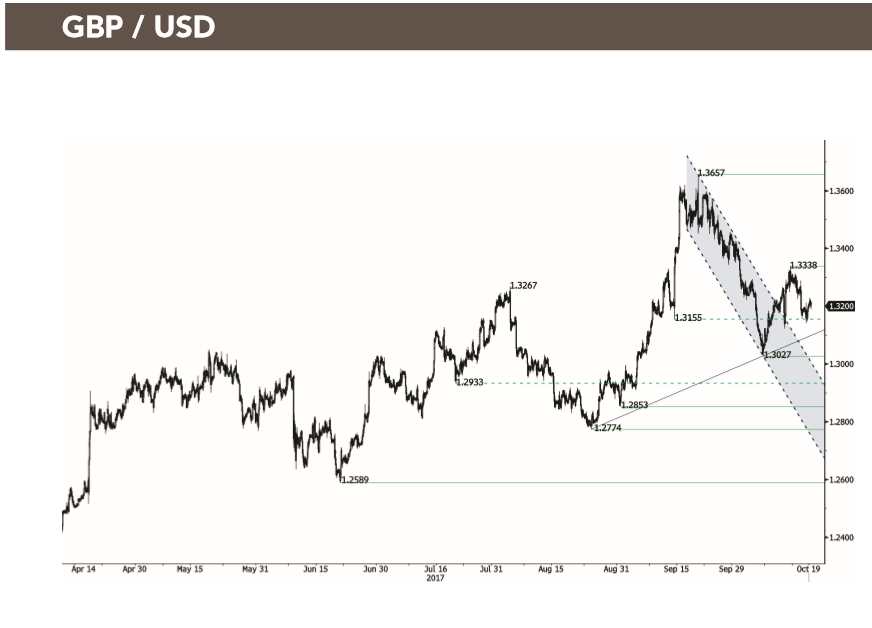

For those wondering whether the bounce from October 6 lows up to the 1.3337 peak represented a revival of the uptrend, the recent sell-off must have come as a crushing disappointment.

For now it appears the recovery was merely a correction and that GBP/USD is headed lower. The latest decline, triggered by an unexpected 0.8% drop in September Retail Sales, 'sealed the deal' as growth concerns mean sentiment toward the pair has soured.

Pound-to-Dollar has reversed the rising sequence of peaks and troughs on the four-hour chart signaling it is now probably in a downtrend.Overnight the pair has fallen even further, breaking well below Thursday's 1.3134 low and opening the way towards the key 1.3030 level where the exchange rate is expected to encounter support from a major trendline.

"..a fresh break below today’s low could send the pound tumbling lower again. The next key support level to watch is around 1.3030 – the low from earlier in the month, where we also have a bullish trend line converging," said Forex.com's Market Analyst Fawad Razaqzada.

Our own view is that the next target to the downside is likely to be at the bottom of the October 6 gap at 1.3075.

A move down to there from the market's current level is highly likely as gaps on charts have a marked propensity to fill.

After that, we also see a high chance of a continuation to 1.3030 and the level of the major multi-month trendline.

At the trendline we would expect a considerable amount of demand as traders will expect a bounce which they will want to capitalise on in the very short-term by 'scalping' the exchange rate.

This, in turn, should lead to a stall or rebound at that level.

Looking Further Afield

Swissquote's, FX Analyst, Peter Rosenstreich notes a negative change in the longer-term trend too:

"The long-term technical pattern is reversing. The Brexit vote had paved the way for further decline. Long-term support can be found at 1.1841 (07/10/2017 low)," he says.

Indeed some analysts would interpret the overshoot of the channel (circled on chart below) as a sign of exhaustion of the medium or long-term uptrend, which supports Rosenstreich's longer-term bearish call.

Commerzbank's Karen Jones is certain the October 6 recovery was merely a correction and labels it a "minor Elliott wave abc correction," which "ended at last week’s 1.3338 high," which was just beneath the 50% retracement level at 1.3343.

She goes on to suggest that whilst the 50% Fibonacci retracement "caps" upside, attention will shift to focusing on downside targets.

"..attention should remain on the 1.2996 2016-2017 uptrend line. This is the breakdown point to the 1.2830 38.2% retracement and the 1.2575 50% retracement."

And for those unclear on how Jones stands on the implications for the longer-term trend, she clarifies:

"The currency pair has recently failed at the 1.3557 2014-2017 downtrend and is thus viewed negatively."

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.