Pound-to-Dollar Reverses on US Federal Reserve Event, Key Resistance Levels Pause Advance

While the GBP/USD outlook remains broadly positive, time for consolidation, triggered in part by the US Fed and technical resistance levels, appears to be in order.

The British Pound has been knocked down a peg by the Dollar following the latest communication released by the US Federal Reserve overnight.

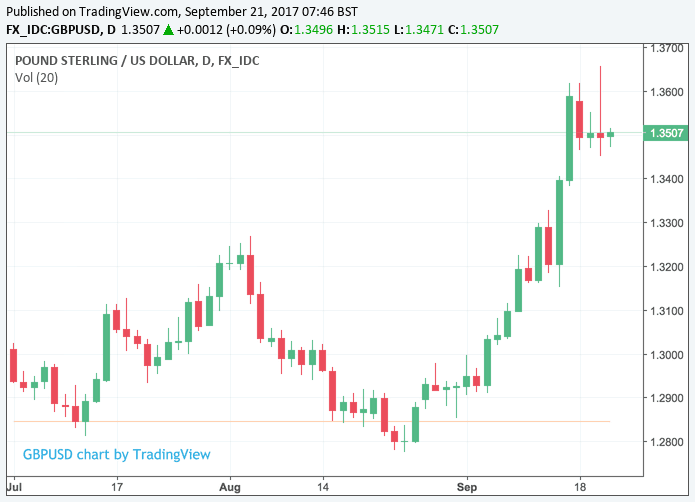

On Thursday, September 21 the Pound-to-Dollar exchange rate is quoted at 1.35; a level that is within the range experienced over the previous five days.

However, the exchange rate had been as high as 1.3658 in the run-up to the Fed event suggesting that on margin, it turned out to be a positive for the Dollar.

In this instance, 'positive' would refer to the fact that the underperforming Dollar has effectively held its ground.

Traders know it could have been worse for Dollar-bulls, and the Dollar might be benefiting from relief more than anything.

The Federal Reserve showed a steady hand and communicated it will raise interest rates one more time this year and three times in 2018.

According to the FOMC statement, the Federal Reserve believed that the hurricanes would not alter the economy's general course because spending is expanding at a moderate rate, investment increased and labor activity strengthened.

Furthermore, the Fed confirmed it plans to start balance sheet rolloff in October.

In fact, the outcome gels with expectations laid out by economists ahead of the events and explains the relative stability in the US Dollar.

Yet looking at the broader Dollar picture, we have seen nothing new from the Fed that would suggest a change in direction.

"We doubt that this is a game-changer for the USD since markets are unlikely to fully price the December hike for now and will not fully converge with the 2018 dot-plot not least because there is considerable uncertainty about Fed leadership next year. We maintain the view that the USD would need to see either major fiscal stimulus or a broad acceleration in inflation to post a sustained rally," says Manuel Oliveri, an economist with Credit Agricole Corporate & Investment Bank.

GBP/USD Runs into Resistance

Concerning the Pound’s technical outlook against the Dollar, Sterling appears to have run into a roadblock.

“GBP/USD ended the day only slightly lower but this unchanged performance masks a major intraday reversal. GBP/USD broke above 1.36 on stronger than expected retail sales but settled the day below 1.35,” notes Kathy Lien at BK Asset Management.

Above: Sterling's uptrend against the Dollar takes a breather.

Karen Jones, a technical analyst at Commerzbank notes the failure of GBP/USD’s move higher coincides with the meeting of a “critical medium-term resistance”.

“GBP/USD has been rejected from critical medium term resistance at 1.3622/70, which represents a double Fibo and the 2014-2017 downtrend. Given the convergence of resistance here we would expect this to continue to hold the initial test and provoke some profit taking,” says Jones.

However, Jones notes the intraday Elliott wave counts are positive and advocating for further gains.

“In order to alleviate immediate upside pressure the market will need to fall sub 1.3267,” says Jones.

So while GBP/USD remains broadly positively aligned, time for consolidation, triggered in part by the US Fed and technical resistance levels, appears to be in order.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.