GBP/USD: The Next Levels

Technical analysts brief us on the key levels that are likely to impact direction in the Pound-to-Dollar conversion.

Pound Sterling is the best-performing major currency thus far in the month of September as the Bank of England prompts a sizeable readjustment in investor expectations regarding the future levels of UK interest rates.

News that the first interest rate rise in ten years could be delivered in November sent the Pound up to a fresh 15-month high against the Dollar with 1.3618 being achieved. A new multi-month high of 1.1396 was achieved against the Euro.

Expectations for further gains in Sterling are now widely held by the technical analyst community who study charts to ascertain where the next moves in the currency might be.

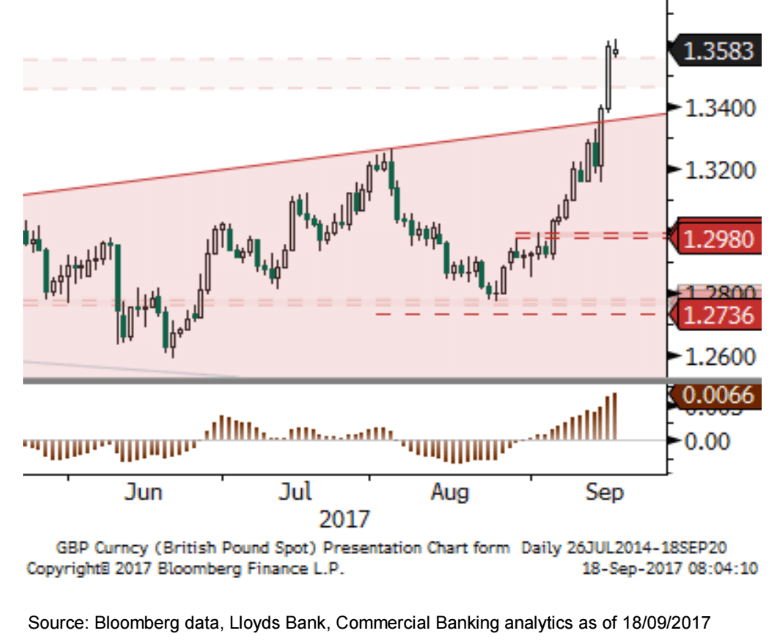

“The British Pound shot higher this week following a successful breakout. The rally this week took the Pound to its highest level since Brexit. The RSI rose to 76.7, a level not seen since September 2013. The rally has occurred on well above average volume, but some of that will be due to quarterly contract expiration as September went off the board on Friday and rolled to December,” says Phil Seaton at LS Trader.

Seaton is a specialist in identifying market trends and based on the evidence at hand says the next target in GBP/USD is at 1.3835.

“While intra-day studies suggest a consolidation phase can be seen ahead of Governor Carney, underlying upward momentum remains intact,” says Robin Wilkin, an analyst with Lloyds Bank.

Governor of the Bank of England, Mark Carney is due to deliver a lecture in Washington D.C. to the IMG at 16:00 BST and markets will be looking for any follow-through guidance on future Bank of England policy to that provided the week prior.

The Bank surprised markets by indicating that the majority of members of the policy-setting Monetary Policy Committee were in favour of raising interest rates in the near-future.

“FX traders will be particularly keen to see if he reaffirms the hawkish comments of other MPC members last week that drove the Pound above the post-Brexit highs in a furious rally on Thursday and Friday,” says Borish Schlossberg, Managing Director at BK Asset Management.

Schlossberg identifies Carney as long being “an unrepentant dove since Brexit vote” but believes the generally robust growth of the UK economy along with much higher than target inflation may have forced him to “throw in the towel”.

“If Mr. Carney reaffirms that the BOE will have to tighten soon – perhaps as early as November – expect sterling to extend its rally and test the 1.3700 barrier as the day proceeds,” says Schlossberg.

If markets are disappointed and Sterling does retrace some of its gains, Lloyds Bank's Wilkins says "the nature of pullbacks is going to be important with 1.3525-1.3490 intra-day support. A decline through 1.3400 is needed to suggest a more significant correction is underway."

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.