US Dollar is Finding a Floor: The Evidence

The Dollar could be bottoming, say strategists at Bank of America Merril Lynch, who suggest markets are expecting to little from the Federal Reserve.

Our technical studies on the matter - published further down in this piece - for the most part corroborate this fundamental argument on the Dollar forwarded by Bank of America.

"The consensus is that the Fed will focus more on low inflation and stay on hold. We argue that the Fed will focus more on loose financial and monetary conditions, as well as risks to financial stability from asset price bubbles, and will continue normalizing policies gradually. We also argue that US inflation could start surprising to the upside," says Athanasios Vamvakidis, FX Strategist with Bank of America Merrill Lynch in London.

In particular, Vamvakidis and his team reckon markets are misreading the inflationary landscape in the US which they deem to have deteriorated to the extent that further USD-supportive interest rate rises are not warranted in the immediate-term.

US inflation is surprisingly low given the position of the economy in the business cycle, but this may not last argue BAML, "the Phillips curve is not dead yet."

The Phillips curve suggests that when unemployment falls, inflation rises. With the US at full employment, markets have been surprised by the lack of inflation.

But, BAML reckon the Fed is already behind the curve as the relationship described by the Phillips curve is still alive.

"Based on historical correlations, the Fed policy rate is too low to begin with compared with core inflation and the output gap," says Vamvakidis.

BAML reckon the Fed will push forward with interest rate rises as they will be keen to normalise policy while times are good. They do not want to risk creating a bubble, and raising rates during a time of economic expansion would therefore be the optimal approach to adopt.

"We think the USD is close to bottoming. Last month we added a long USD/MXN position given risks around NAFTA negotiations. GBP has been weak against the EUR as Brexit negotiations struggle on and the respective growth outlooks diverge. We roll GBP/USD put spreads as we still we see room for downside," say BAML.

Market Still Moving Against the Dollar

It is a brave call given the Pound shot up to a monthly high above 1.30 against the Dollar on Tuesday after Federal Reserve officials doubted the central bank would be in a position to raise interest rates again before the end of the year.

With official expectations of an end-of-year hike at just 24.0% - from 38.0% only a few days ago at the weekend, the USD's fall comes as no surprise.

A hurricane-fest over America is not helping either, as still reeling from Harvey's destructive power, the authorities evacuate Florida in anticipation of Hurricane Irma.

And despite Dallas Fed president Kaplan downplaying the impact of Harvey he doubted a third rate hike would be warranted in 2017, further pressuring the Dollar lower.

And then came the mid-week announcement that Fed Vice Chair Stanley Fischer will be resigning, a move that Royce Mendes of CIBC Capital Markets says adds "further uncertainty to the already murky outlook for the future of the central bank's leadership."

But in a contrarian bid, BofAML suggest the Dollar is probably marking a major low.

They are not the only ones sceptical of continued Dollar weakness - especially versus currencies with little fundamental underpinning:

"The selling pressures on Pound remain intact due to Brexit shenanigans. The Pound’s rally could remain short-lived and rapidly fade as soon as the US Dollar finds support," says London Capital Group's Ipek Ozkardeskaya.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Technical Studies Also Confirm the Currency Might be Bottoming

Given the heavy market bias towards a bearish view of the US currency, what do the charts say?

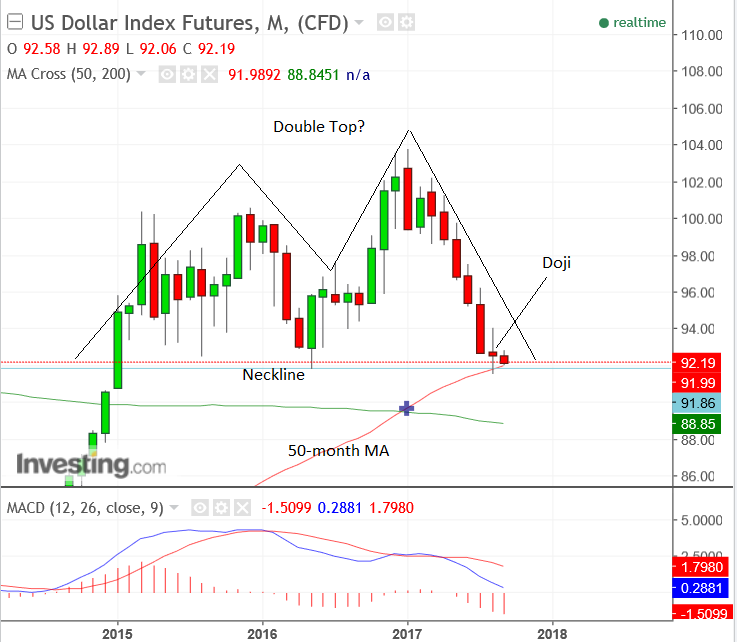

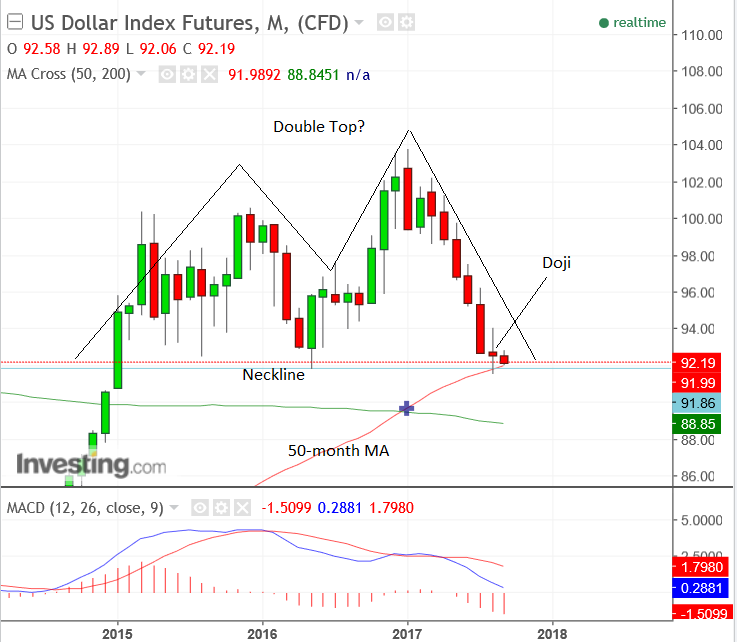

The chart of a Dollar Index (DXY) is full of interesting insights to anyone with an eye for technical signals.

On the DXY monthly chart, for example, the exchange rate has just met a major support level (turquoise line, called "neckline") at the May 2016 lows, which is likely to prove an obstacle to further downside - potentially supporting the notion that the USD may be finding its feet.

The month of August also formed a candlestick pattern which is known in Japanese candlestick lore as a 'doji' and is symptomatic of indecision.

These candles often occur at market tops and bottoms, further supporting the possibility the currency may be reaching a low.

The fact the pair has encountered the 50-month moving average at 91.99 could be another sign it might be bottoming as these large moving averages offer dynamic support and resistance, are difficult to break below, and often provide points of reversal.

Looking at the weekly chart we see further evidence the Dollar may have found a floor.

The pair has formed a spinning top pattern at the level of May 2016 lows.

Spinning tops, like dojis, are signs of indecision and indicate the asset is bottoming and could be about to reverse.

The pair has also stalled in its downtrend at the level of the 200-week moving average, which provides yet more support at that level, and increases the chances the level could hold.

Haunting Double Top

Despite the signs we have uncovered that suggest the Dollar could be bottoming, we can't ignore another signal that suggests further downside is possible.

It is quite possible to interpret the turquoise line on the monthly chart of the May 2016 support lows as the neckline of a large double top reversal pattern with extremely bearish connotations for the Dollar.

Double tops are major reversal signs and there is a strong chance one may have formed on the Dollar Index's monthly chart.

According to such an interpretation, a break below the 91.55 August lows would confirm and activate a bearish target of 80.00-82.00, based on the height of the double top pattern extrapolated from the neckline lower.