GBP/USD Rate Drops Below 1.30 on Record Job Openings Data out of the US

The British Pound has weakened further against the Dollar following some stronger-than-expected economic statistics out of the United States.

GBP/USD fell below 1.30 to reach 1.2987 after Job Openings data from the US Bureau of Labor Statistics increased to a record 6.2 millon on the last business day of June.

Markets had only been forecasting a reading of 5.77 million.

The data suggests perhaps the US economy is likely to see an increase in activity which would in turn force the US Federal Reserve's hand into quickening the pace it intends to raise interest rates over coming months.

Job openings data does not typically move the market but that the USD is higher following today's release confirms this is a market that intends to look favourably on the currency on even the slightest good news.

The data might also go some way in flushing out some of the negative bets on the US Dollar and prompt a short-squeeze higher in one of 2017's worst-performing currency.

"It seems that the JOLTS job openings reading – which far surpassed expectations at 6.16 million against last month’s 5.67 million – mainly benefited the dollar, which is currently on the hunt for the faintest whiff of good news. Cable plunged 0.4% after the figure was released, sending the pound to a sub-$1.30 2 and a half week low, while the euro slipped 0.1% to trickle back below $1.18," says Connor Campbell, an analyst with Spreadex.

The dip in GBP/USD now opens up the question - has a new downtrend istarted?

“No significant or structural damage has yet been done here despite an initial rejection around 1.3250 but with Sterling technicals less obviously positive in macro terms an intermediate top could nonetheless form in coming sessions,” says Lucy Lillicrap at AFEX.

“To confirm this (directly bearish) scenario Lillicrap is looking for the market to break below at least 1.2925/35 support.

If this happens, the risk arises that a fall back towards key 1.2590/00 demand happens next.

Lillicrap stresses that because the market has yet to deteriorate into a bearish sequence, another test of 1.3245/55 cannot be ruled out with 1.3400 not yet out of reach either should resistance here give way.

However there are others who would argue that the Dollar’s period of weakness might be coming to an end.

"Sterling is the most vulnerable to a deep correction this week as there was nothing positive in the most recent Bank of England Quarterly Inflation report and monetary policy announcement," says Kathy Lien, Director of BK Asset Management.

Given how much GBP/USD rose in the last 4 months (from 1.24 to 1.3250), the tone of the central bank and the healthy U.S. non-farm payrolls report suggests to Lien 1.3270 is most likely the top in GBP/USD.

"On a technical basis, this is also where the 20-day SMA on the monthly chart and the 23.6% Fib retracement of the 2014 to 2016 sell-off converge, making it the perfect stopping point for the pair after a prolonged rally that took it from 1.20 in October of last year to 1.3270 this month. Next stop for GBP/USD should be 1.3000 and then 1.2920," says Lien.

Dollar to Recover, GBP/USD En-Route to 1.20

The GBP/USD’s recent run of strength that takes it back above 1.30 is however largely the result of a broad-based weakness in the Dollar.

The Greenback has struggled through 2017 amidst disappointment in Donald Trump over his ability to pass legislation - recall it was the promise of significant tax rates spurred a sizeable Dollar rally in 2016.

Another reason for the currency’s underperformance has been US data has not impressed this year. The data has in turn lead markets to start discounting the pace at which the US Federal Reserve is seen raising interest rates in 2017 and 2018.

There is a sense for some that this negative story has run its course.

Citibank - the world’s largest foreign exchange dealer - remains resolutely bearish on GBP/USD as a result and reckon that a substantial breakdown in value beckons.

“Despite recent hawkish BOE rhetoric, no definitive plan for the Brexit negotiations may restrain GBP in the short term,” says a client briefing from Citi dated August 7.

As such, “GBP/USD may fall back to 1.30 for the coming 0-3 months and 1.20 for the coming 6-12 months.”

It is worth pointing out that this picture does differ from that painted by the majority of the analyst community who see the next three months as posing the most downside risk for Sterling as they see a stabilisation and gradual rise through the 2018.

Is the fall in value of Sterling impacting your international payments? Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Lead Indicators Give Dollar Bulls some Heart

Also suggestive of a potential Dollar turnaround is a little-watched, yet intriguing, development concerning the Dollar’s performance versus a middle-eastern currency.

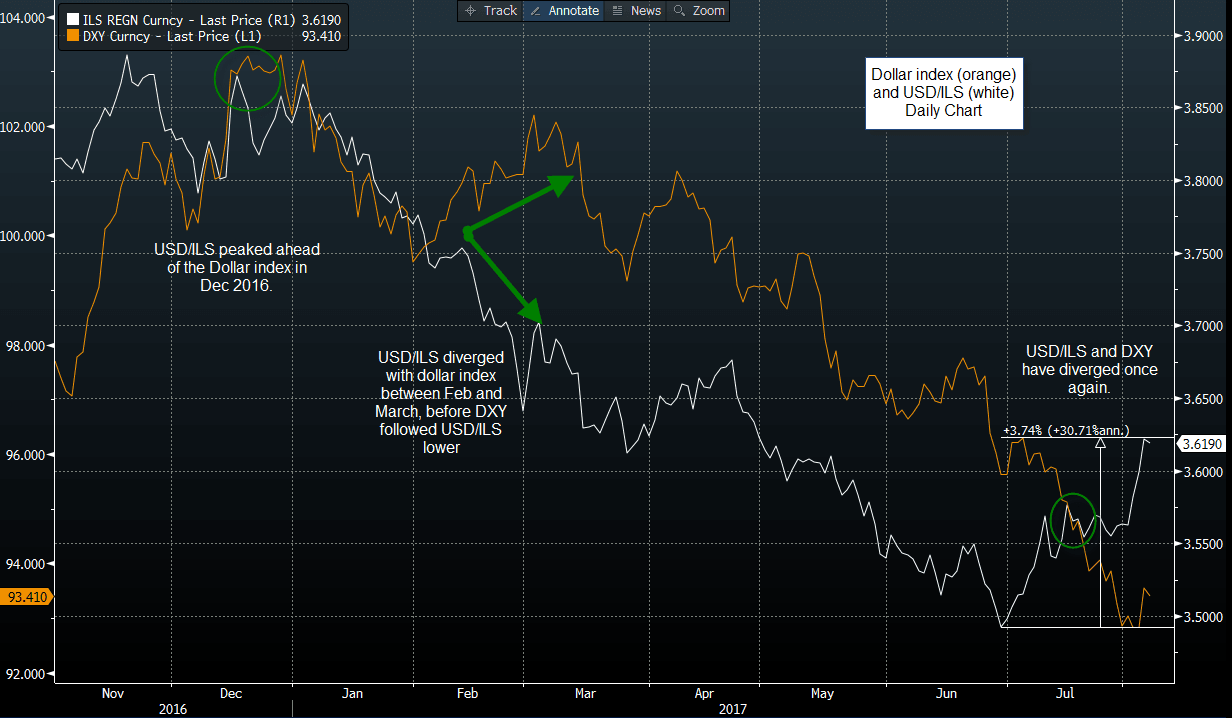

Analyst Kathleen Brooks at City Index says one lead indicator to watch is the Dollar / Israeli Shekel rate (USD/ILS) which tends to be a lead indicator for the dollar index as you can see in the chart below.

Source: City Index and Bloomberg

Source: City Index and Bloomberg

“Over the last year, USD/ILS peaked ahead of the Dollar Index in December 2016, circled in the chart below, it then continued to decline through February and March, even though the Dollar Index made a stab at recovery before joining the USD/ILS in a sustained downtrend for the next few months,” says Brooks.

Brooks notes, things started to change in July, when USD/ILS seems have made a bottom and has engaged in a fairly decent uptrend since then, rallying some 3.7%.

Considering USD/ILS and the dollar index have a fairly strong positive correlation, more than 50% over the last 5 years, and the ILS dollar cross has been a decent lead indicator for the broader dollar index in the last 9/10 months, it is worth taking notice when USDS/ILS makes a move ahead of the dollar index.

“Of course, lead indicators don’t give us the crucial bit of information that every trader wants to know: the timing of the change in trend; however they are a good warning signal for the Dollar bears to take note that the buck’s downtrend may be on its last legs,” says Brooks.