GBP/USD Rate's Slip Likely to be Temporary

The Pound to Dollar exchange rate is correcting back from its recent 1.3125 high to a current level of 1.3028, and many readers will be asking whether this is the start of a deeper decline.

The pull-back has been driven largely by a recovery in the Dollar, but will the recovery last?

“This is likely to simply be a pause in Dollar selling pressure,” says Richard Perry from Hantec Markets.

The Dollar has many headwinds: Janet Yellen’s recent cautious testimony concerning the future of Federal Reserve policy, weakening inflation and Donald Trump’s “limited legislative potential” are still headline concerns which are unlikely to ease anytime soon.

The pair has pulled back to just above 1.3000, which is a key psychological level, unlikely to be easily broken.

“The hourly chart shows that if the buyers can continue to hold on to the $1.3000 support then the momentum indicators are all around levels where the bulls have previously resumed control,” says Perry.

Monday and Tuesday were both down-days and for a third day in a row to also be bearish - in the midst of a strong up-trend - is much less likely.

Research has shown that there is a roughly 66% probability, in fact, that the third day of a pull-back in an uptrend will be positive – indicating today (Wednesday) will probably close on a positive note.

Get up to 5% more foreign exchange by using a specialist provider. Get closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

We continue to stick to the technical forecast contained in our week-ahead analysis, which sees a continuation of the bullish trend higher, to a target at 1.3175 subject to confirmation from a break above Tuesday’s 1.3125 highs.

The next major release for GBP/USD is the release of Retail Sales on Thursday, at 9.30 BST, which unfortunately is likely to show a continuation of the recent decline.

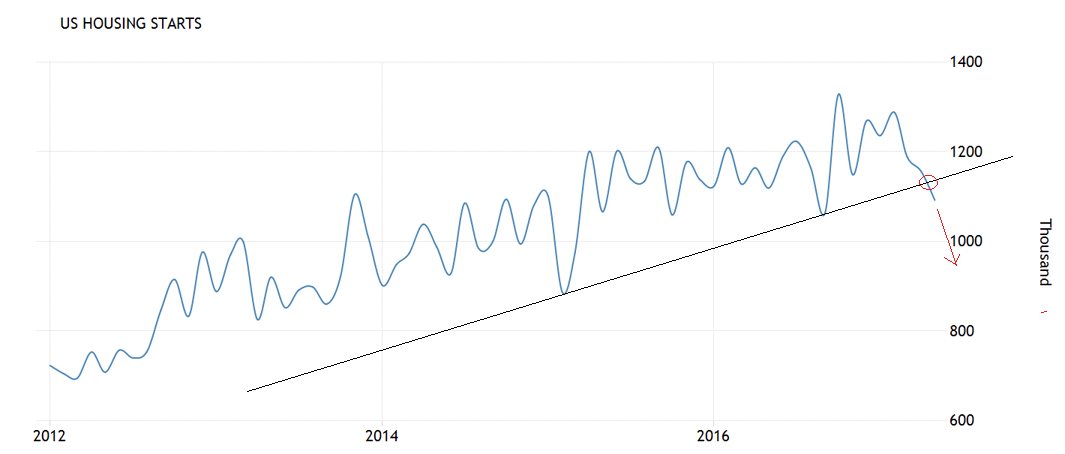

For the Dollar, there is also the possibility of a decline from Housing data out at 13.30 BST on Wednesday.

This has shown a sharp retraction recently which is concerning because housing leads the economy.