Pound Pares Losses Against Dollar on US Employment Data Miss

- Written by: Gary Howes

The British Pound was seen recovering ground lost earlier in the day against the US Dollar as a key US economic data released disappointed investor expectations.

The monthly release of US employment data showed the headline non-farm payrolls figure - a key gauge of the economy's health - read at 98K which is well below the 180K increase markets were looking for.

The Dollar edged lower against a basket of currencies on the release with the Dollar index declining back to 100.54 having been at 100.77 earlier in the day.

The Pound to Dollar exchange rate was seen back up at 1.2439 having been as low as 1.2411 earlier.

Where Next for GBP/USD?

The Pound to Dollar exchange rate has bounced midweek, leaving it within its recent range.

What will it take to prompt a notably stronger Pound against the US Dollar? The initial impetus going forward will be provided by the employment report release, but the market appears quite resistant to GBP strength at current levels.

There are many other answers to this question but from a technical perspective there are some key levels readers should be aware of as a break above these points could well spell the beginning of a more sustained move higher.

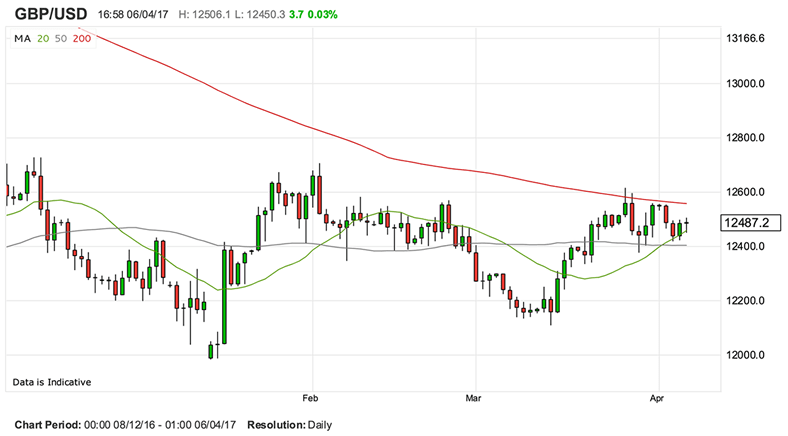

“Resistance moves to 1.2517 initially, with a break above 1.2559 needed to see a test of a tougher resistance zone and the top of the range starting at the March high at 1.2617 and stretching up to the trendline and 200-day average hurdles at 1.2635/50, where we would continue to look for a cap,” says David Sneddon, a technical analyst at Credit Suisse in London.

The 200 day moving average is denoted by the red line in the above, as can be seen Sterling has been unable to break above here over recent weeks.

Selling interest picks up notably on any forays into this areas with traders setting orders in anticipation of a reversal.

The market is therefore structurally biased against the Pound at this level and it will take a notable event to push a break higher towards a new 2017 best.

Indeed, if this resistance to be overcome we could well see a strong advance towards the 1.30 region.

If however Sterling fails and reverses Sneddon says we should watch for support to come into play at 1.2419 where buying interest is likely to be found.

However, a fall below here could see a test of a more important price area at 1.2377/60, the low from late March.

“Follow-through beneath here should see weakness extend to 1.2324, beneath which can see a deeper fall to the mid-March low at 1.2109,” says Sneddon.