Pound at “Risk of Deeper Selloff” against US Dollar

- Written by: Gary Howes

Pound Sterling is seen trading in a contained pattern just above the 1.25 mark at the time of writing.

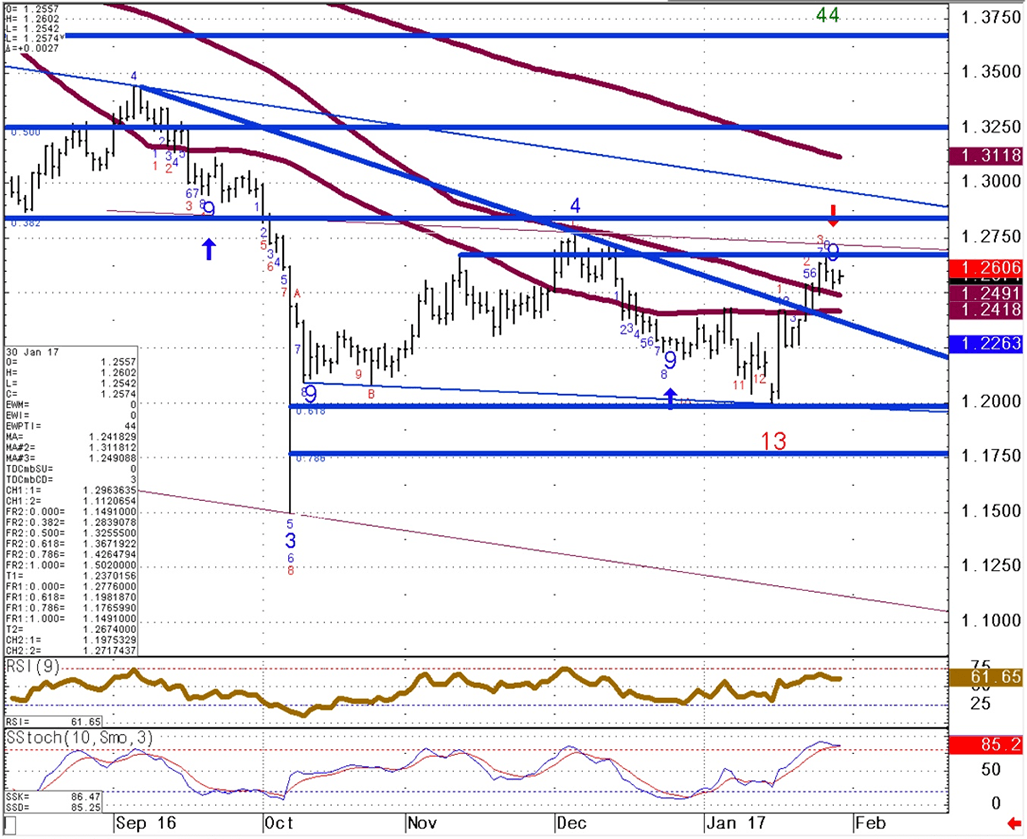

We are now well off the previous week's highs registered at 1.2673 and as our analysis notes, the exchange rate is at a critical inflection point. In short, trade over coming hours and days will decide whether the short-term uptrend remains a valid proposition going forward.

Karen Jones, technical analyst at Commerzbank, believes the British Pound is at risk of further declines against the US Dollar over the near-term.

“GBP/USD last week we charted a TD perfected set up on the daily chart and the near-term risk is that we will see a deeper sell off,” says Jones.

The reference to a ‘TD Setup’ by Jones references Tom Demark technical analysis which essentially looks to warn when momentum is slowing.

In this instance, upside momentum is seen slowing.

In a briefing to clients at the start of the week Jones does however observe that any weakness should be limited to established support levels.

Dips lower are indicated to hold circa 1.2420/1.2340.

“The market is bid above the 55 day ma at 1.2418 and the near term risk remains on the topside,” says Jones.

As a result, Jones caution that she remains unable to rule out further strength to the 1.2776 December high, but this should represent a limit.

“Between here and 1.2836 lies several Fibonacci retracements and major resistance and we suspect that it will struggle here,” says Jones.

To the downside, Commerzbank suspect that prices will need to go sub 1.2250 in order to alleviate immediate upside pressure.

Support at 1.2250 guards the 1.1988/80 recent low.