US Dollar Forecast to be Better Supported: Views on EURUSD, GBPUSD and More

Our latest technical forecasts for the US dollar against the euro, pound, Australian, New Zealand and Canadian dollars.

The dollar is trying to build a bottom after last week’s sell-off. The reaction of global markets to the US payrolls was ambiguous; the US dollar rebounded as the details of the report were strong while equities sold off.

The USD should find some support after the recent sell-off, as the employment report showed some signs of strength despite the miss in the headline number.

Expect currency markets to fixate on the words of Janet Yellen, who appears before Congress on Thursday.

This will be Yellen’s first official appearance after the January FOMC meeting.

Analysts at UniCredit expect the Fed Chair to reiterate the same two-tiered message that was provided by both the January post-meeting FOMC statement as well as by Vice Chair Stan Fischer earlier this week:

Further (gradual) policy normalisation is in the pipeline, but most FOMC members want to see evidence that recent headwinds (e.g. from China and tighter financial conditions) do not impact the US economy before pulling the trigger again.

Should Yellen be deemed to have turned more cautious expect the US dollar to come under pressure. Indeed, we see risks skewed to the downside.

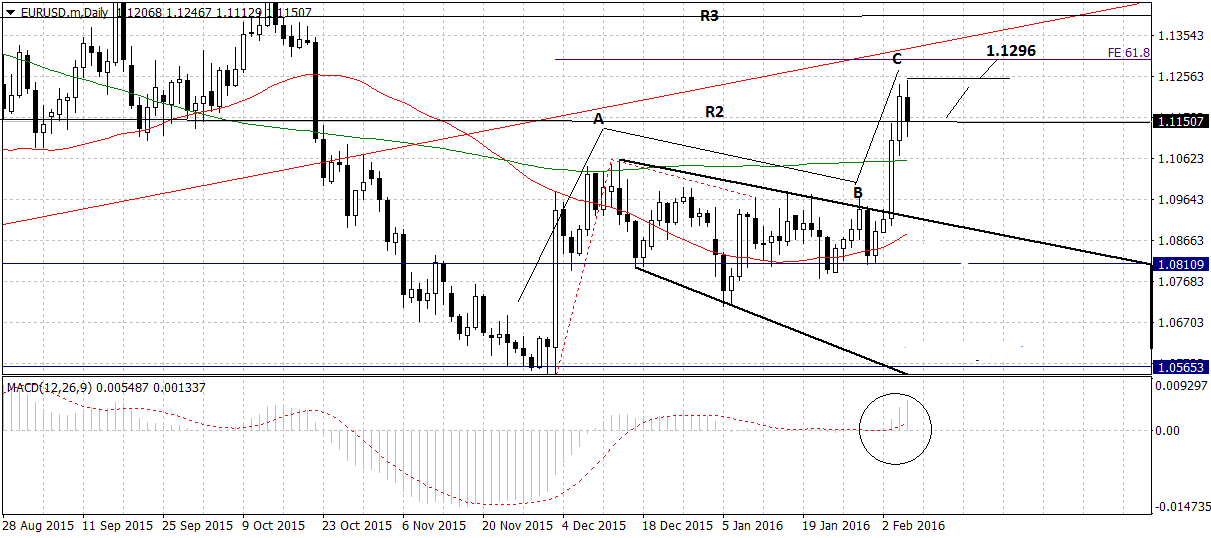

EUR/USD Technical Outlook

By breaking out from its January consolidation and moving rapidly higher following poor US Non-Manufacturing ISM data, the EUR/USD started the final ‘C’ leg of an A-B-C correction which started at the December lows.

It has risen up a fair way but it will probably go even higher, as wave ‘C’ is normally at least 61.8% of ‘A’ which gives a minimum rate expectation of 1.1296.

The pair has currently lost ground on marginally positive payrolls data which showed a unexpected rise in wages of 0.5% (exp 0.3%) and a fall in the overall Unemployment Rate to 4.9%.

However, the headline payrolls number was significantly lower than expected so the data may be unlikely to move the dollar much further.

It has currently fallen to the R2 Monthly Pivot at 1.1115, where it is finding support, from which it might launch a resumption of the breakout mini up-trend.

Therefore, I would expect a break above the current 1.1247 highs to confirm a move up to 1.1296.

The strong MACD cross above the zero-line is a further bullish sign supporting more upside.

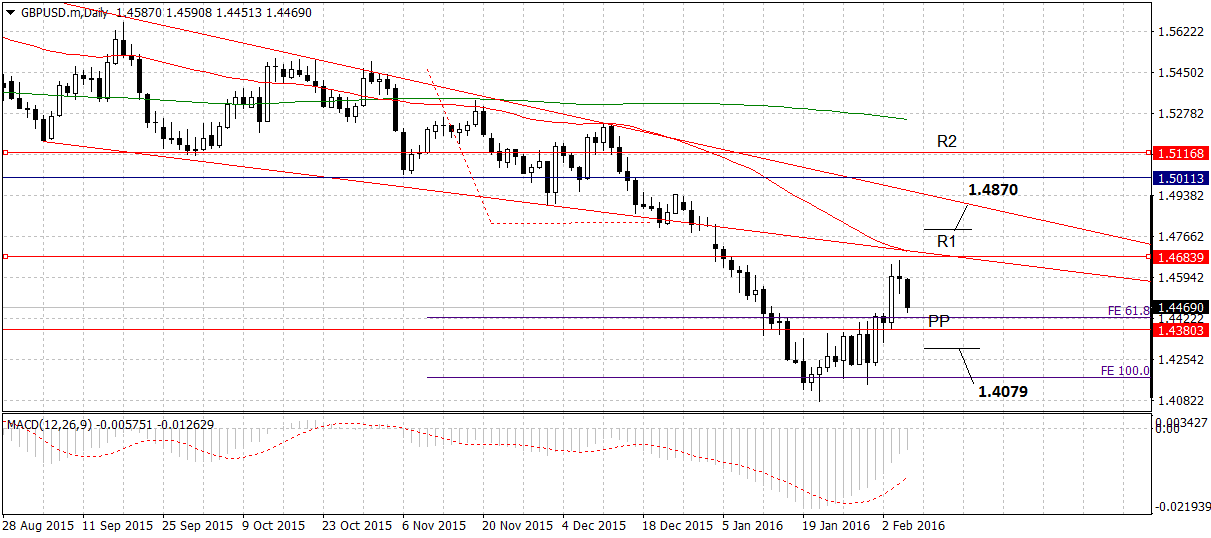

GBP/USD Technical Outlook

Sterling continues to recover versus the dollar.

The pair has taken a hit following Non-Farm Payrolls but this has not been significant enough to suggest a reversal of the recovery and a resumption of the broader down-trend.

Currently further upside still appears possible, however, the R1 Monthly Pivot, the 50-day MA and resistance from the lower border of the previous descending wedge lie not far above, clustered around 1.4680, and the exchange rate could rise up to there and then rotate and start moving lower again.

It would take a clear break above this resistance trio to confirm a continuation higher, such as would occur it the pair broke above 1.4775 for example.

Such a move would be expected to move up to the upper border of the falling wedge at around 1.4870.

Alternatively, a break below the Monthly Pivot at roughly 1.4380, including a confirmation margin – so below 1.4275 - could signal further downside to the previous lows at 1.4079.

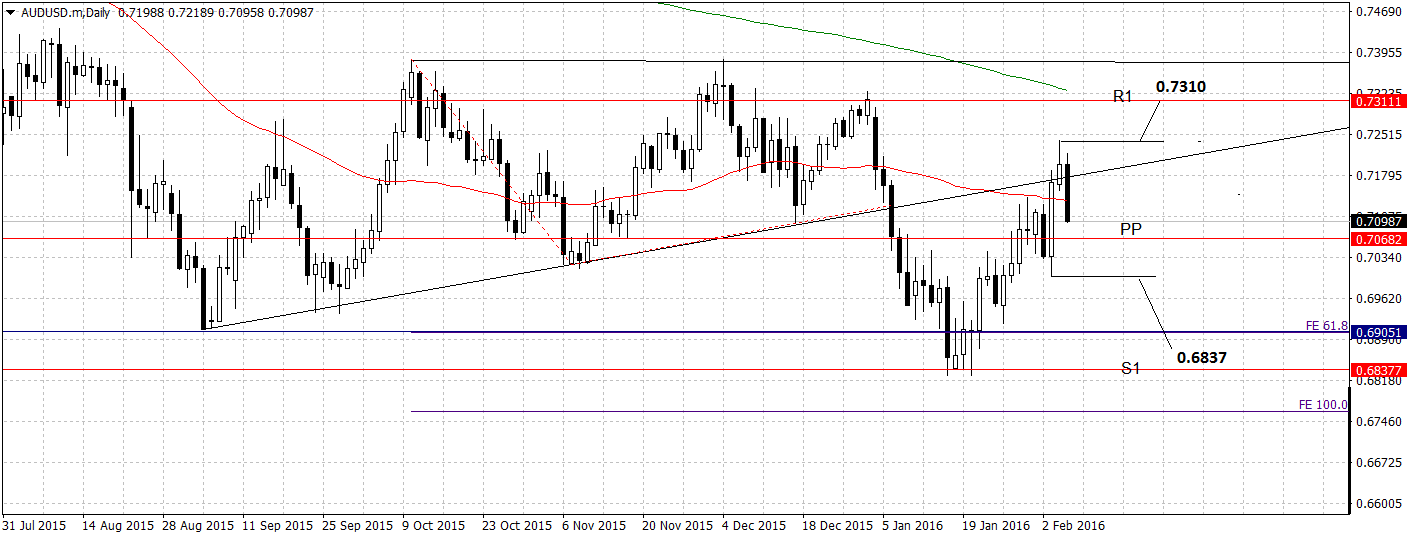

AUD/USD Technical Outlook

The pair has sold off heavily following U.S Non-Farm payrolls data and is moving down.

Resistance from the lower border of a triangle pattern is also putting a cap on gains, and lending fuel to the sell-off.

The small up-trend – or dead monkey bounce – as it has been referred to, may indeed be losing steam, and we could see a capitulation back down beginning, however, the monthly pivot at 0.7068 stands in the way of further downside, and could provide major support to the exchange rate.

To forecast a stronger move lower, the pivot would need to be definitively breached, confirmed by a move below 0.6980, with a target then being activated at the Jan 20th lows and the S1 Monthly Pivot situated close to 0.67837.

Alternatively, a break above the 0.7243 highs would probably confirm more upside to a target at 0.7310.

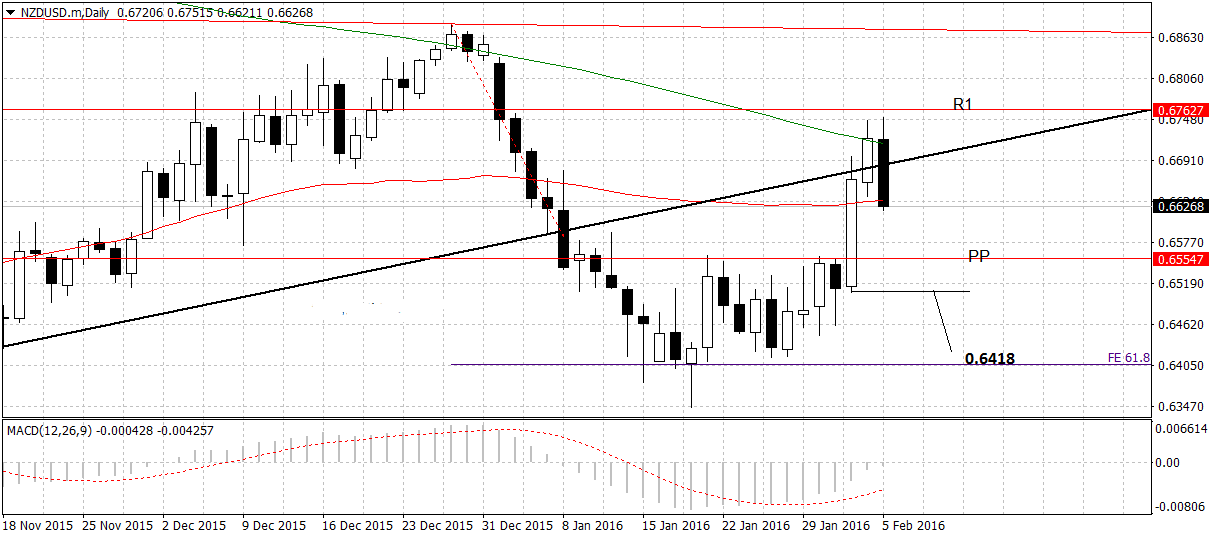

NZD/USD Technical Outlook

The kiwi has rotated at resistance supplied from a legacy trend-line.

It is selling off quite strongly now, given added impetus by U.S data which saw a rise in wages and a fall to 4.9% in the unemployment rate.

Risks seem biased to the downside now, and a break below 0.6506 would probably lead to a move down to 0.6418.

MACD is also still in bearish territory.

USD/CAD Technical Outlook

The loonie has extended its down-trend, breaking clearly below the trend-line and the 50-day MA.

It has rotated after reaching the S1 Monthly Pivot at 1.3622 and put in a good hammer reversal candlestick, followed by an up-day today off the back of stronger U.S data, however, the trajectory of the short-term trend remains bearish.

MACD has turned below the zero-line heralding the onset of a bearish trend.

A move clearly below S1 confirmed by a break below 1.3560, would usher in a new bearish phase, with an end target down at the next major support shelf at 1.3300.