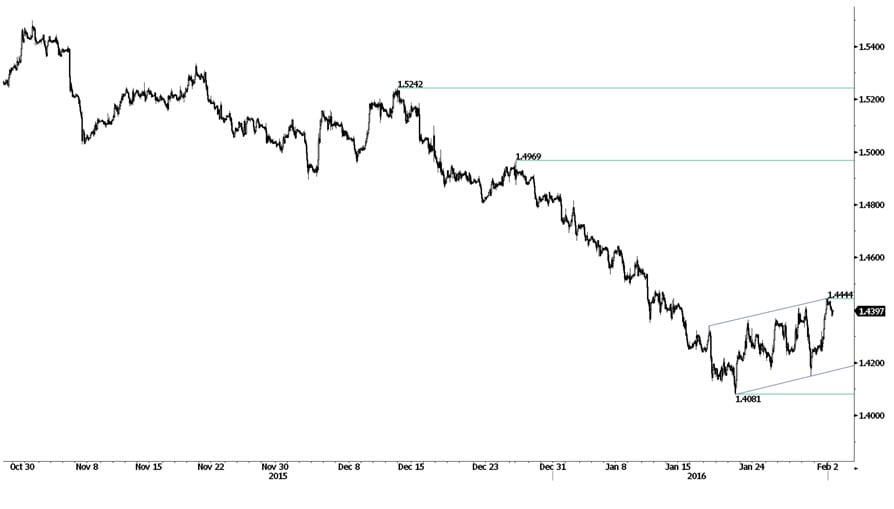

GBP/USD: 3 Week Best Confirmed, But Further Declines Favoured by Speculators

The British pound was the best performing currency in global FX on the first of February and the GBP to USD conversions enters the mid-week session from a position of strength.

Stronger than expected manufacturing activity and an uptick in mortgage approvals set the tone for a stronger pound sterling at the start of the month.

The positive monentum has continued with GBP/USD rising to a 3-week high of 1.4446 as a UK-EU deal looked more likely, potentially paving the way for an early referendum.

However, it was weakness in the US dollar complex, sparked by a manufacturing PMI disappointment, that has really propelled GBPUSD higher to a multi-week best.

GBP/USD managed to heave itself to 1.4411 last week and has now managed to clear its 20 day ma, which is located at 1.4360.

“This is the first time that the market has managed to overcome its 20 day ma this year. It remains upside corrective to Fibonacci resistance at 1.4492 and the 1.4568 April 2015 low,” says Karen Jones at Commerzbank.

Commerzbank note the Elliott wave on the daily chart is implying scope to the 1.4625/1.490 zone and this cannot be ruled out.

This is Just a Correction

“Between the better than expected PMI manufacturing report and overstretched positioning (CFTC report short sterling positions at their highest level since 2013), today's move in GBP/USD is a classic short squeeze,” says Lien.

The implications of branding the move as a ‘short squeeze’ is that the move is unsustainable and Lien, like many other speculators in the market, are looking for GBPUSD to fall further.

Make no mistake, many out there will be loading up on their ‘short GBPUSD’ trades on the back of this GBP strength.

“Last weeks low at 1.4151 guards the January low at 1.4083. Below it lies the minor psychological 1.4000 region. The 1.3502 January 2009 low remains our primary target medium term but first we still expect a minor bounce to be seen,” says Jones confirming that it is too early to call a reversal in fortunes for sterling.

Indeed, analyst Yann Quelenn at Swissquote Bank takes a step back and looks at the longer-dated charts.

The message is clear:

"The long-term technical pattern is negative and favours a further decline towards the key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64m (04/11/2015 low see also the 200 day moving average)."

However, the general oversold conditions and them recent pick-up in buying interest pave the way for a rebound notes Quelenn.

Note that for these two currencies there are big events on the horizon. On Thursday we get a raft of information from the Bank of England who release their February interest rate decision and their Inflation Report.

Then Friday brings with it the release of non-farm payrolls in the United States when we will get a good gauge on the prospects for the US economy. Expect volatility.

Rally Extends on Services Data

The data highlight of the week has passed and it has gone the way of the pound.

U.K Services activity has increased by a greater-than-expected amount in January, according to a survey by Markit/CIPS on Wednesday morning.

The metric rose to 55.6 from a previous 55.5 reading, and beat analysts’ expectations of a decline to 55.4.

Sterling is now adding to its 3 week best.