EUR/USD Exchange Rate Tests Top of Extended Range As Euro Becomes Unlikely Haven

The Euro to Dollar exchange rate continues to extend in a tight range, but one analyst suggests the next notable move could be towards the upside.

The euro has increasingly become one of the goto currencies in times of high risk, a new role for it as traders come to believe more and more in the current recovery narrative.

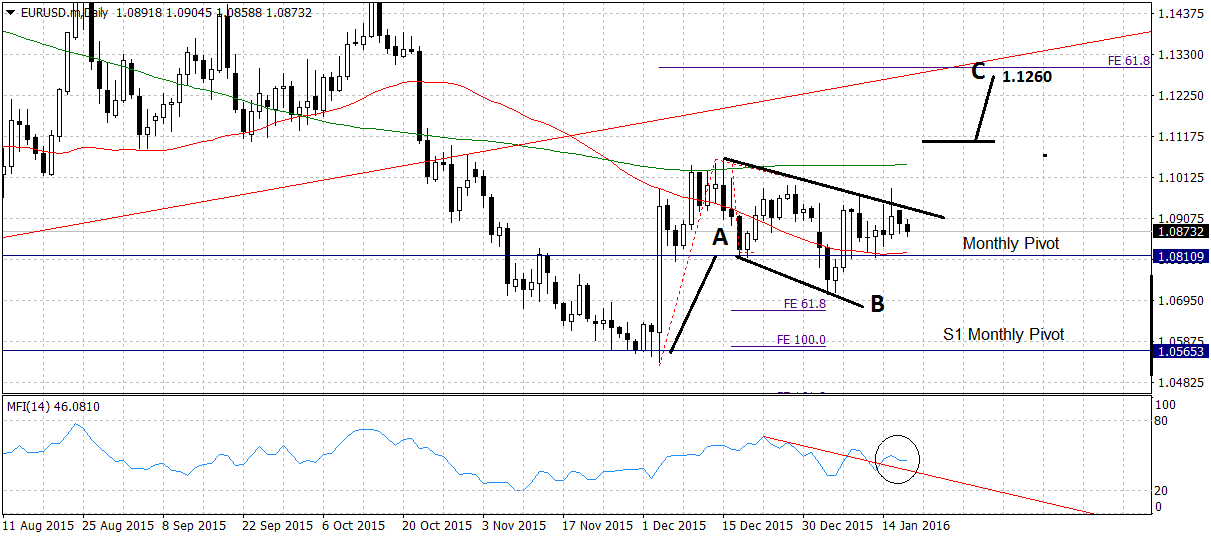

The EUR/USD pair, which was trapped in a sideways down-sloping range for weeks, now appears to be testing the upper-boundary of the range in an attempt to breakout to the upside, in line with PSL's own technical forecasts and those of several fundamental analysts too.

Nevertheless, the potential for a reversal later in the day should not be overlooked, with the release of U.S CPI (13.30 GMT), which if higher-than-expected could put downwards pressure on the pair again as it resurrects a more hawkish outlook for Federal Reserve policy in 2016.

Testing Up

The pair is currently testing the upper level of a relatively tight, down-sloping range on the daily chart.

There is potential for further upside, given the pattern formed since the early December lows may well be the A-B part of a corrective three-wave A-B-C pattern, with the C wave yet to extend higher.

Wave C is expected to rise a Fibonacci 61.8% of wave A, which indicates an expected target at 1.1260.

There are several layers of resistance in the way, however, including the 50-week moving average right under it at 1.1041 and the 200-day MA only 3 points above at 1.1044.

It’s important the exchange rate decisively breaks above these levels for confirmation of the up-trend extending.

Such a break would probably come from a move above 1.1115, which would confirm an extension up to the aforesaid 1.1260 target.

The Chaikin Money Flow Index is showing underlying strength in the consolidation supports the bullish bias to the outlook.

'Bullish Bunds' and 'Bearish Yields'

According to SocGen’s Kit Juckes the Bund-Treasury yield ratio is a useful way to forecast the EUR/USD.

“EUR/USD has tended to rally on ‘risk-off' days and slip on risk-on ones as the Treasury/Bund spread drives the currency and the fall in Treasury yields has supported the euro in recent weeks.

“A brighter risk mood could see US yields move higher and the euro drift a bit lower, but I'd be surprised to see a break from the current range.

“In the back of my mind, the risks are still skewed towards a break to the upside in Q1, and a move lower only when there's some reason to start looking for Fed rate hikes to resume”.