Deutsche Bank CORAX: British Pound in Demand with 'Big Buyers' Again

The big fish in global currency markets have turned more bullish on the pound sterling of late, suggesting a potential positive turn-around in fortunes for the UK currency.

Research conducted by Deutsche Bank has confirmed the GBP is finding favour once more.

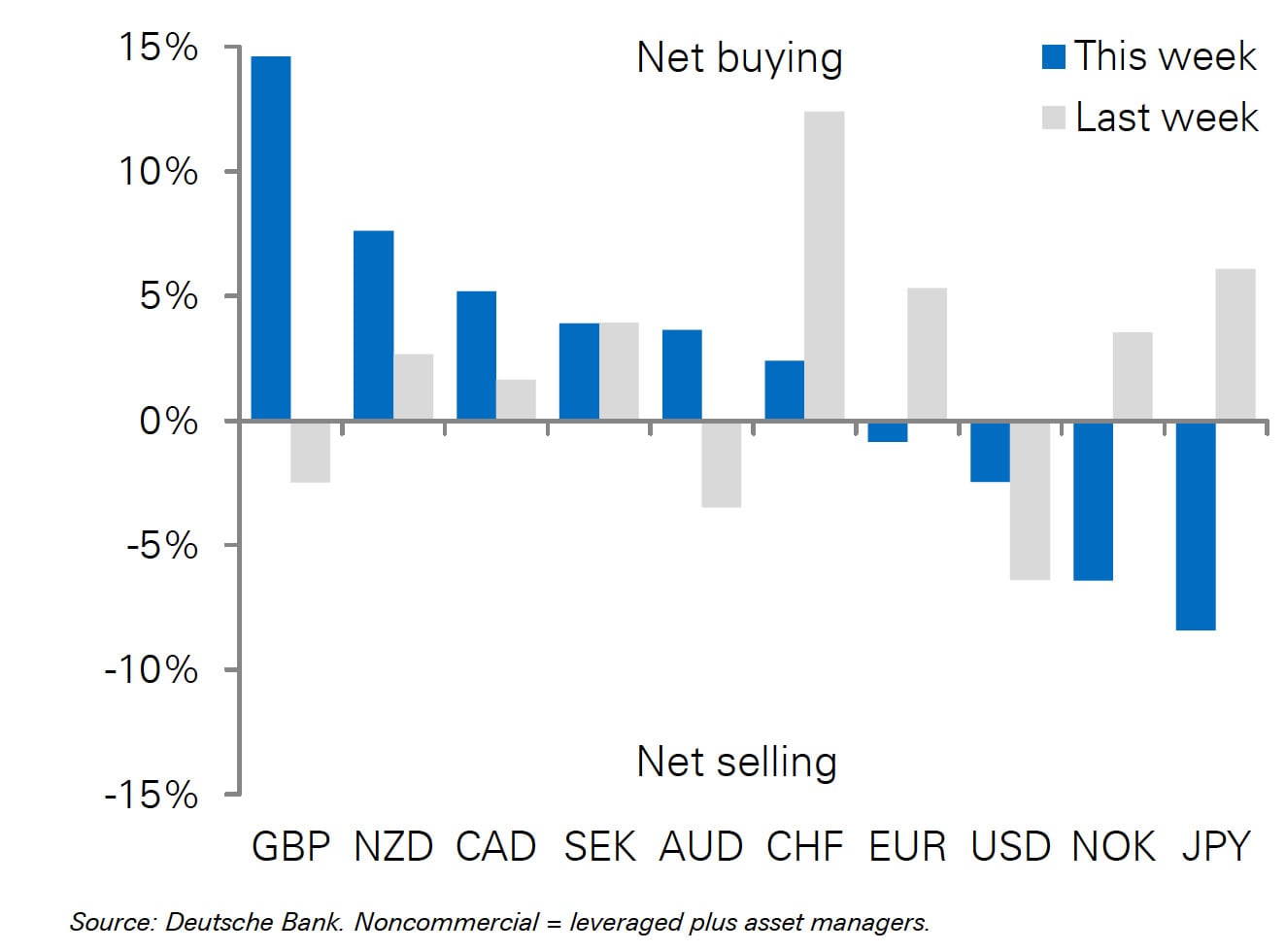

“Big buyers of GBP as dollar longs trimmed further. Investors bought the largest amount of sterling in almost a year last week helped by positive M&A news and a overall neutral GBP market position compared to earlier in the year,” says Deutsche Bank’s Nicholas Weng.

The data comes courtesy of Deutsche Bank’s CORAX indices.

The CORAX (Categorised ORderflow from Autobahn FX) indices are flow positiong indices derived from globally aggregated spot flows from the Deutsche Bank Autobahn platform, which represents 17.5% of the electronic trading market surveyed by Euromoney in 2015.

We see this as confirmation that markets may be looking to reverse the GBP-negative stance they have held on sterling since the July highs.

Indeed, we are seeing bullish sentiment improve further on Thursday following the knock-out reading from the UK retail sector where September figures blew away expectations.

The turn in trend required a positive data event such as this.

An improvement in commodity prices have been attributed to the recent good run in the Australian and New Zealand dollars - CORAX confirms the move has been exacerbated by short-covering.

While sterling is finding favour aggressive short covering in commodity currencies continued with large NZD and CAD buying.

“Our positioning proxies now indicate that NZD positioning is much more balanced, while CAD and AUD shorts remain elevated,” says Weng.

Elsewhere, the market has used the dip in USD/JPY to re-build longs, with the JPY suffering from large net selling on our platform this week, but overall positioning still showing large under-weights in yen shorts.