Pound-to-Dollar Week Ahead Forecast: Setback to Extend

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling's uptrend against the Dollar has paused.

The Pound-to-Dollar exchange rate is in an uptrend that appears to have reached a temporary peak that will allow for consolidation into the all-important April 02 tariff announcements.

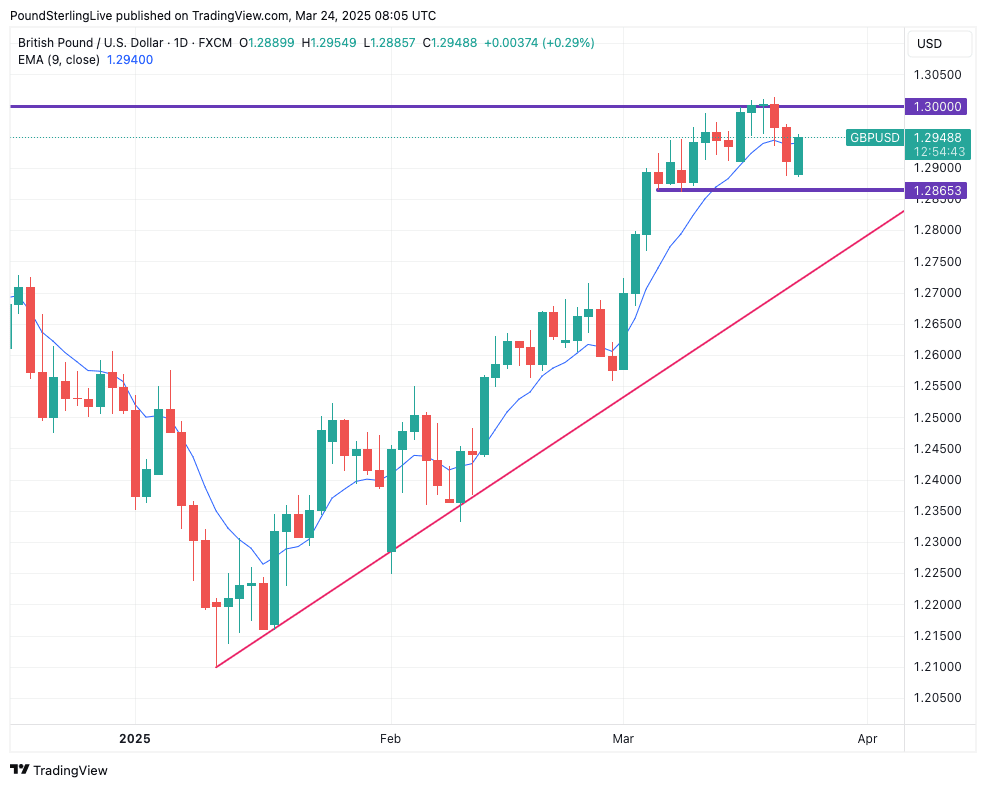

The pair rallied to as high as 1.3014 last week, but ultimately, a break above 1.30 was not to be, confirming the strength of selling interest layered around this resistance zone.

With the bulls unable to punch through the ceiling, a pullback ensued, albeit one that is shallow and consistent with a consolidative phase as opposed to a trend-turn lower.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"GBPUSD was pushed higher by the broader sentiment boost toward European assets and has been testing the 1.30 resistance mark in recent days. While we do not rule out a breaking of the line, we think this will only happen later in the year," says Dominic Schnider, a strategist at UBS.

This is the theme we are looking at in the coming days: further consolidative action, with scope for weakness to 1.2865 and then 1.28.

"GBP/USD failing at 1.3000 and now back to 1.2943, we should see a further migration back to 1.2798 as the EU defense spending euphoria cools and the USD sell abates into quarter end," says W. Brad Bechtel, Global Head of FX at Jefferies LLC.

However, the trend higher should ultimately resume and a break above 1.30 would transpire at some point in April (although Schnider thinks we will have to wait longer as he thinks this break will "later this year").

Above: GBP/USD at daily intervals.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

For FX markets, U.S. tariffs remain the overarching theme, with the focus increasingly turning to the April 02 announcements, when the most far-reaching set of tariffs of Trump's second administration will be announced.

The existing theme is that tariffs are proving a negative for the U.S. economy and the U.S. Dollar, which is why there is a sense GBP/USD can extend higher as these tariff decisions come through and are implemented.

However, a word of caution: "We maintain our forecasts for a USD rebound in Q2," says Daniel Tobon, a currency analyst at Citi. "Tariff risks look underpriced and we expect USD undervaluation to correct on a hawkish April 2 announcement."

If Citi are correct, we could be in for another big surprise, whereby tariffs start to play positive for the Dollar again.

We think, therefore, that the current consolidation in GBP/USD and other Dollar exchange rates is symptomatic of any building uncertainty around April 02.

Turning to the calendar, the UK offers up some idiosyncratic interest for Pound Sterling this week.

British Pound Calendar

Picture by Kirsty O’Connor / HM Treasury.

Monday, March 24

📌 S&P Global Flash PMIs (Mar)

Services PMI:

Expected: 51.0

Previous: 51.0

Manufacturing PMI:

Expected: 47.2

Previous: 46.9

🔹 GBP Impact:

Readings above 50 suggest expansion. A strong services PMI could support GBP, while weakness in manufacturing may be overlooked if services remain solid.

📌 BoE Governor Bailey Speech (18:00 GMT)

🔹 GBP Impact:

A hawkish tone (concern over inflation, rate cut caution) could lift GBP. A dovish tone may signal future easing, pressuring GBP.

Wednesday, March 26

📌 CPI (Feb)

Expected:

Monthly: +0.5%

Annual Headline CPI: 2.9%

Annual Core CPI: 3.6%

Previous:

Monthly: -0.1%

Annual Headline CPI: 3.0%

Annual Core CPI: 3.7%

🔹 GBP Impact:

A higher-than-expected print could delay BoE rate cuts, supporting GBP.

A cooler-than-expected CPI would reinforce disinflation and increase easing expectations, likely weighing on GBP.

📌 Chancellor Rachel Reeves Budget Update (12:30 GMT)

🔹 GBP Impact:

Fiscal stimulus or prudent budgeting could support GBP if seen as growth-positive or fiscally responsible. Loose spending without funding clarity might raise debt concerns, which are mildly bearish for GBP.

A repeat of the Liz Truss 'mini budget' currency collapse is highly unlikely.

Friday, March 28

📌 Final Q4 GDP (QoQ & YoY)

Expected (QoQ): +0.1%

Expected (YoY): +1.4%

Previous: +0.1% QoQ, +1.4% YoY

🔹 GBP Impact:

As a final print, market impact will be limited unless revised. A surprise upward revision could boost GBP modestly.

📌 Retail Sales (Feb)

Including Fuel:

Expected: -0.4% MoM (0.6% YoY)

Previous: +1.7% MoM (1.0% YoY)

Excluding Fuel:

Expected: -0.5% MoM (0.4% YoY)

Previous: +2.1% MoM (1.2% YoY)

🔹 GBP Impact:

A sharp drop in sales could signal weakening demand, negative for GBP. If data surprises positively, it may support GBP by reducing growth concerns.

USD Week Ahead

Image © Adobe Images

Monday, March 24

📌 S&P Global Flash PMIs (Mar)

Manufacturing PMI:

Expected: 51.8

Previous: 52.7

Services PMI:

Expected: 51.2

Previous: 51.0

🔹 USD Sensitivity:

Above 50 signals expansion; if PMIs hold up, it supports the Fed’s soft landing narrative, boosting USD. A drop toward 50 or below could raise slowdown concerns, weighing on USD.

Tuesday, March 25

📌 Conference Board Consumer Confidence (Mar)

Expected: 94.0

Previous: 98.3

🔹 USD Sensitivity:

Confidence falling in line with expectations may reflect moderating consumer momentum. A positive surprise would boost growth expectations, supporting USD.

📌 New Home Sales (Feb, MoM)

Expected: +3.5%

Previous: -10.5%

🔹 USD Sensitivity:

Not typically a significant driver of USD.

Wednesday, March 26

📌 Durable Goods Orders (Feb, Preliminary)

Expected: -0.7%

Previous: +3.2%

🔹 USD Sensitivity:

A larger decline may signal slowing investment, which could pressure USD. If the drop is smaller or rebounds, it may support economic resilience narrative, lifting USD.

Thursday, March 27

📌 GDP (Q4, Final Estimate, Annualised)

Expected: 2.4%

Previous (Second Est.): 2.3%

🔹 USD Sensitivity:

This is unlikely to have a significant currency impact.

📌 Initial Jobless Claims (week ending Mar 22)

Expected: 225K

Previous: 223K

🔹 USD Sensitivity:

With all eyes on the U.S. labour market in light of the DOGE job cuts, a stable low number signals labour market strength, supporting USD. A sudden increase could fuel rate cut expectations, softening USD.

📌 Advance Goods Trade Balance (Feb)

Expected: -$134.5bn

Previous: -$155.6bn

🔹 USD Sensitivity:

A narrower deficit supports GDP tracking and USD. A wide deficit weakens net exports, slightly negative for USD.

📌 Pending Home Sales (Feb, MoM)

Expected: +1.5%

Previous: -4.6%

🔹 USD Sensitivity:

Rebound in-home sales would reinforce consumer activity, which supports USD. Continued housing weakness may hurt sentiment.

Friday, March 28

📌 PCE Price Index (Feb)

Headline PCE:

Expected: +0.3% MoM (2.5% YoY)

Core PCE:

Expected: +0.3% MoM (2.7% YoY)

🔹 USD Sensitivity:

These are the Fed’s preferred inflation gauges. Sticky or stronger-than-expected PCE → fewer rate cuts expected → USD bullish. Weaker PCE → increased cut expectations → USD bearish.

📌 Personal Spending (Feb)

Expected: +0.6%

Previous: -0.2%

🔹 USD Sensitivity:

A bounce in spending signals resilient demand, supporting USD. A miss would weaken the growth outlook, pressuring USD.

📌 University of Michigan Consumer Sentiment (Mar, Final)

Expected: 57.9 (unchanged)

🔹 USD Sensitivity:

Stable confidence likely neutral; large revisions may cause short-term volatility.