Pound-to-Dollar Week Ahead Forecast: Extending the Recovery

- Written by: Gary Howes

Above: File image of Elon Musk. Photo credit: (NASA/Aubrey Gemignani).

Pound Sterling's recovery against the Dollar should extend in the coming week amidst DOGE cutbacks, equity rotation and Bank of England messaging.

Our Week Ahead Forecast model shows a green dashboard for the Pound-to-Dollar exchange rate over near-term timeframes and looks for a new two-month high at 1.27 before the week is out.

The uptrend rests on the broader pullback in the dollar as investors lower the odds of damaging tariffs under President Donald Trump and as expectations for U.S. economic outperformance wane.

To be sure, the risks of rising unemployment and increased economic uncertainty relating to Elon Musk's DOGE programme are emerging as a USD headwind that must be monitored.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Musk's mantra of 'move fast and break things' underpins DOGE's approach, which spells uncertainty for U.S. federal employees and could severely risk their smooth running. DOGE could yet be a success, but in the near term, it does pose risks that we think will weigh on USD.

On Saturday, DOGE emailed Federal employees asking what they accomplished in the past week and saying failure to respond would be considered a resignation.

Analysts at Pantheon Macroeconomics think the cost-cutting drive should start to reflect in labour market figures from this week. They are watching the weekly jobless claims release, due Thursday, for signs of an uptick in those claiming unemployment benefits. Should the data surprise, we could see USD soften.

For their part, Pantheon is forecasting GBP/USD to recover to 1.28 by the start of the second quarter of the year.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

"We are starting to worry about the downside risks to the economy and markets from: 1) the impact of DOGE layoffs and contract cuts on jobless claims and 2) persistently elevated policy uncertainty weighing on capex spending decisions and hiring decisions," says Torsten Sløk, Chief Economist at Apollo.

"Slok, who has been adamant and correct on the US economy for a long time (bullish) is turning more cautious and I think that’s worth paying attention to," says Brent Donnelly, founder of Spectra Markets.

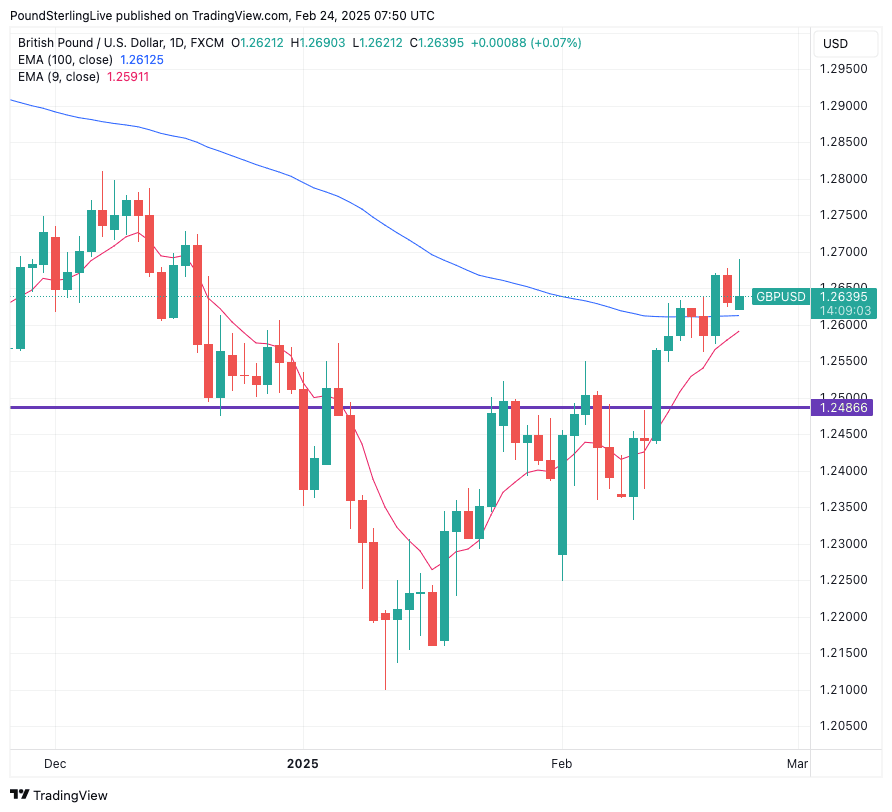

Looking at near-term technicals for GBP/USD, the signals are constructive, with a steady uptrend taking the market to 1.2640 on Monday, ensuring the pair remains above the nine-day exponential moving average (EMA) at 1.2591. While above here, we would expect a steady run higher to 1.27.

GBP/USD is now sitting on top of the 100-day EMA (1.2612), which will act as support following last week's successful upside break, confirming that the uptrend is building in strength.

Above: GBPUSD at daily intervals.

Rotation Underway

Analysts expect the ongoing underperformance of U.S. stock markets to extend in the coming days, which has been something of a drag on the Dollar.

"A surprising trend in 2025 has been the underperformance of US equities compared to other markets. This is attributed to the high valuations of US stocks, with their price-to-earnings (PE) ratios increasing significantly over the past years, leading to a ceiling effect," says an FX strategy note from Deutsche Bank.

"Similar to US equities, the US dollar is seen as expensive relative to other global currencies. Thematic trends in the G10 FX market indicate a preference for "cheaper" assets, which has contributed to some softening in the USD," it adds.

Second-tier releases dominate the week's calendar, but we will be looking for further signs of a cooling in the U.S. economy. Should this be confirmed, bets for further Federal Reserve rate cuts will rise, potentially weighing on the USD.

Tail risks would involve 'hawkish' tariff threats from President Donald Trump.

However, USD strength on these comments should fade as has been the pattern of late, which suggests Trump's tariff agenda is not considered as USD supportive as was the case at the start of the year.

UK: Bank of England Speakers in Focus

Turning to the UK, there are no major data releases, but numerous Bank of England Monetary Policy Committee (MPC) members will be speaking.

Deputy Governor for Monetary Policy Clare Lombardelli will give the opening remarks on Monday at the annual BEAR conference. Chief Economist Huw Pill will deliver the closing remarks to the same conference; his comments are always closely followed.

In the afternoon, Dave Ramsden will discuss the Bank’s balance sheet ahead of the Bank’s decision on its future balance sheet later in the year. Ramsden will deliver another speech on Friday, giving him ample scope to touch on interest rates.

Ramsden is important because he is 'dovish', and we will be interested to hear whether he would vote for another interest rate cut next month.

Swati Dhingra will also be speaking, and she will almost certainly confirm she will be voting to cut again next month. As her views are so predictable, she is not expected to be a market mover.

The market has lowered bets for the number of rate cuts to come from the Bank this year, following last week's consensus-beating economic data prints, and is now pricing in just two more cuts.

We know the Bank itself would prefer about three more cuts (maintaining its quarterly run rate), and it is therefore hard to see how this repricing can continue. Some 'dovish' MPC members will likely try to encourage the market to price in more cuts, which would technically weigh on Pound Sterling.

However, we would expect weakness to be limited, as the economy has a louder voice, and right now, it is warning that inflation risks are notably tilted to the upside, limiting the scope for Bank of England rate cuts.