Pound to Dollar Rate Extends Year-end Recovery

- Written by: Gary Howes

Image © Adobe Images

The Dollar is lower against the majority of its G10 peers as traders navigate the final full trading day of 2024.

With no data or events on the docket to see the year out, traders will continue to be guided by technical considerations, which are improving for Pound Sterling, at least on a near-term basis.

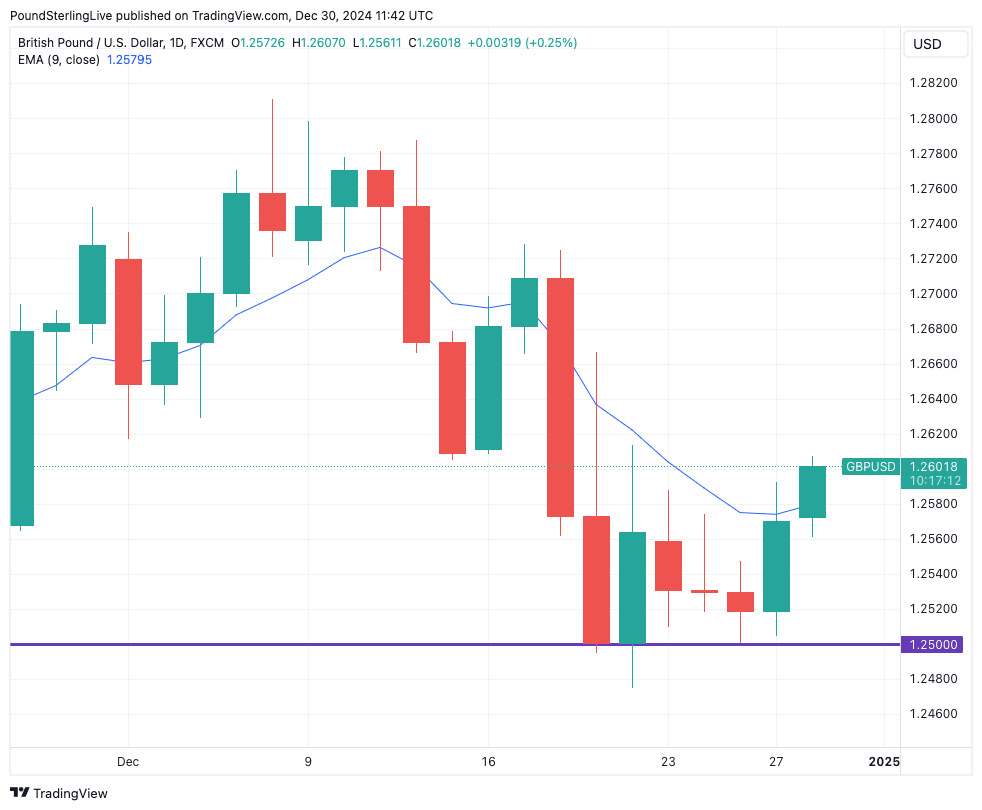

Amidst profit-taking on the Dollar, we see the Pound to Dollar (GBP/USD) exchange rate trade 0.30% higher on the day at 1.2606, as it builds on Friday's 0.40% gain.

The moves underpin the 1.25 level as an interim floor for GBP/USD, while it is now in the process of breaking above the nine-day exponential moving average (EMA).

A successful close above this technical indicator - currently at 1.2579 - would solidify the improved near-term tone and open the door to further gains over the early part of January.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The Dollar strengthened through much of December after the Federal Reserve cut interest rates but indicated that it has turned more cautious about cutting interest rates, which will help keep U.S. bond yields afloat. For the Dollar, this means a stronger-for-longer trade that can extend through 2025.

Given the fundamental backdrop, rallies in Pound-Dollar will likely remain temporary, and the first quarter of 2025 could well bring with it fresh lows as the 1.25 floor gives way.

"The U.S. dollar looks set to rise further in January due to a combination of seasonal, fundamental and technical factors," says Martin Miller, a Reuters market analyst.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

"FX traders should note that the dollar is usually in demand at the start of each year. An analysis of the January performance since 2000 of the USD index, shows it has risen in 15 of the past 25 years," he adds.

Rising U.S. Treasury yields have been a tailwind for the dollar, with the benchmark 10-year note hitting a more than seven-month high last week.

"The USD index, which tracks the dollar against a basket of six major currencies, has scope for an eventual probe of the major 108.962 Fibo, a 61.8% retrace of the 114.78 to 99.549 (2022 to 2023) drop. Fourteen-week momentum remains positive, reinforcing the overall bullish market structure," says Miller.

Such USD strength would ensure downside pressure on GBP/USD builds.

It won't be until next Friday when the first real data test of 2025 lands in the form of the first non-farm payroll report of the year.

The consensus expects the report to show an ongoing robustness in the labour market, justifying the Federal Reserve's decision to pause raising interest rates.

The big surprise would be on a materially weaker print, which would send the USD lower. But, given all the survey evidence we are seeing, this is unlikely and the USD's outperformance can extend.