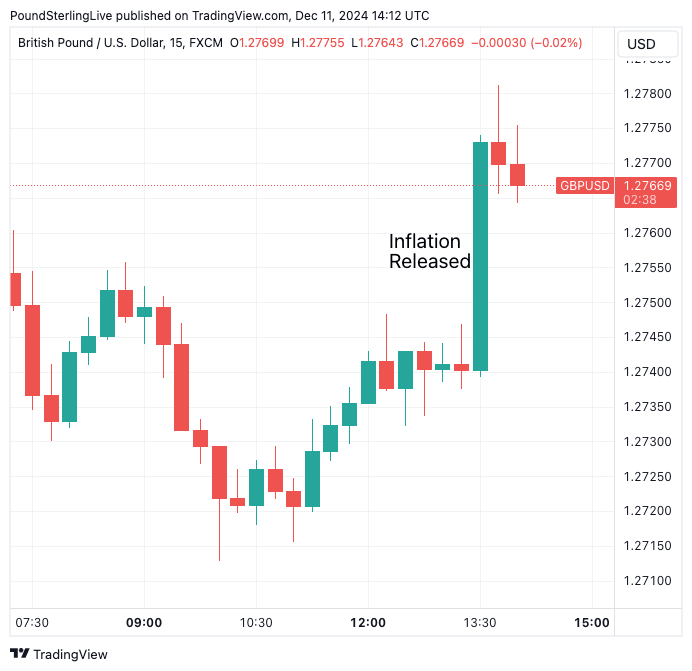

Pound to Dollar Rate Rises After U.S. Inflation Reading

- Written by: Sam Coventry

Image © Adobe Images

The Dollar retreated from earlier highs after U.S. inflation met expectations.

The Pound to Dollar (GBP/USD) rose exchange rate after U.S. CPI inflation rose to 2.7% in November, as expected, but this was up from 2.6% in October, making for the fifth consecutive increase.

This is as CPI rose 0.3% month-on-month, also in line with expectations.

Core CPI printed at 0.31% in November, holding the 12-month rate at 3.3%, which met analyst predictions.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The key takeaways are inflation is proving stubborn, which will limit the pace at which the Federal Reserve will cut interest rates in 2025.

However, the Federal Reserve will likely proceed with another interest rate cut next week because the figures have met expectations.

"This should be enough for the Federal Reserve to cut rates again in December," says Jeroen Blokland, Founder of the Blokland Smart Multi-Asset Fund.

Fed cut pricing for next week up to 95% from 85% with all the CPI data in line.

"The rise in inflation is unlikely to stop the Fed from cutting rates by 25 basis points in a week's time. The federal funds rate is still well above the inflation rate, which puts the U.S. policymakers in a comfortable position," says Dr Thomas Gitzel, Chief Economist at VP Bank.

The overlay is that the Dollar can remain under near-term pressure as the strong October-November rally unwinds, but multi-month it can remain strong as the Fed pursues a cautious approach to cutting rates.

"If the Fed cuts next week, we expect to see a pause in the new year as policymakers start to get a clearer picture of the inflationary risks from President-elect Trump’s expansionary fiscal policies and tariff plans which could further stoke price pressures," says Isaac Stell, Investment Manager at Wealth Club.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

The major unknown heading into the new year is how Trump's policy agenda will impact the U.S. currency.

"In terms of outlook, the Dollar sits between a crosscurrent of forces," says Pierre Roke, Analyst at Validus Risk Management. "On one hand we’ve seen support through Trump’s incoming policies, and on the other, he continues making his preference of a weaker dollar widely known."

Currently, supportive market forces prevail, with the dollar strengthening significantly since Trump's election, but Roke explains that no outcome can be overlooked for someone as unconventional as Trump.

"One example of this is his public scrutiny of Powell's competence and making it clear he favours lower rates. This not only challenges the Federal Reserve's independence—once thought untouchable—and has the potential to weigh on the dollar," he adds.