GBP-USD Predictions Warn of a Potential Return to 2015 Lows

- Written by: Gary Howes

Barclays, Swissquote Bank, Morgan Stanley and JPMorgan give us their latest forecasts for the pound dollar currency pairing as we enter the new month.

The pound to dollar exchange rate conversion (GBP-USD) has lost ground for two weeks in succession as the recovery, in place since April, stalls and reverses. The U.S. dollar started the month of June in formidable fashion with a solid gain across the board, holding near 12-year highs against the yen and notching its strongest levels in nearly a month against its U.K. counterpart.

Both Greece and the U.S. economy will dominate the opening week of June with the former missing an end of May deadline to reach a deal for more rescue cash to stave off imminent default and potential expulsion from the euro. "With the US data and particularly ISM coming in stronger than expected yesterday, the USD has extended recent gains against most of its trading partners, with added support coming from the US bond yields pushing higher across the curve too," note Lloyds Bank Research in a currency note to clients on the 2nd of June.

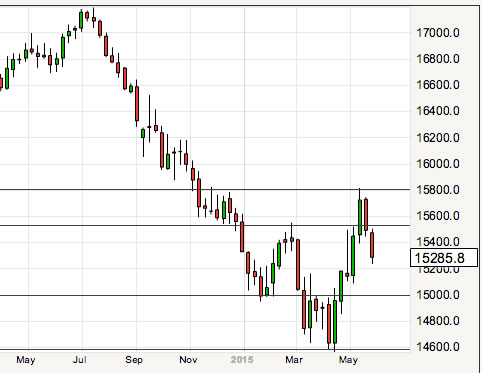

Despite the falls of recent weeks the GBP-USD is well off its 2015 lows - are the latest declines part of a pullback in this recovery story or are we destined to head back to the April minimum at 1.46? We ask a number of leading analysts their views on the outlook facing the British pound v dollar exchange rate and search for the key levels that will determine direction.

At the time of writing the pound to dollar exchange rate conversion at 1.5195, down from the 2015 best at 1.5815. The below graphic shows gives an idea of recent performances and shows a firmer base to declines may have formed:

Viewpoints on the GBP-USD Outlook

Lloyds Banking Group:

"In terms of the USD in general, it has rallied significantly since the beginning of May, but with a distinct lack of macro fundamental support behind it. That and the fact that the US rates markets are not supporting the move (the 2-10 U.S. curve steepened into the end of last week) leaves the USD looking vulnerable to a sharper pullback if we don’t get strong data this week to support it."

Yann Quelenn Market Strategist at Swissquote Bank:

“GBP/USD is declining through a short-term trend-line. Lower lows suggest a downside momentum. Hourly resistance can be found at 1.5437 (27/05/2015 high) and supports is given at 1.5261 (28/05/2015 low).

“In the longer term, the technical structure looks like a recovery bottom whose maximum upside potential is given by the strong resistance at 1.6189 (Fibo 61% entrancement).”

Morgan Stanley:

“With the USD rally resuming, we believe that GBPUSD may have topped out and like to sell on rebounds. However this is a USD specific story, since we believe that there could be some support against the EUR so we keep short EURGBP in our portfolio.

“This trade is supported by monetary policy differentials. The services PMI will be of particular focus this week since this has started to turn around. We will be watching for any signs here of wages continuing to be strong.”

Danske Bank:

“We expect GBP/USD to head lower over the coming three to six months forecasting it at 1.52 in 3M and 1.48 in 6M.

“However, we see the BoE as a ‘mini-Fed’ (ie that it will also raise rates, but with a lag) and expect it to begin raising interest rates in November. Hence, we expect the down-trend in GBP/USD to reverse in 12M as Fed hikes from September are counter-weighed by the beginning of the BoE hiking cycle.”

Barclays:

“We have turned neutral since reaching our short-term targets near 1.5335 and look for signs of a base as price squeezes lower in range towards a cluster of support between 1.5130, the 50-dma, and 1.5190. A move back above the 1.5450 area would signal that the correction is over and open targets near 1.5550 and then 1.5700.”