GBP/USD & EUR/USD Dumped as Investors Digest "Wild Wednesday" in Washington

- Written by: Gary Howes

President Joe Biden walks to the Oval Office with President-elect Donald Trump, Wednesday, November 13, 2024. (Official White House Photo by Adam Schultz)

... but both European currencies are now oversold against the Dollar on a tactical basis.

USD buying picked up in the London morning as markets continue to get ahead of the Trump era, egged on by the frantic pace and determination shown by Trump in setting out his store.

"There is an emerging narrative that unlike in 2016, when Donald Trump was unprepared for office, this time around he plans to hit the ground running in January. To some degree that supports the extension of the Trump trades right now," says Chris Turner, an FX analyst at ING Bank.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Investor focus was sharpened by confirmation overnight that the Republicans had won the House of Representatives, giving Trump control of the executive and the legislature.

This time around, Trump is clear he won't be encumbered by appointments that end up fighting his vision as he is going all-in with loyalists who share his global view.

These are the developments markets have been digesting:

- "Political bomb-thrower Matt Gaetz" will be Attorney General.

- "Controversial former congresswoman" Tulsi Gabbard to become Director of National Intelligence (DNI).

(Source) - Marco Rubio, an avowed China 'hawk' is nominated Secretary of State.

- Fox News host Pete Hegseth will be Defense secretary.

"In aggregate, Trump’s wild Wednesday underscored just how dramatic a jolt he is going to deliver in Washington as he prepares to return to the White House after last week’s election victory," says Niall Stanage at The Hill.

There's no stopping the GBP/USD and EUR/USD selloffs it seems.

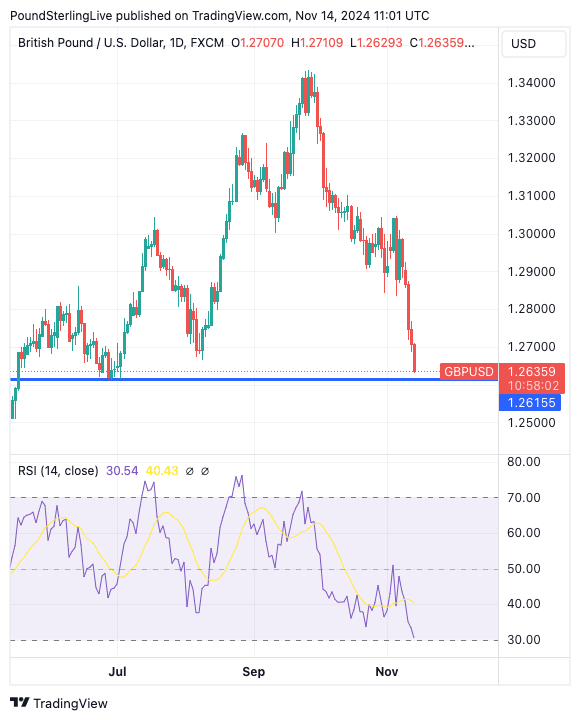

The Pound to Dollar exchange rate (GBP/USD) recorded a new low 19-week low at 1.2641 on Thursday, down half a per cent today.

All eyes are on the major graphical support level that is approaching at 1.2615.

At the same time, the Relative Strength Index (RSI) is about to reach oversold at 30.

The confluence of this graphical support and the oversold RSI could prompt speculators to buy, initiating a relief rebound near-term.

A failure of support and a confirmed break here opens the door to the 1.23, which is the April 2024 low.

The Dollar's romp brought the EUR/USD to 1.0517, down 0.43% from its last high of 1.0517 one year ago.

This is after EUR/USD sliced through major support at 1.06.

"The currency broke decisively below the important $1.06 mark against the US dollar. Investors have made up their mind about which currencies are likely to suffer under the Republican trifecta lead by president-elect Donald Trump. The euro and yuan are topping that list," says Boris Kovacevic, Global Macro Strategist at Convera.

Yet, the EUR/USD is now oversold according to the RSI (27.5); the rules say a reading below 30 represents oversold and that to unwind this condition, a recovery or consolidation must take place.

The RSI was last oversold in late October, and the corrective rise in the RSI corresponded with a 1.64% rally in early November.

In short, oversold does not mean a trend turn. Instead, it could mean a breather, and the overarching theme very much favours the Dollar at this stage.