Wary Fed Brightens U.S. Dollar's Glow

- Written by: Gary Howes

Above: File image of Jerome Powell. Source: Federal Reserve.

The Dollar glows a little brighter after the Federal Reserve showed it is awake to the resilient U.S. economy and that future interest rate cuts will be hotly contested by policymakers.

The Federal Reserve cut interest rates by a blockbuster 50 basis points in September, but the minutes covering that decision revealed that the move was not unanimously supported.

It was revealed that "some" members of the policy-setting committee (the FOMC) were in favour of a 25bp cut, and a "few others" could have backed a smaller move.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

This suggests the timing and scale of future cuts will be contested by a lively FOMC, drawing a line under expectations that the Fed was on autopilot to an interest rate level that could be considered as neutral for the economy.

"The FOMC September meeting minutes suggest the threshold for another 50 bp rate cut is high," says Elias Haddad, Senior Markets Strategist at Brown Brothers Harriman.

"EUR/USD is under downside pressure near its 100-day moving average at 1.0934," he adds, "GBP/USD is range-bound near recent lows."

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

"The minutes have reinforced the perception amongst market participants that the Fed will be more cautious over the scale of further rate cuts in line with their plans to deliver smaller 25bps cuts at the upcoming policy meetings," says Lee Hardman, Senior Currency Analyst at MUFG Bank Ltd.

U.S. bond yields have risen throughout October as investors take stock of data showing the U.S. economy is starting to outperform expectations again, which naturally supports the Dollar.

Evidence that the Fed is alert to this and will respond if need be further bolsters this trade.

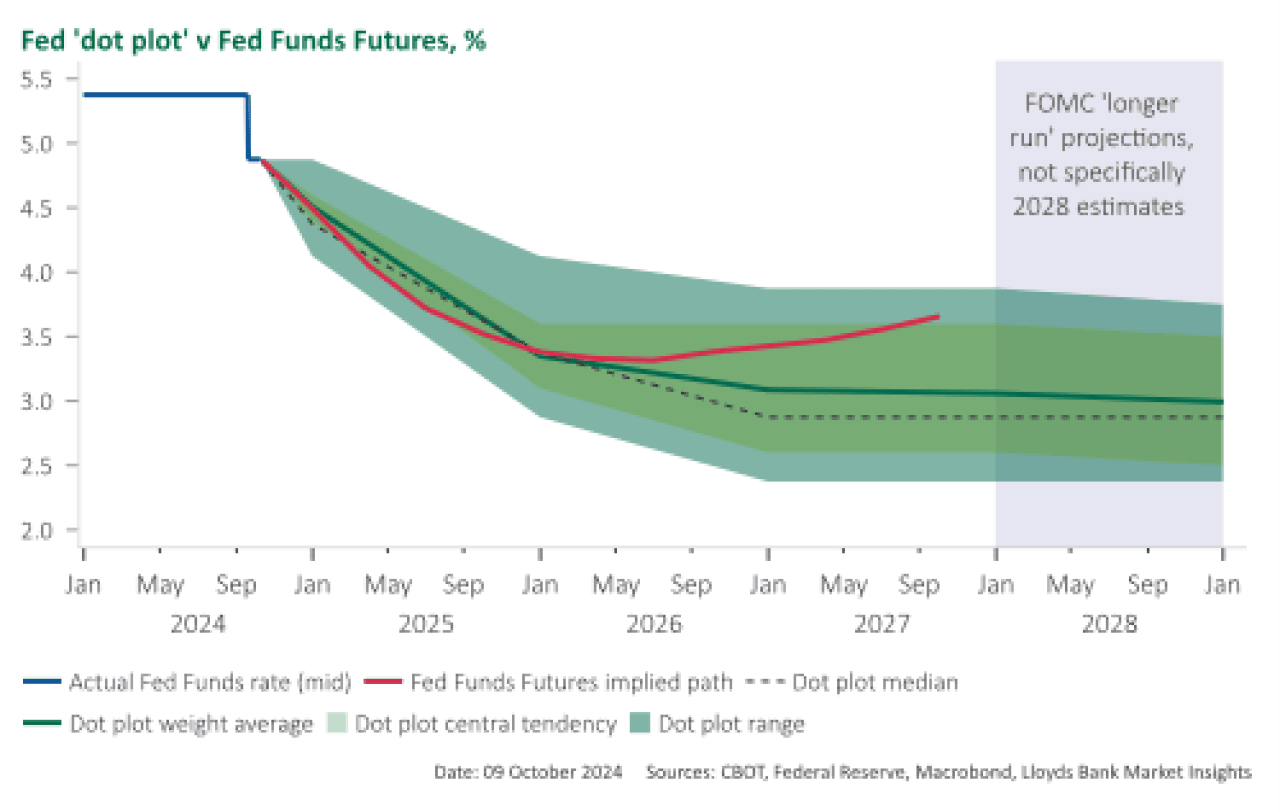

Above: Markets are aligned with the Fed's thinking. Image courtesy of Lloyds Bank.

"For the Fed to deliver further larger 50bps rate cuts, it will require evidence of a sharper slowdown in the U.S. labour market, which was not evident in the latest nonfarm payrolls report," says Hardman.

The Fed delivered the first cut since March 2020 as it cut the Fed funds rate by 50bp to 4.75%-5% and projected a total of 100bps of easing by year-end (50bp after the cut).

Market pricing shows investors are now on board with this, seeing approximately 40bps of cuts over the remainder of the year.

To be sure, this suggests the market might have overcorrected to an extent as this implies the market is no longer fully priced for two more cuts.

If pricing settles around current levels the Dollar's rally might fade.

That said, the U.S. election is now less than one month out, and the outcome is a 50-50 coin toss, which makes for potential volatility in FX markets.

Uncertainty linked to the election would create the febrile backdrop that tends to support the Dollar, so we see limited odds of a meaninful rebound in GBP/USD and EUR/USD.