Dudley Helps Pound to Dollar Exchange Rate's Near-term Recovery

- Written by: Gary Howes

Above: File image of Bill Dudley. Image: Pound Sterling Live / Bloomberg TV.

The British Pound is looking better supported against the Dollar, which sets up a platform for a more substantive rebound heading into next week's Federal Reserve interest rate cut.

The Pound to Dollar exchange rate (GBP/USD) has recovered from midweek lows at 1.3018 to test 1.3132 at the time of writing, helped by an upswing in U.S. equity markets and comments from an influential economist.

Former Federal Reserve policymaker Bill Dudley made it clear he would push for a 50 basis point interest rate cut were he still in the FOMC.

"One part of his speech that particularly struck us is this: “It’s very unusual to go into the meeting with this level of uncertainty – usually the Fed doesn’t like to surprise markets”. One possible interpretation is that markets themselves can tilt the balance towards a half-point move should their dovish bets be pent up into Wednesday’s meeting," explains Francesco Pesole, FX Strategist at ING Bank.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"There were also some media reports suggesting it would be a close call between 25bp and 50bp, which contributed to the dovish repricing," adds Pesole.

On the data docket, U.S. initial jobless claims stabilised at around 230k, with continuing claims at around 1850k. The former surprised consensus slightly to the upside, triggering a temporary move lower in U.S. yields, which mechanically weighed on the Dollar.

"The U.S. equity rally (led by tech/growth and small caps) kept USD under pressure globally," says a note from Citibank's FX division. "Traders saw net USD selling over the session."

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Near-term price action remains dependent on U.S. investor sentiment and we would look for a broadly constructive tone ahead of next week's U.S. interest rate cut and in the absence of any pesky data releases that might derail the good vibes.

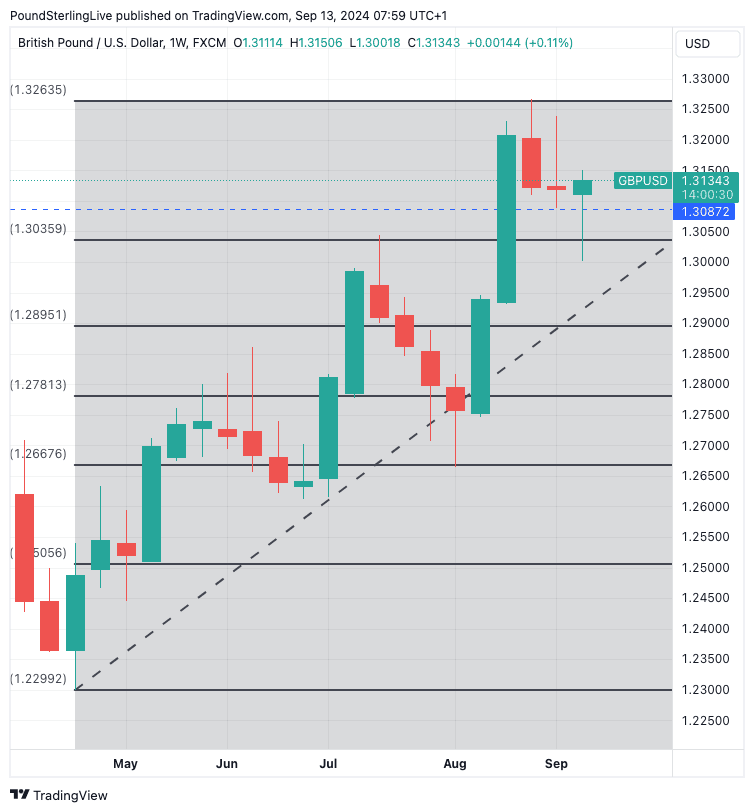

The weekly chart shows the selling pressure on Pound-Dollar has subsided, and this could signal a more substantive rebound in the offing.

As the below shows, the April-August rally is the instructive impulse and is indicative of a medium-term uptrend that remains intact. The pullback of Septmeber thus far looks to be a countertrend move that found buying interest at the 23.6% Fibonacci retracement of that uptrend at 1.3035.

A rally back towards the 2024 highs, therefore, becomes a more achievable prospect in a multi-week timeframe, although we wouldn't position for such an outcome until we parse the outcome of next week's Federal Reserve and Bank of England decisions.

The Dollar could yet stage a comeback if markets walk away from the midweek Fed event with a realisation that a further 75 basis points of rate cuts over the remainder of 2024 are out of reach. The subsequent revision lower in expectations would bolster the Dollar and potentially weigh on markets, which can send GBP/USD back to this week's lows close to 1.30.

We also keep an eye on next week's UK inflation numbers and Thursday's Bank of England decision for UK-specific drivers of GBP/USD.

We see asymmetric risks to the Pound heading into both events, meaning it will prove highly sensitive to an undershoot in the data and less sensitive to any upside surprises.

Markets are already expecting the Bank of England to keep rates unchanged next Thursday, but should inflation undershoot, it could raise expectations for further cuts down the line and encourage the Bank to deploy 'dovish' language. This would weigh on the Pound.

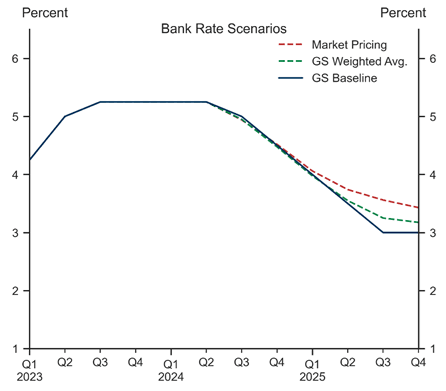

Above: Goldman Sachs thinks the market is vastly underestimating the pace of BoE rate cuts to come. Image courtesy of Goldman Sachs.

Goldman Sachs thinks the Bank will step up the pace of rate cuts from November, as inflation is set to cool and wage prices set to fall.

Economists at the Wall Street bank see a steeper path of rate cuts from the Bank than the market is currently pricing, and this poses significant downside risks to the Pound if it is proven correct.

"We now expect the Bank of England to move to consecutive cuts starting at the November MPC meeting; we have left the terminal rate unchanged at 3%, below market pricing," says Sven Jari Stehn, an economist at Goldman Sachs in London.

Stehn says this new baseline expectation has a 40% probability attached.