Dollar Primed for a Brief Comeback

- Written by: Gary Howes

Image © Federal Reserve

The Dollar (USD) could make a short-lived comeback in the wake of a key speech by the Chair of the Federal Reserve, which forms today's marquee event for financial markets.

The Fed Chair is expected to verify expectations for a September interest rate cut and the prospect of further cuts before the end of the year.

But for currency markets, this outcome is now fully expected and is baked into the value of the Dollar. "The USD sell-off seems to have stabilised," says Jens Nærvig Pedersen, Director of FX and Rates Strategy at Danske Bank.

The Fed chair knows the market is now expecting an aggressive pace of rate cuts in the coming months, and he might wish to cool expectations, fearing that a loosening in monetary conditions risks spiking inflation once more and undoing all the recent hard work.

"The short-term risk to the pound is a potentially less-dovish Powell speech today boosting the dollar and keeping the risk rally in check," says George Vessey, Lead FX Strategist at Convera. "This could be a pivotal momentum for market participants and determine whether the current scale of expected easing baked into markets is justified and whether the dollar’s downtrend will gather steam or not."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

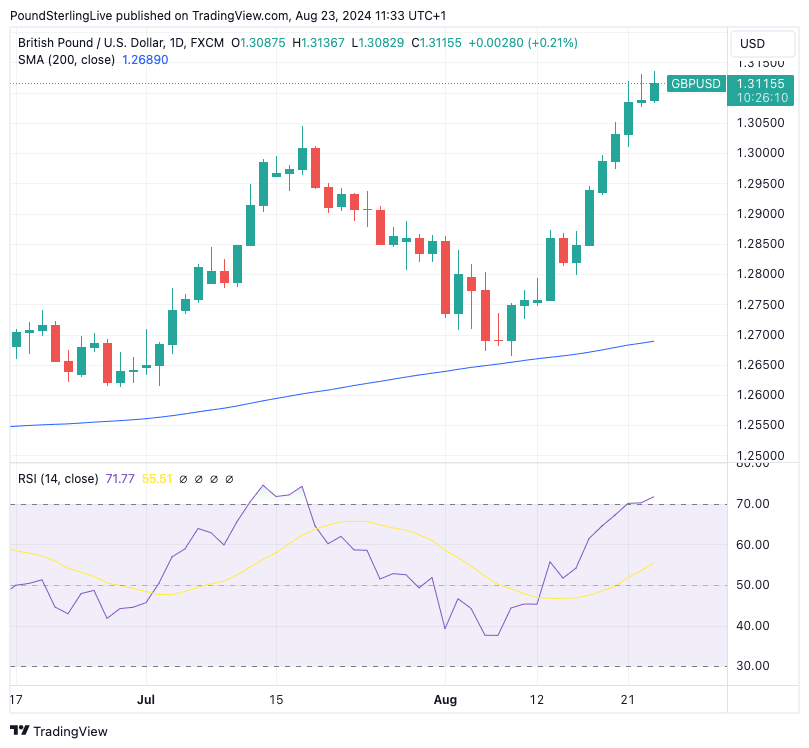

Ahead of the speech, the Pound to Dollar exchange rate (GBP/USD) looks set to make a seventh consecutive daily advance as it scales 13-month highs at 1.3118 in anticipation of Powell's speech.

But a look at the charts reveals the RSI is now reading in overbought territory at 72, which means the odds of a sharp pullback have grown in the event of any disappointment:

"There is often greater value in saying too little than too much in central bank communication and a market that is already pricing in a 50bp Fed cut by December may prompt Chair Powell too avoid strong guidance today at Jackson Hole. The dollar might like it, but the impact should be short-lived," says Francesco Pesole, an analyst at ING Bank.

Nicholas Kennedy, FX Strategist at Lloyds Bank, says a dovish appraisal from Powell is already generously priced by the market.

"He ought to retain a degree of caution cognisant that pricing is already running ahead of its skis," he says.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Traders will parse the speech for any clues as to the path of monetary policy over the remainder of this year. However, Kennedy notes that the dovish July FOMC minutes released earlier this week probably made the task easier.

The minutes revealed that "several" members suggested the timing was right to consider a rate cut as early as the July meeting.

The Pound-Dollar rally looks to be long in the tooth over short-term timeframes and is due to a corrective pullback. However, the prospect of Fed rate cuts and buoyant market sentiment suggests weakness should remain shallow.