GBP/USD Week Ahead Forecast: Better Balanced

- Written by: Gary Howes

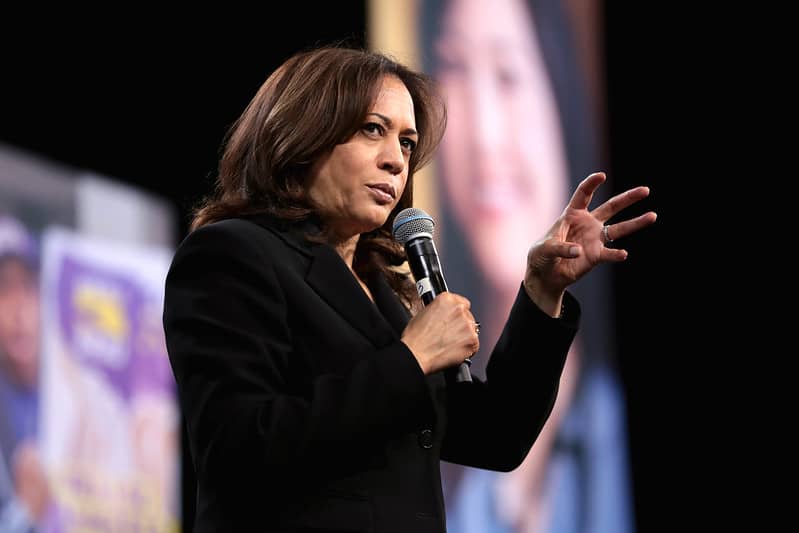

Above: Vice President Harris is expected to replace Biden on the Democrat's ticket this November. Source: Gage Skidmore.

Pound Sterling hit highs above 1.30 against the Dollar last week, but a decline in stock markets brought the rally to a halt. This week, we will watch the market's reaction to U.S. political developments for guidance.

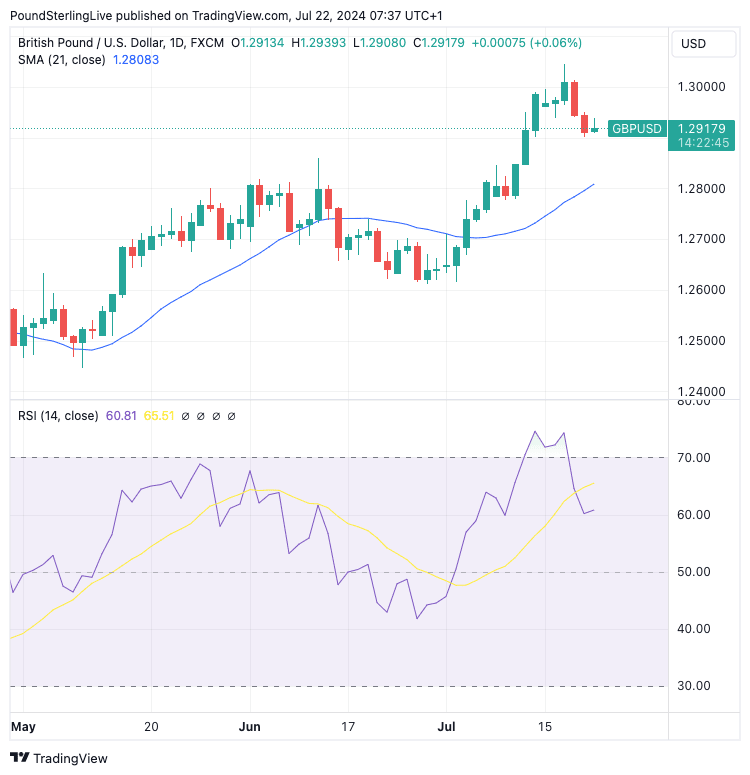

The Pound to Dollar exchange rate peaked at 1.3044 but has since retreated to 1.2912 and looks to be under short-term pressure amidst a shakier global investor sentiment backdrop.

In last week's Week Ahead Forecast, we said Pound-Dollar looked overbought and needed a correction. This has played out thanks to a global IT outage and fresh U.S. restrictions on the global chip industry.

The pullback leaves the exchange rate better balanced at the time of writing on Monday, and any improvement in sentiment can help the exchange rate recover.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"Following its recent rally the GBP has started to look very expensive vs both the EUR and the USD when compared to short-term fair value estimates based on the pound’s relative rate appeal among other drivers. The GBP further remains one of the biggest longs in the G10 FX market. In turn, this warrants some cautiousness on the near-term outlook for the currency," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

However, some analysts see the potential for some further near-term downside. "Cable's strong run higher through July so far may correct a little more in the short run. Intraday price signals suggest some demand is emerging on weakness to the 1.29 area but there is perhaps stronger technical support for the GBP in the 1.2860/80 zone. Gains back above 1.2950 resistance are needed to steady the short-term outlook for the pound," says Shaun Osborne, Chief FX Strategist at Scotiabank.

And, despite a recent pullback, the Pound remains expensive against the Dollar according to the median forecasts of over 30 investment banks, as it trades above the September and year-end point targets.

Above: GBP/USD is retreating back to the 21-day moving average. Note overbought conditions have now been erased according to the RSI in the lower panel. Track GBP/USD with your custom alerts; find out more here

Trade in the coming week will depend on how global stock markets perform, as recent days have reminded us that Pound-Dollar maintains a positive correlation with investor sentiment.

Last week's IT outage worried markets, prompting investors to buy 'safe haven' dollars at the expense of pounds. With the glitch fixed, we could see some improving investor sentiment that can support Pound-Dollar, which is positively correlated to stock markets.

"Barring major surprises, we still believe investors should stay the course and not make major changes to their portfolios," says Carsten Menke, Head of Next Generation Research at Julius Baer.

The decision by the Biden administration to further squeeze technological exports to China was a major driver of recent USD demand as it raised concerns of a sizeable trade war, which would only be more intense under an expected Donald Trump Presidency.

The 'Trump trade' is nevertheless under scrutiny following Sunday's decision by Joe Biden to withdraw from November's presidential election. Biden's replacement on the ticket is highly likely to be Vice President Kamala Harris. Any USD-related flows linked to expectations for a Trump presidency can unwind if his odds of winning retreat from recent highs.

"The impact on the USD from Harris’ likely ascension depends on whether the odds of a President Trump victory increase or decrease. If President Trump’s chances of victory are perceived to increase, we expect the USD to lift," says Joseph Capurso, a foreign exchange strategist at Commonwealth Bank.

Turning to the economic calendar, UK PMIs are the only significant calendar risk for Pound Sterling in the coming week. They are released on Wednesday and you can see the updated consensus forecasts on our calendar.

Should PMIs beat expectations, the Pound could recover some of its recently lost ground. However, any undershoot will take the exchange rate to the downside targets we discussed above as weak data could prompt the Bank of England to cut interest rates on August 01.

"PMIs will be in the spotlight and are expected to improve marginally. If they disappoint, the pound would be placed on the defensive," says Asmara Jamaleh, an economist at Intesa Sanpaolo.

In the U.S., preliminary GDP figures for the second quarter are on view Thursday, where an annualised figure of 2.0% is expected.

The highlight of the week is Friday's release of the PCE inflation measures, which the Federal Reserve places a great degree of weight on when considering interest rate policy.

The PCE index is expected to have risen 0.2% m/m in June, and any undershoot of this figure can weigh on the Dollar as it bolsters the odds of a September interest rate cut.