GBP/USD: Inflation Preview

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling looks vulnerable to a meaningful technical breakdown against the Dollar in the event of a strong U.S. inflation report midweek.

GBP/USD dropped 0.60% Friday after it was announced the U.S. created 272k jobs in May and saw wages rise 4.1% year-on-year, figures that were stronger than expected. They lower the odds of a September interest rate cut and raise speculation that we won't see a cut until 2025.

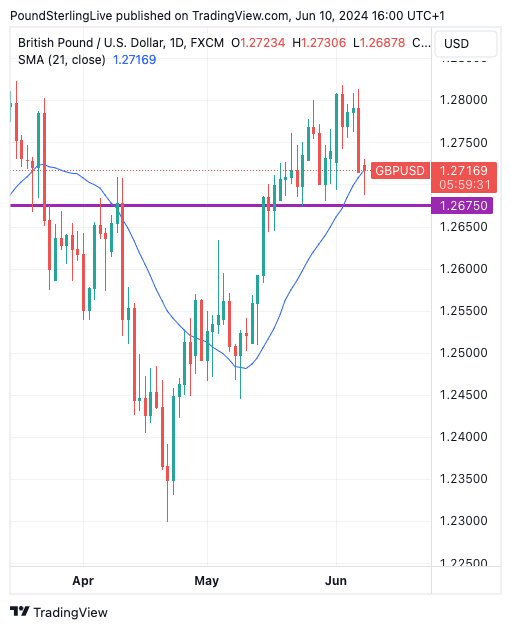

The subsequent decline in Pound-Dollar brings the exchange rate down to the 21-day moving average (1.2717), which looks like an immediate level of technical support ahead of the midweek release of U.S. inflation numbers:

Above: GBP/USD at daily intervals. Track GBP/EUR with your own custom rate alerts. Set Up Here

"The pound's failure to extend gains through the low 1.28s through early June is coming home to roost," says Shaun Osborne, Chief FX Strategist at Scotiabank. He says the current selloff could target support at 1.2675, which is where support formed in late May.

"Loss of support here—which is hard to rule out because of the broader buildup of US bullish momentum—would target losses extending to the 1.2550/00 zone," warns Osborne.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

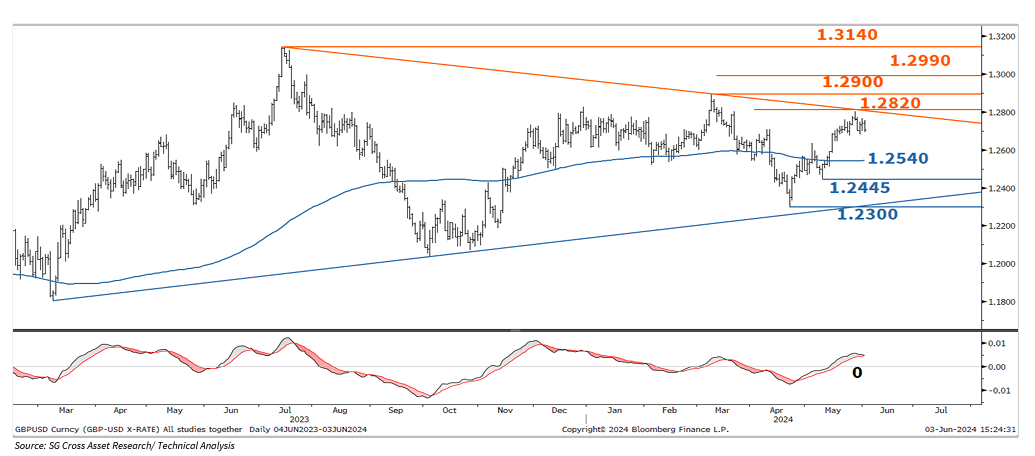

The Pound is nevertheless competing with the Dollar for the title of 2024's best-performing currency, with the two trading places regularly. This speaks of ongoing GBP outperformance and we note the broader technical setup in GBP/USD is still broadly supportive as it resides above the majority of the key moving averages.

A retest of 2024 highs over the coming weeks cannot be ruled out at this stage.

"GBP/USD has unfolded a sideways consolidation since last year it has evolved within two converging trend lines forming a symmetrical triangle," says Tanmay Purohit, a technical analyst at Société Générale.

He says the pair is approaching the upper band near 1 2820 which could be an interim hurdle.

"Once this is overcome, a larger up move is likely towards 1 2900 and perhaps even towards last year's peak of 1 3140," he predicts.

The USD side of the equation will be important this week, with the Federal Reserve and U.S. inflation release on tap.

Regarding inflation, the figure to watch is 0.1% month-on-month for headline CPI and 0.3% m/m for core. A beat on this figure could prompt a breakdown in Pound-Dollar below the aforementioned 1.2675 support.

A surprisingly soft report would put GBP/USD back into the early 1.28's and reinvigorate the uptrend.

Watch the release of the Federal Reserve's policy decision, also due midweek.

Analysts expect the Fed to maintain current policy settings. Of interest will be the changes in the forecasts, with Fed members likely to reduce the number of rate cuts they now believe appropriate for 2024 to two (down from three previously).

So, changes should be in a hawkish direction for the Dollar, but a good deal of these developments are well understood and baked into the value of the USD.