GBP/USD Week Ahead Forecast: Look for Gains, But Watch U.S. PCE Print

- Written by: Gary Howes

Image © Adobe Images

The Pound to Dollar exchange rate is forecast to extend its journey towards the top end of its 2024 range in the coming days, but a strong PCE inflation print at the end of the week could upend the rally.

Pound Sterling retains a bullish technical setup against the Dollar, helped by the broader USD pullback and last week's above-consensus inflation print that nullified the odds of a June rate cut at the Bank of England.

The retreat in back of Bank of England rate cut expectations came amidst stable central bank expectations elsewhere, which propelled the Pound to the top of the performance board for 2024.

Technical momentum lies with the Pound, and further gains against the Dollar are the preferred stance as we head into June.

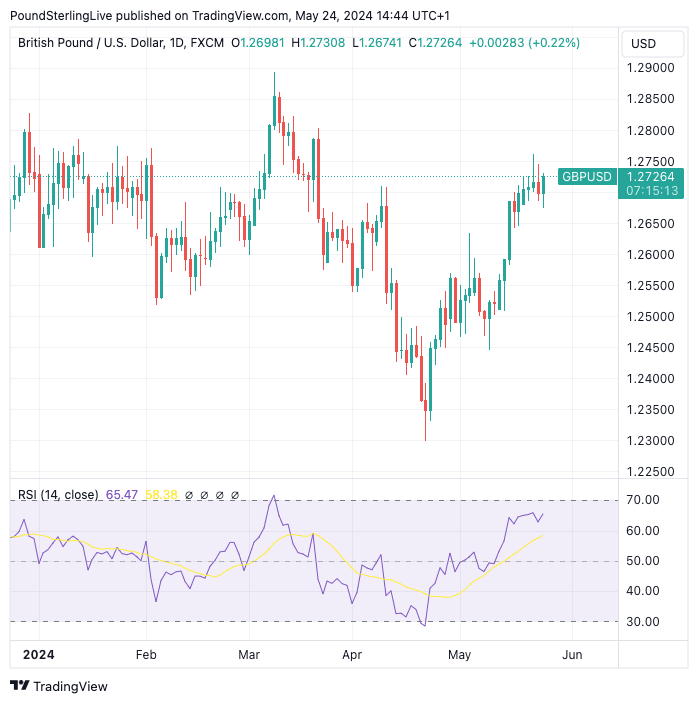

Above: GBP/USD at daily intervals. Track GBP/USD with your own custom rate alerts. Set Up Here

Momentum is constructive with the exchange rate residing above the important moving average levels we watch when conducting our Week Ahead forecast calls. Also, the Relative Strength Index advocates for further gains as it reads at 65 and is pointed higher.

We look for Pound-Dollar to test 1.28 in the coming days ahead of an eventual move towards the 2024 highs at 1.2893.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Shaun Osborne, Chief FX Strategist at Scotiabank, says last Friday saw "a strong rejection of sub-1.27 levels" which speaks of a constructive setup.

"Intraday price patterns are bullish (bullish outside range session generated by the dip below 1.27 earlier and the pound’s quick recovery). Resistance at 1.2755 remains significant," he says, detailing his immediate upside target.

There are no major releases due from the UK in the coming week, which, if anything, can support the ongoing supportive narrative regarding Sterling.

It also puts the onus on the Dollar to turn Pound-Dollar's uptrend around. With this in mind, Thursday's U.S. GDP numbers will be of note, with the market looking for a reading of 1.5% annualised in the first quarter.

A stronger-than-forecast print can boost the Dollar as it would support a view the Fed is in no rush to cut interest rates. However, arguably more important than the headline GDP print would be the bit of the report detailing personal consumption, as this is an effective measure of inflation at the personal level.

The market expects personal consumption to read at 2.1% y/y in the first quarter.

Friday brings the release of the PCE deflator measure of inflation, which many economists are fond of pointing out is the Federal Reserve's favoured measure of inflation.

A strong beat of expectations (2.8% year-on-year) could propel the Dollar into the weekend and upend Pound-Dollar's rally, making it the main short-term risk to consider.