GBP/USD Week Ahead Forecast: 1.26 on U.S. Inflation Undershoot

- Written by: Gary Howes

Image © Adobe Images

It's off the races for the Pound to Dollar exchange rate if Wednesday's U.S. inflation print undershoots expectations.

Since late April, the Pound to Dollar exchange rate has been engaged in a short-term recovery sequence, but it is too soon to suggest a corner has been turned and this is the start of a more significant trend higher.

The Dollar holds the upper hand and is still widely tipped by numerous institutional analysts to retain strength over the coming weeks and months, but this assumption will be severely tested if this week's U.S. inflation numbers disappoint.

Pound-Dollar's fate is largely a function of what happens to the Dollar, meaning the key to a sustained rally relies on what happens in the U.S. economy.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

For the Dollar to advance to fresh 2024 highs, we need signs that the economy continues to run hot and for above-consensus inflation prints to further undermine expectations for 2024 interest rate cuts.

This will happen if Wednesday's double-header of CPI inflation and retail sales print above expectations: look for an inflation reading of 3.4% y/y (0.3% m/m) and retail sales (0.4% m/m).

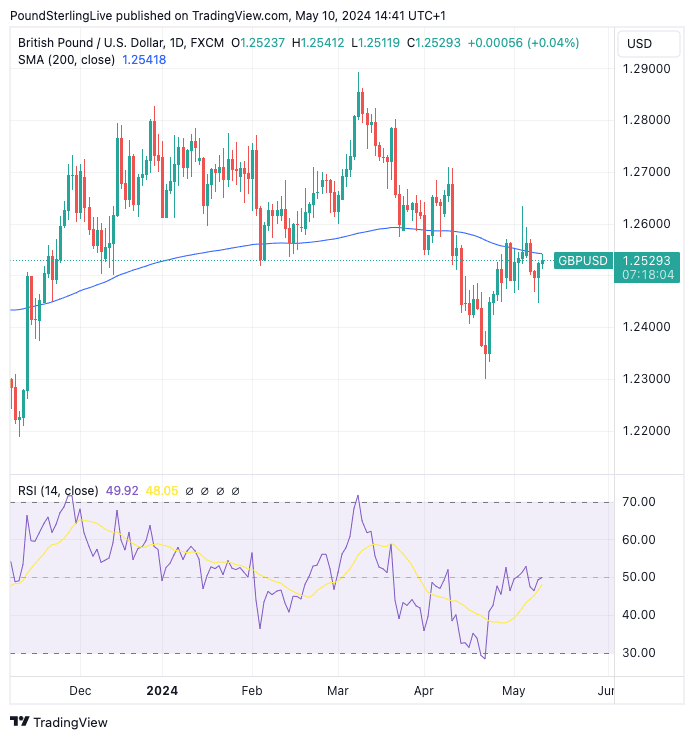

But should these data undershoot, the Pound to Dollar conversion can cross the 200-day moving average at 1.2541 and potentially end the week above here.

Above: GBP/USD has struggled to cross the 200-day moving average (blue line). Track GBP/USD with your own custom rate alerts. Set Up Here

A break above the 200 DMA would amount to an increasingly supportive technical setup that will increase the odds of further gains over the remainder of the month, potentially opening the door to levels above 1.26.

"The CPI report in the US due Wednesday will be the key data release next week. It follows a number of strong inflation prints but also signs of a cooling economy seen in other indicators, so it will be important as investors assess the likelihood of rate cuts from the Fed this year," says Galina Pozdnyakova, Research Analyst at Deutsche Bank.

Turning to the UK, Pound Sterling retreated last week as investors prepared for the Bank of England to indicate it was nearing an interest rate cut, which was ultimately confirmed by Thursday's monetary policy decision and guidance.

The Bank says it will carefully consider the next two wage and inflation prints before deciding whether or not a June rate cut is appropriate. With this in mind, if Tuesday's all-important wage figures from the ONS print at weaker-than-expected levels then expect GBP weakness to resume over the coming days

The more the market sees a June cut as being likely, the more downside we can expect in Pound-Dollar, all else equal. Market-implied expectations for a June rate cut are now at 45%, meaning there is ample space for a repricing that can weigh on this exchange rate.

However, if earnings growth is above the 5.3% y/y figure the market expects, look for a decent rebound in Pound-Dollar towards 1.26, especially if U.S. data comes in on-target or below target.