GBP/USD Rate: 3 Bank of England Scenarios

- Written by: Gary Howes

Above: Arch-hawk Catherine Mann will likely resist any push for imminent rate cuts. File image: Pound Sterling Live and Bank of England.

The Bank of England won't cut interest rates until September say some economists, which means a 'hawkish' repricing in interest rate expectations must follow today's decision.

This would surprise markets that have increased odds of a mid-year rate cut, in turn supporting the Pound.

Markets are now positioned at 50/50 odds for the first rate hike to take place in June, and we note a high risk that the Bank's Monetary Policy Committee verifies these bets by saying it is confident inflation will continue to fall.

But economists at Commonwealth Bank say the first interest rate cut is still some way off, in September, because wages growth and services inflation are "still very strong".

"If we are correct, the BoE may not be perceived as dovish enough today to justify market pricing of an August cut, supporting GBP," says Carol Kong, a strategist at Commonwealth Bank.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

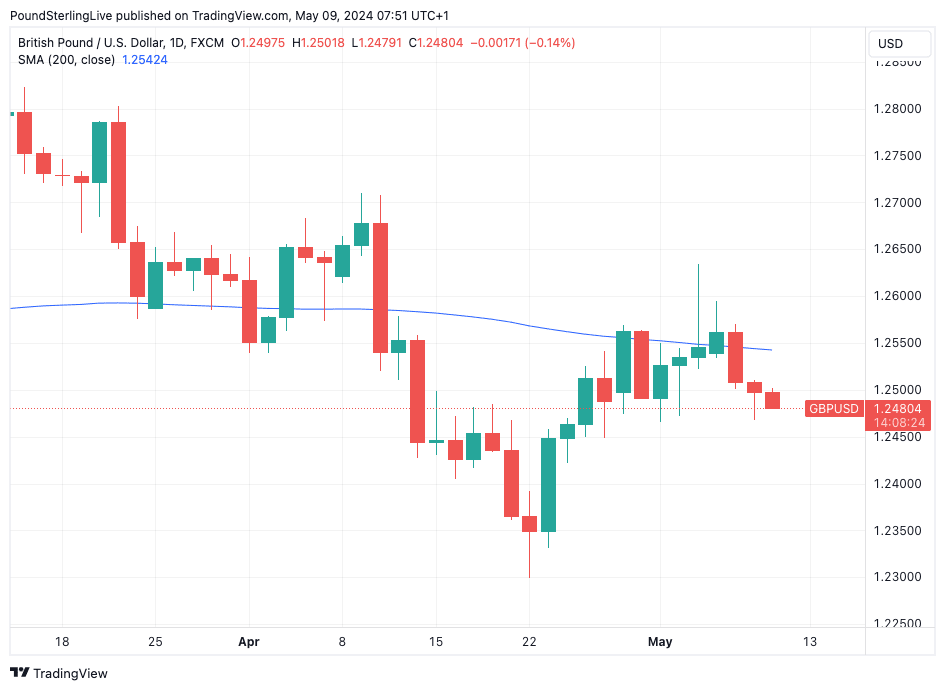

The Pound to Dollar exchange rate has lost ground in the days leading up to today's decision, falling from 1.2539 on Monday to 1.2483 today.

The exchange rate will recover recent losses and can potentially push beyond the 200-day moving average at 1.2542 if the Bank is unwilling to clearly commit to a June rate cut and ultimately leaves rates unchanged until September.

The Bank's MPC members are divided, with some (Dave Ramsden) leaning into a nearer-term rate cut, while others like Huw Pill are still keen to watch incoming data for clear proof inflation is falling. Others such as Catherine Mann and Jonathan Haskell have indicated in recent speeches they remain unready to vote for imminent rate cuts.

FX strategists at TD Securities say that in a 'hawkish' scenario Pound-Dollar could rise 0.45%. This would involve the Bank acknowledging recent upside surprises on services inflation support a slightly higher persistence of underlying domestic price pressures.

"In turn, while the statement is largely copy-paste, it puts a bit more emphasis on the potential for high for longer policy moving forward," says James Rossiter, a strategist at TD Securities.

Rossiter's base-case scenario heading into Thursday's MPC (55% odds) sees the MPC delivering another 8-1 vote to hold rates. Here, the statement is left largely unchanged, with the MPC reiterating that "the Committee will keep under review for how long Bank Rate should be maintained at its current level".

Under this scenario, Pound-Dollar can recover by approximately 0.15%, according to TD Securities.

Above: GBP/USD at daily intervals. Track GBP/USD with your own custom rate alerts. Set Up Here

A downside scenario (25%) would see the Bank turn decidedly more 'dovish'. "The statement is tweaked slightly to indicate that policymakers are becoming more confident that persistent inflationary pressures are fading. In turn, the Committee's inflation forecasts are lower, in part due to a further step down in the assumption for inflation persistence," says Rossiter.

Here, the Pound could fall 0.35% against the Dollar.

"Our base case remains for an 8-1 vote today, with risk of 7-2, should Dave Ramsden join Swati Dhingra in voting for a rate cut. A 6-3 vote would surely be a big dovish surprise today and hit sterling," says Chris Turner, an analyst at ING.

At some point this summer, ING expects sterling to sell off, as the market accepts the Bank of England will follow the ECB/euro cycle rather than the Fed/dollar. "The question is whether BoE communication today triggers that adjustment or the adjustment happens in June," says Turner.

"We do not expect the recent data flow to prevent the BoE from delivering a more dovish policy signal this week indicating they are moving closer to cutting rates," says Derek Halpenny, Head of FX Research at MUFG Bank Ltd. "A more dovish BoE policy update poses downside risks for the pound in the week ahead."

However, Hardman says improving cyclical momentum for the UK economy and still supportive conditions for higher-yielding carry currencies should prevent a sharper sell-off for the GBP.

Shreyas Gopal, a strategist at Deutsche Bank, says a recent dovish repricing of the UK shorter-term bond yields over the past few sessions has left a cut by June half-priced.

Once the cut is fully priced, the selling can ease and we would not be surprised to see a "buy the fact" reaction by the Pound in the coming days.