USD Facing High Bar Heading into May Jobs Report

- Written by: Gary Howes

Image © Adobe Images

The Pound can extend its recovery against the Dollar into the weekend as the bar to further U.S. Dollar strength is set high, say analysts.

The U.S. non-farm payroll presents the first major test for the Dollar of May, and already markets are expecting another strong print as the economy extends a strong start to the the year.

The consensus expectation is for 240k new jobs, and Antje Praefcke, FX Analyst at Commerzbank, says a higher result could support the dollar again.

"At the same time, however, we have repeatedly pointed out that it is becoming increasingly difficult for the dollar to benefit from good figures, as a much later cut in the key interest rate is already priced in," she adds.

The incidentally the highest consensus forecast since September 2022 and the 4th consecutive increase in NFP expectations

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The Dollar is 2024's top-performing G10 currency thanks to the slashing of expectations for U.S. interest rate cuts. The markets started the year betting on 150 basis points of cuts, but they are now only fully priced for one cut in December. This represents a significant pushback in rate cut bets already.

With a host of other central banks set to cut rates before the Fed, the divergence in interest rate policy must grow if the Dollar is to rally to fresh highs, particularly given the 'long' USD trade is significantly bloated.

"We think that any disappointments from the NFP or ISM today could be seen as more consequential for the overbought USD than any upside surprises," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole. "The USD further remains the biggest long in G10 FX according to our positioning data and could be vulnerable to positioning squeeze in the near term."

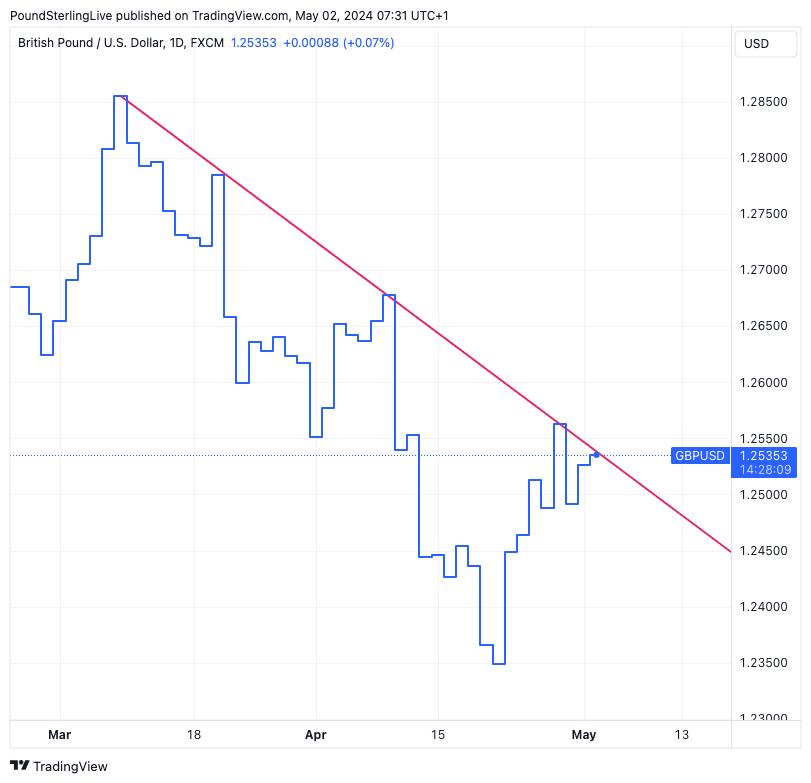

Above: GBP/USD recovers within the context of the 2024 decline. Too early to call an end to the selloff.

Paul Robson, G10 currency analyst at NatWest, says the market is clearly positioned for this divergence, as well as for a continuation of US economic and USD dominance. "That naturally ups the ante for US economic data to outperform a seemingly ever-rising bar."

Robson says the Dollar may need fuel from a strong April data cycle to extend further; "we aren’t confident that upcoming US data will meet that standard."

Track GBP with your own custom rate alerts. Set Up Here

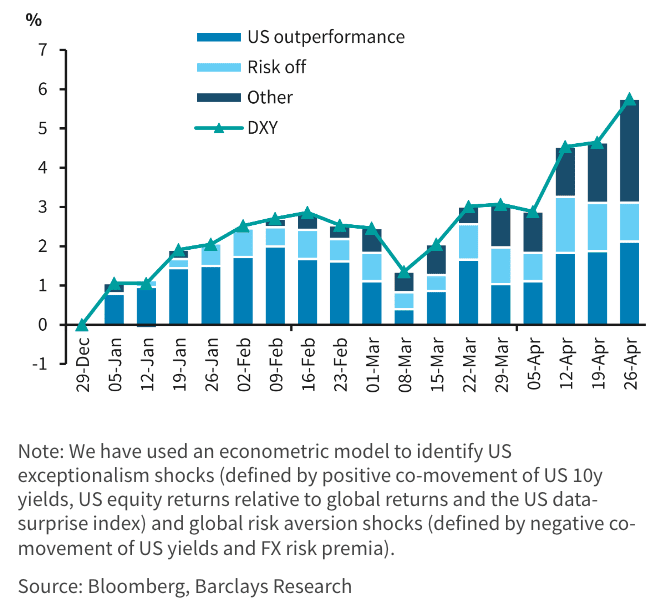

"The bar is already high - and rising - for large data surprises," says a weekly FX strategy note from Barclays.

Researchers say strong job reports have generated a smaller repricing of Fed expectations than inflation releases. Nevertheless, they have offered clear signals of U.S. economic outperformance, which, according to Barclays analysis, has been the dominant factor behind USD outperformance.

So while the Dollar rally might be on hold, the pro-USD thesis remains very much alive, and it will take a series of disappointing data prints to suggest U.S. outperformance is over.

Until then, near-term Pound-Dollar strength will likely be viewed as temporary, with risks still pointed lower.