Fresh 2024 Lows for GBP/USD Exchange Rate

- Written by: Gary Howes

Image © Adobe Images

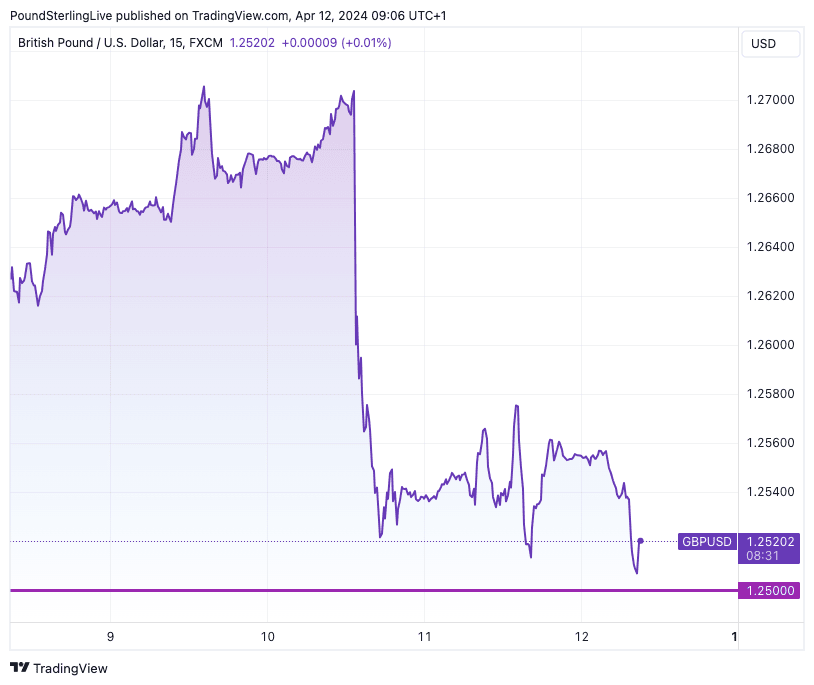

A renewed bout of U.S. Dollar strength has pushed the Pound to Dollar exchange rate to a fresh 2024 low at 1.2428, and price action remains heavy.

This is largely a U.S. Dollar story: we are seeing the Greenback cement its position as 2024's top-performing currency, egged on by fading hopes for a Federal Reserve interest rate hike amidst strengthening U.S. inflation and a resilient jobs market.

U.S. economic strength highlights an ongoing divergence in fortunes from the Eurozone and the UK, where the process of disinflation remains intact owing to sluggish economic activity and a loosening in job market conditions.

The ECB indicated on Thursday that based on current trends it would cut interest rates in June, while the Bank of England could go in either June or August. This divergence is a powerful force for currency dynamics and means the Dollar can strengthen against the Euro and Pound Sterling.

The paring in expectations for U.S. rate cuts has also spilt over to equity markets, which are back under pressure and further abets the 'safe-haven' Dollar while weighing on the 'high beta' Pound via the risk channel. It's a win-win for USD at present.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

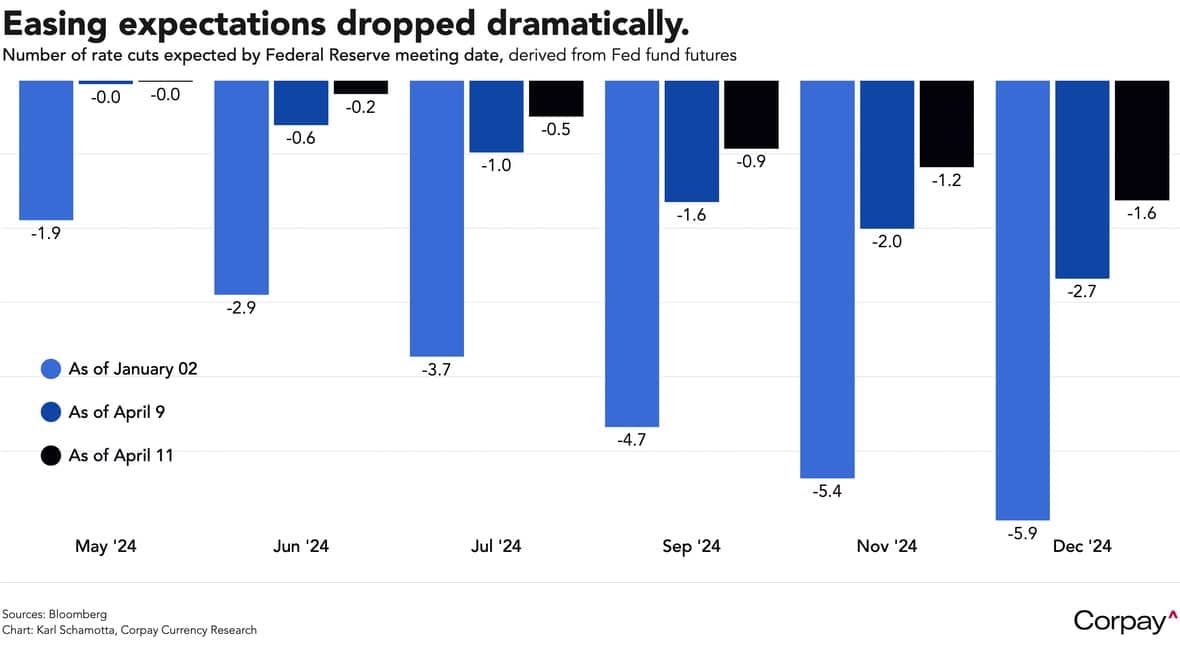

Swap-implied odds on a June rate at the Federal Reserve plunged to less than 17% following Wednesday's strong U.S. inflation print, down from more than 58% a day prior. The odds of a cut at the July meeting dropped to 43% from almost 75% previously.

Swap markets now price in only one rate cut for 2024 in the U.S., down from the peak reached several months ago at seven cuts. This alone explains Dollar dominance.

Above: GBP/USD at 15-minute intervals. Track EUR/USD with your own custom rate alerts. Set Up Here

The question, though, is can this continue? How much further can rate cuts be 'priced out'. The answer to this question will hold the key to the Dollar turnaround.

But the clues will only arrive in the next set of labour market and inflation data, due in May. Even then, it will take a series of soft prints to convince the market the U.S. economy is finally cooling. When rate cut bets begin to rise again, the Dollar will turn.

"Until last week there still appeared to be a viable possibility that recent stronger than expected US inflation readings were just bumps in the road. The fact that Friday’s blow out US payrolls report has been followed by yet another stronger than expected US CPI inflation reading yesterday has made those hopes look like a pipe dream," says Jane Foley, Senior FX Strategist at Rabobank.

Rabobank now see the prospect of just two Fed rate cuts this year starting in September, having expected three cuts this year starting in June, a view the bank had held since 2022.

"On the margin, the prospect of a stronger USD also argues against an earlier move by the BoE. That said It is our view that the BoE will not be ready to cut rates before August anyway at it waits from further slack in the UK labour market to develop," says Foley.

Rabobank expects Pound-Dollar to trade in the 1.25/1.26 area on a 6-month view before edging higher towards the end of the year.