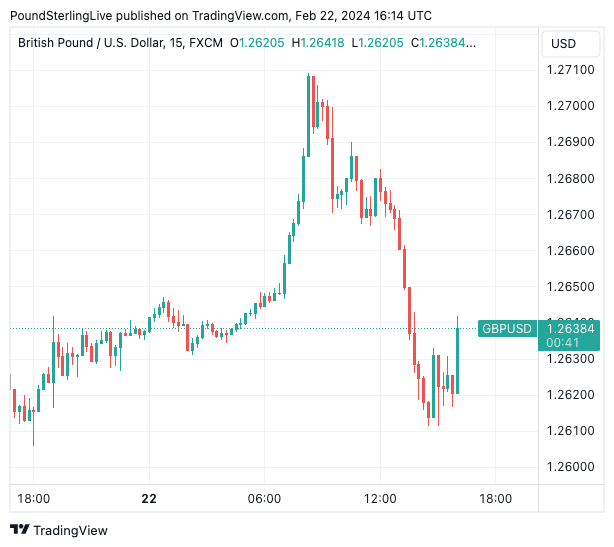

GBP/USD Rally Cut Short: Is it the Nvidia Effect?

Image © Adobe Stock

Strong U.S. jobs data and the 'Nvidia effect' have put the U.S. Dollar back on top.

Something important happened in the currency markets on Thursday. The initial and relatively sharp fall of 0.7% in the dollar index was reversed, and now, as trading begins in New York, we are seeing a strengthening to the day's opening level.

In terms of news, the disappointing Eurozone PMI data helped to halt the dollar's slide.

Just as notably, buying U.S. currency has increased significantly with the start of active trading in the U.S.

Above: The Pound to Dollar exchange rate slid as U.S. equity market trade got underway.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The release of the weekly jobless claims can be seen as a supporting factor. This is another robust data with initial claims falling to 201 thousand (minimum for five weeks).

Continued claims came in at 1.862 million against a forecast of 1.885 million. This data fits perfectly into the picture of a strong US economy, which will allow or even force the Fed not to rush to cut interest rates.

But we are also looking at another factor - Nvidia.

The company once again blew away expectations for last quarter's revenue and future guidance.

It is quite possible that the company's report, together with the solid macroeconomic data, is attracting capital from abroad to the U.S. markets, supporting interest in the dollar.

A more fundamental approach is also valid: a strong labour market and confident corporate forecasts are a strong plus for higher interest rates in the long run.

Nvidia a Buy Says Goldman Sachs

By Sam Coventry.

With a Nasdaq 100 weighting of 5%, Nvidia's 12% gains has pushed the index up by around 2% and swung risk sentiment positive.

The Dollar has traditionally fallen in 'risk on' conditions, and that it is up alongside rising markets would suggest foreign capital is making its way into the equity market.

Nvidia delivered another big beat and guided above expectations, with Data Center once again serving as the key growth driver.

Looking ahead, despite the >3x year-on-year increase in Data Center revenue in FY2024, equity analysts at Goldman Sachs model another >2x y/y increase in FY2025 as they expect sustained growth in Generative AI infrastructure spending by the large CSPs and consumer internet companies.

The investment bank increases its estimates by 8%, raises the target to $875 (from $800), and reiterates a 'buy' call.