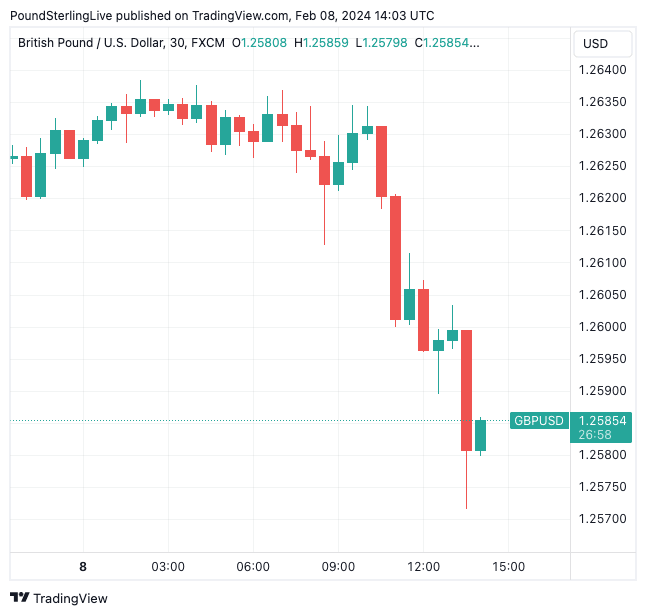

GBP/USD Rate Dips Below 1.26 on Strong Claims Data

- Written by: Gary Howes

Image © Adobe Images

The Pound to Dollar exchange rate dipped below the 1.26 level amidst fresh evidence of strong U.S. economic growth.

The Dollar was bid across the board after initial jobless claims rose 218K last week, down on the previous 227K and the 220K expected by the market. Continuing claims read at 1.817 million, down from 1.894m and below expectations for 1.878M.

"Initial Jobless Claims figure is in line with expectations, with these releases continuing to print at a strong level. There is no immediate pressure on the Fed to lower rates as desired by the market. The U.S. labour market, and the economy more broadly, continues to demonstrate resilience, giving the Fed some time to decide when the time is right to cut rates," says Ryan Brandham, Head of Global Capital Markets, North America at Validus Risk Management.

Above: GBP/USD at 30-minute intervals.Track GBP and EUR with your own custom rate alerts. Set Up Here

These claims numbers underscore the trending narrative that the U.S. economy is proving far more resilient in early 2024 than markets expected at the turn of the year, lowering the odds for imminent rate cuts at the U.S. Federal Reserve.

"A cyclical or structural upswing in U.S. activity would make a case for pronounced and extended USD strength. This scenario has risen in probability," says Steve Englander, Head of Global G10 FX Research at Standard Chartered.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

It was reported last week that U.S. nonfarm payrolls increased by 353K jobs in January, and the unemployment rate was unchanged at 3.7%.

Thursday's claims numbers underscore a sustained labour market strength that has forced financial markets to dial back expectations of the first interest rate cut from the Federal Reserve to May from March.

The U.S. exceptionalism theme that centres on higher U.S. bond yields and rising stock markets are proving supportive of the Dollar, and currency strategists maintain expectations for further USD outperformance in the near term.

Members of the Fed's board have signalled through this week that they were in no rush to lower interest rates until they were confident inflation was headed down to the Fed's 2% target.

The odds of a March rate cut, which was an odds-on bet at the start of the year have now receded to just below 20%.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks