GBP/USD Rate: "A Break There Would Be a Big Deal"

- Written by: Gary Howes

Image © Adobe Images

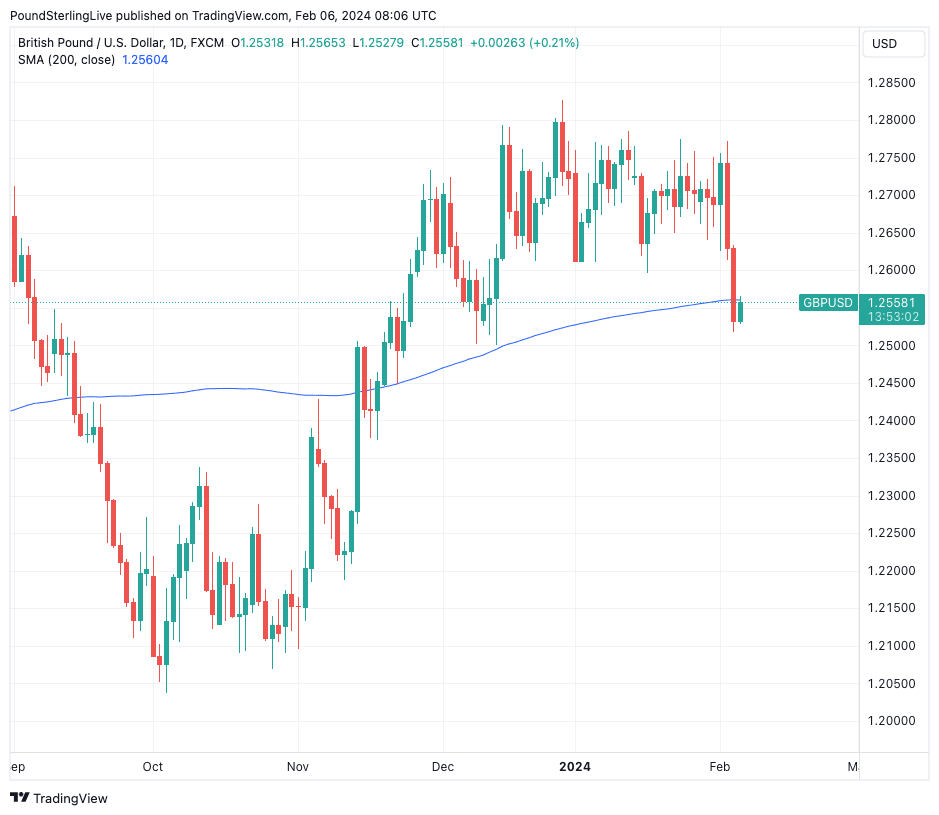

The Pound to Dollar exchange rate has broken through the 1.26 level, but an analyst says a trapdoor awaits just below here.

"GBP/USD is through 1.2600 for the first time this year and testing its 200dma which comes in around 1.2564. A break there would be a big deal," says W. Brad Bechtel, Global Head of FX at Jefferies.

The Pound-Dollar rate lost 0.80% in value following the release of Friday's blowout jobs report that showed the U.S. economy might actually be picking up a head of steam at the start of the new year.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Hammering the pound further was Monday's ISM report that showed the employment situation at U.S. businesses had indeed improved, confirming Friday's payroll report was no outlier.

Pound Sterling meanwhile faces seasonal headwinds as February is traditionally a month in which the UK currency declines. Also in the mix is the extended long positioning in GBP that left it ripe for a retreat.

Above: GBPUSD at daily intervals showing the break below the 200-day moving average.

Bechtel says if Pound-Dollar breaks 1.2564 then "we would see 1.2476 pretty quick after that where the 100dma comes into play."

"1.2400 the key pivot for this pair and that is where I think we are heading," he adds.

Bechtel explains that the U.S. Dollar "is feeling the love" after the U.S. jobs report proved "unabashedly strong, and the sceptics had to dig pretty deep to find any semblance of weakness in there".

Track GBP/USD with your own custom rate alerts. Set Up Here