GBP/USD: Trading The Fed, By TD Securities

- Written by: Gary Howes

Image © Adobe Images

The routes to Dollar strength outweigh those to weakness, according to a new strategy analysis conducted by a leading investment bank.

TD Securities have revealed their 'cheat sheet' heading into this evening's Federal Reserve Open Market Committee decision, which will almost certainly see interest rates left unchanged.

But this is an important meeting given investors are sensing the Fed is closer to signalling the time to cut interest rates is approaching, and the Dollar's reaction will rest on the finer details contained in the guidance and tone of Fed Chair Jerome Powell's media appearance.

TD Securities see 80% odds that the Dollar ends the session higher, albeit with 65% odds that the move is restricted to an approximately 0.10% advance in the Dollar under the base-case scenario.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The move comes amidst ongoing Dollar strength in 2024, although the Pound to Dollar exchange rate has largely weathered the advance with a 0.40% loss for the month.

The base-case counts on the Fed keeping policy guidance largely unchanged in the statement. Here, the Fed is biased to retain optionality as the economy remains on a solid footing.

In short, there is no sense the Fed feels rushed into cutting interest rates.

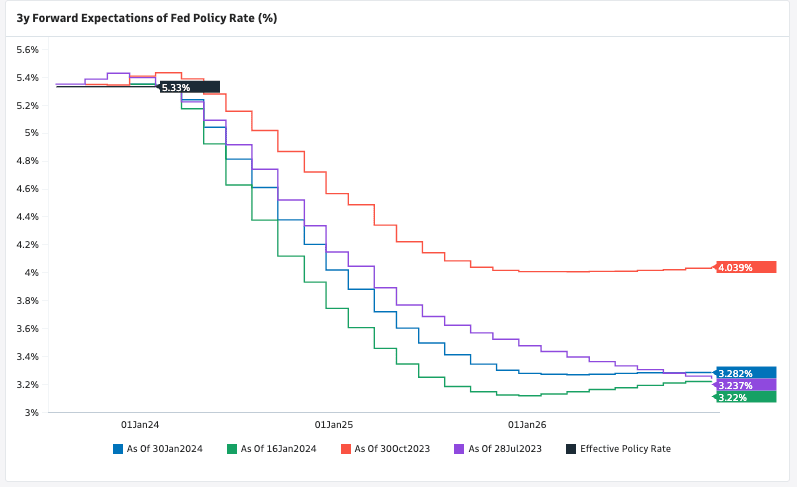

Above: The evolution of market expectations for future Fed interest rates, image courtesy of Goldman Sachs.

TD Securities expects Powell "to walk a fine line as he tries to avoid sending any strong signals ahead of the March meeting."

Under a more 'hawkish' scenario (15%) odds, the Dollar rises by some 0.30% as Powell signalls policy likely needs to stay restrictive for longer, until there are clearer signs that inflation will stay at the 2% target.

In this instance, the Fed says it retains the optionality to hike as the economy remains strong, and there is no guarantee inflation will fall to 2.0% on a sustained basis.

The 'dovish' scenario (20%) involves a potential fall in the Dollar of approximately 0.45% as Powell confirms progress on lowering inflation has been made and he raises the potential for lowering nominal rates as real rates have risen (as a result of falling inflation).

"Given policy remains in highly restrictive territory, the chairman anticipates that the Fed might entertain the idea of preemptive rate cuts in the near term," says TD Securities.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks