FX Markets Cautious of Fed Pushback

- Written by: Sam Coventry

Above: Federal Reserve Chairman Jerome Powell. Image © Federal Reserve.

Beware further weakness in the Pound to Dollar exchange rate through the midweek session that will feature the Federal Reserve's latest interest rate decision and guidance.

Analysts at ING Bank say Federal Reserve Chair Jerome Powell and his colleagues "can still help the dollar" by convincing the market it continues to see too many rate cuts in 2024.

The dollar has rallied through December as markets anticipate a more 'hawkish' message from the Fed this month following further data releases that show the economy remains robust and the fall in inflation is slowing.

"Markets have trimmed around 11bp of easing from the 6m section of the Fed funds futures curve, but still fully price in a first cut in May, and we think Chair Jerome Powell and the majority of FOMC members will still consider those expectations as too dovish for their objectives," says Francesco Pesole, a strategist at ING Bank.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

ING's strategists say the main tool the central bank will have to steer the market is the new set of Dot Plot projections.

"We estimate that the 2024 plot will be revised lower to 4.9% from 5.1%, meaning 50bp of cuts next year from the current rate. That would be quite a clear pushback against the over 100bp of easing priced in by the end of next year," says Pesole.

On the FX side, Pesole says risk sentiment may face a tougher environment favouring Dollar strength via the safe-haven channel.

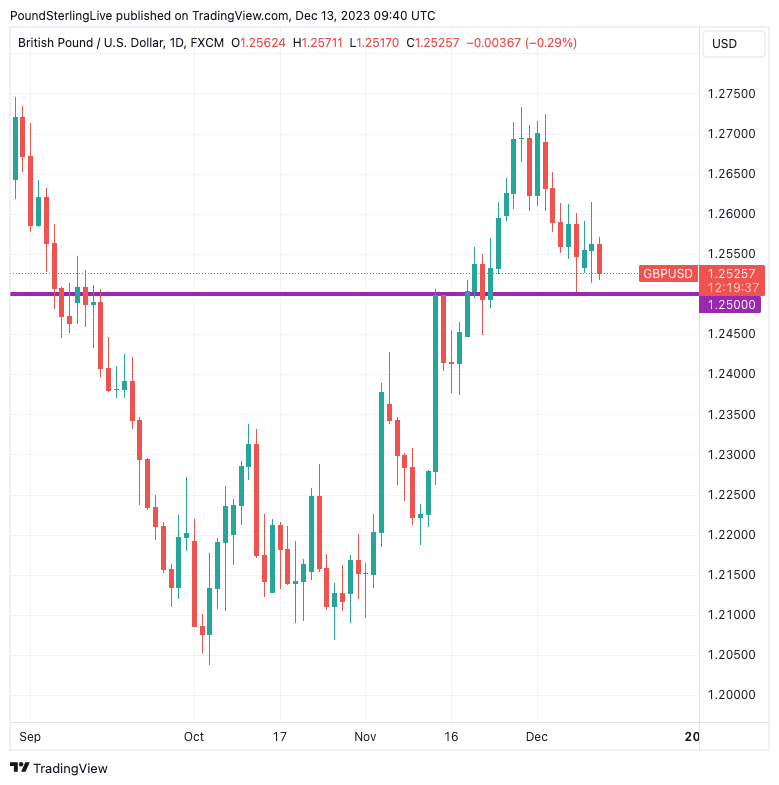

The Pound to Dollar exchange rate entered December at 1.2622 but has since retreated to 1.2530, with ING warning that today could see it break below the 1.2500 gravity level.

Above: GBPUSD at daily intervals. Track GBP with your own custom rate alerts. Set Up Here.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks