Strong Dollar a Boon for UK Service Exports to the U.S.

- Written by: Gary Howes

Image © Adobe Stock

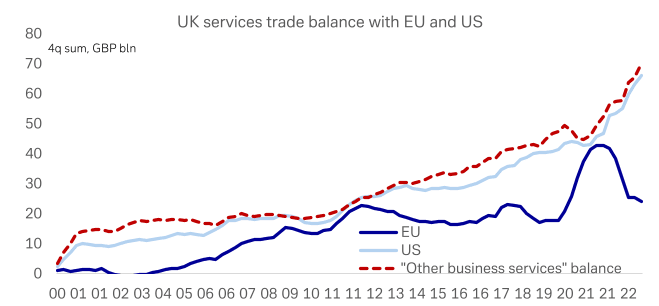

The UK's dominant services sector appears to have been boosted by the decline in the value of the Pound against the Dollar, however, Sterling's resillience against the Euro might have contributed to a decline in service exports to the Eurozone.

This is according to economists at Deutsche Bank who find services such as law and consultancy might be behind a boom in services supplied to U.S. clients.

"Over the past two years the UK's trade surplus in services has boomed with the U.S. but fallen with the EU," says Shreyas Gopal, Strategist, Deutsche Bank.

Image courtesy of Deutsche Bank.

In an ad-hoc research note, Gopal says a lot has happened over the past two-and-a-half years in the UK, including the country leaving the EU's single market in early 2021 (at the end of the Brexit transition period), as well as Covid restrictions being lifted later that year.

The pound has meanwhile fallen significantly against the dollar since 2020, but has been roughly flat against the euro.

Deutsche Bank reckons part of the fall in the surplus with the EU will simply be a function of net tourism outflows returning as Covid restrictions were lifted, but it's also possible that a lack of detailed provisions for services within the UK-EU TCA (agreed in late 2020) is also hurting at the margin.

But what's behind the increase with the U.S.?

"It's likely a combination of "other business services," which includes sectors like law and consultancy, as well as intra-company trade. Given the level of cable, it may currently make sense for say a US consultancy firm to outsource their work to an affiliated enterprise in the UK at an overall cheaper cost," he explains.

For this trend to continue, Deutsche Bank says the onus is on the dollar remaining very strong, given how unlikely a US-UK FTA currently seems.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks