GBP/USD Week Ahead Forecast: Weakness Can Extend Below 200-DMA, Fed and BoE in Focus

- Written by: Gary Howes

- GBPUSD below 200-day MA is bearish

- USD in focus Wednesday with Fed decision

- Wednesday also sees UK inflation release

- Thursday Bank of England is GBP's highlight

Image © Adobe Images

Pound Sterling has slid below a key level on the charts that suggests the trend has flipped in favour of further weakness against the U.S. Dollar at the start of a busy week that will be dominated by the U.S. Federal Reserve, UK inflation data and the Bank of England interest rate decisions.

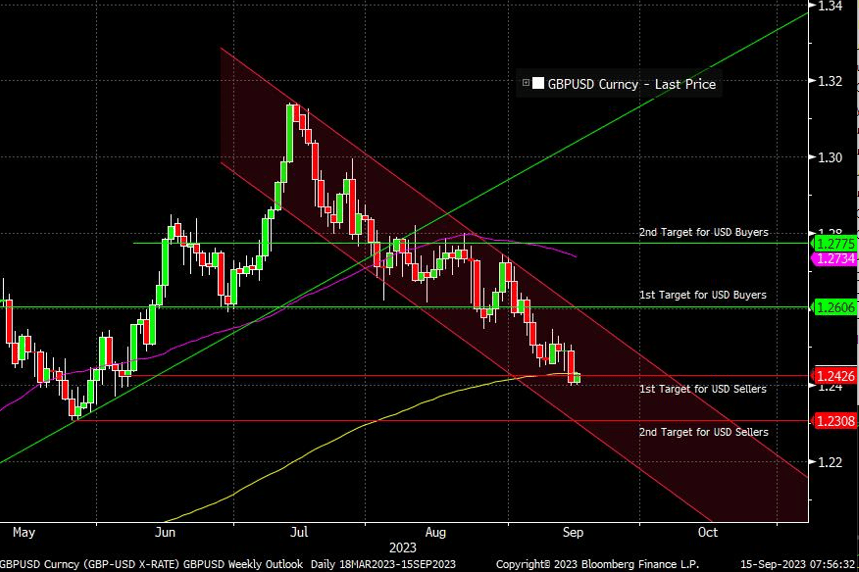

The Pound to Dollar exchange rate is currently at 1.2397 and late last week broke below the 200-day moving average, which we tend to use as a benchmark for gauging a trend in a currency pair.

The move below this key marker suggests to us that the 2023 uptrend in the conversion, which took it as high as 1.31, has been negated, and further downside is now preferred over a multi-week basis.

"GBP/USD fell with the euro and has slipped below its 200-day average, which looks ominous," says Kit Juckes, an analyst at Société Générale. "Even someone as untechnical as me can see the significance of the 200-day average here."

The above image is courtesy of Equals Money showing new channel and 200-day Moving Average (yellow line).

"GBPUSD has declined over 5% since peaking in July, and since breaking the year-long uptrend in August, we can clearly see that we are now in a downtrend. The 200-day moving average should have acted as support for GBP but... we even saw a break of this key level suggesting that more weakness could also come on the pair. A move towards the May 2023 lows could be seen before we see a retracement higher," says Thanim Islam, Head of FX Analysis at Equals Money.

Juckes explains that the Pound and Euro are likely to remain under pressure against the Greenback given the relative strength of the U.S. economy, although a massive decline is still unlikely at this stage.

"The only positive I can think of for the euro or sterling, in a world where growth expectations re the biggest driver of exchange rates, is that expectations about UK and Eurozone growth are already dire relative to the US. That ought to be enough to prevent a sharp collapse by EUR/USD or GBP/USD (parity for EUR/USD, or GBP/USD down to around 1.15 seem unlikely) but GBP/USD could get to 1.20, and EUR/USD can easily trade below 1.05 easily if we don’t get any positive surprises from the real economy data in Europe soon," says Juckes.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Richard Jones, Richard Jones is a Macro Strategist for VDK Capital, a London-based venture capital firm, says he has been bearish Pound sterling for the past six months.

"While the position has at times been frustrating and required patience, we think the recent sell-off in GBP/USD can continue," says Jones, "the pound remains our favoured short in the G10 space."

Short-term GBPUSD strength might yet be encountered on any surprises in U.S. data and central bank developments, although at this juncture it will likely be sold into and those watching the market need to take advantage of such short-term tactical advantages.

Federal Reserve: Dot Plot in Focus

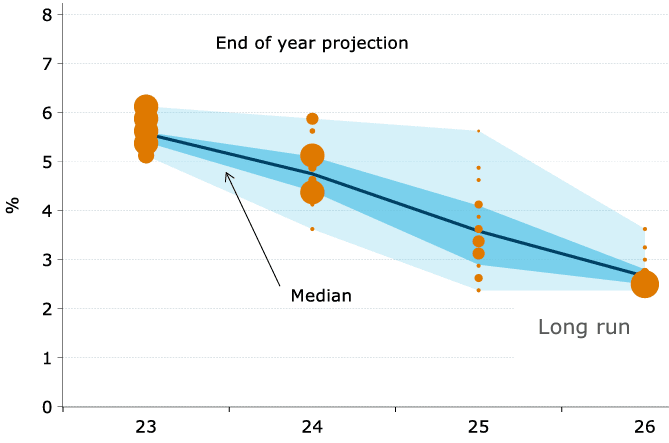

Above: FOMC dot plot (Jun 2023). Source: Federal Reserve, Macrobond, ANZ Research. Image courtesy of ANZ.

Wednesday sees the Federal Reserve give its latest decisions and guidance, offering some potential volatility in the U.S. Dollar, but a fundamental trend-turning decision is unlikely.

"On balance we think that the data released in the interim between meetings supports our view that the U.S. central bank will maintain the Federal funds rate at 5.25-5.50% next Wednesday at 19:00 BST, matching both other economists and market expectations," says Ellie Henderson, an economist at Investec.

The Fed's updated set of economic projections will be watched in the form of the latest 'dot plot' chart, which anonymously sets out where FOMC members think rates are heading.

"From various comments, even from those on the more hawkish side of the spectrum, we would expect more members to shift their end-2023 dots towards the current level of rates, signalling that we are indeed at the peak," says Henderson.

"If we are correct, then this is likely to be one of the few concrete giveaways from the Fed that we could already be at peak rates," she adds.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Downside risks to the Dollar would involve some members of the Fed signalling the prospect of rate cuts in 2024.

Investec says the Fed's summer scorecard will reveal two very close-to-consensus CPI inflation reports, a sizeable upside surprise to the latest unemployment rate number, offsetting the marginally below-expectation July print and a significantly below-consensus PMI report.

"This is just a selection of the data that the Fed has to digest, but in all the current environment appears to be one of falling core inflation (headline CPI inflation has been propped up be higher fuel costs), a loosening in labour market conditions and a cooling in overall economic momentum. Against such a backdrop the current level of rates is probably appropriate to help guide inflation back to target," says Henderson.

Bank of England Tipped to Strike a Dovish Tone, Inflation To Flavour the Mix

However, the bigger surprise in FX will likely come from the Bank of England on Thursday.

The Bank looks keen to signal the end of the rate hiking cycle is close, even as it delivers another 25 basis point hike in response to elevated inflationary levels.

The risk for Pound Sterling is that it makes a hash of navigating a tricky juncture that triggers a sell-off, as was the case throughout the duration of 2022.

"Will BOE indicate a pause after hiking 25bp next week? If so, GBP should have room to drop," says Anders Eklöf, an analyst at Swedbank.

Above: "Market pricing suggesting the BoE are finally within striking distance of the terminal rate" - Deutsche Bank.

"We think the currency will soften into yearend. And, given the potential for further near-term USD outperformance, GBP/USD can gather downside momentum and trade near its YTD low of ~1.18," says Jones at VDK Capital. "All-in-all, these economic challenges facing the UK will limit the BoE’s ability to tighten policy. Already, we have seen über-hawkish BoE market expectations soften materially in recent weeks. As such, we think the currency will soften into yearend."

Bank of England Governor Andrew Bailey contributed to Sterling weakness when he appeared before members of Parliament's Treasury Select Committee and explicitly stated the Bank was close to reaching a peak in interest rates.

The subsequent adjustment lower in UK rates and the Pound therefore suggests much of the downside that comes from a 'dovish' turn might already be accounted for, limiting potential GBP weakness at the event itself.

Wednesday's inflation release is ahead of the Bank's decision, where it is hard to see any upside for the Pound.

A stronger-than-expected inflation figure would normally be associated with strength in the Pound, but markets might not reward such a print if it suggests the UK's stagflation problem is more acute than previously expected.

A downside miss will also simply suggest the Bank of England can afford to relax in November, egging on the recent trend of GBP weakness.

On balance, however, the non-staglationary signal of a below-consensus print is likely more supportive of the Pound on a longer-term basis.

"The MPC's hope will be that Wednesday's CPI print doesn't now raise pricing - and thus raise the stakes for sterling - right before their decision," says Shreyas Gopal, Strategist at Deutsche Bank.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks