U.S. Dollar Rally Finds Support from Rising Oil Prices: Bank of America

- Written by: Gary Howes

Image © Adobe Stock

The rise in oil prices is tipped by analysts to be supportive of the U.S. Dollar as non-oil exporting countries are expected to see inflation rates remain elevated as growth continues to slow.

Such stagflationary conditions are however unlikely to be experienced by the U.S. where growth continues to outperform expectations relative to China and Europe in what amounts to a reboot of the 'U.S. exceptionalism' trade.

Oil prices are resting near recent highs following the longest winning run in more than four years as OPEC+ leaders extended supply cuts to the end of 2023.

Brent crude is quoted near $90 a barrel and WTI crude is near $86 a barrel - their highest levels since last November - after Saudi Arabia and Russia said they would prolong a plan to withhold supplies from the global market until December.

"WTI and Brent crude have reached fresh YTD highs, mainly on OPEC+ supply factors, which are further underscoring global stagflation risks," says Alex Cohen, FX Strategist at Bank of America.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"Taken together, these signals are broadly USD supportive as the relative growth/inflation mix continues to favour the U.S. among most of the G10," he adds.

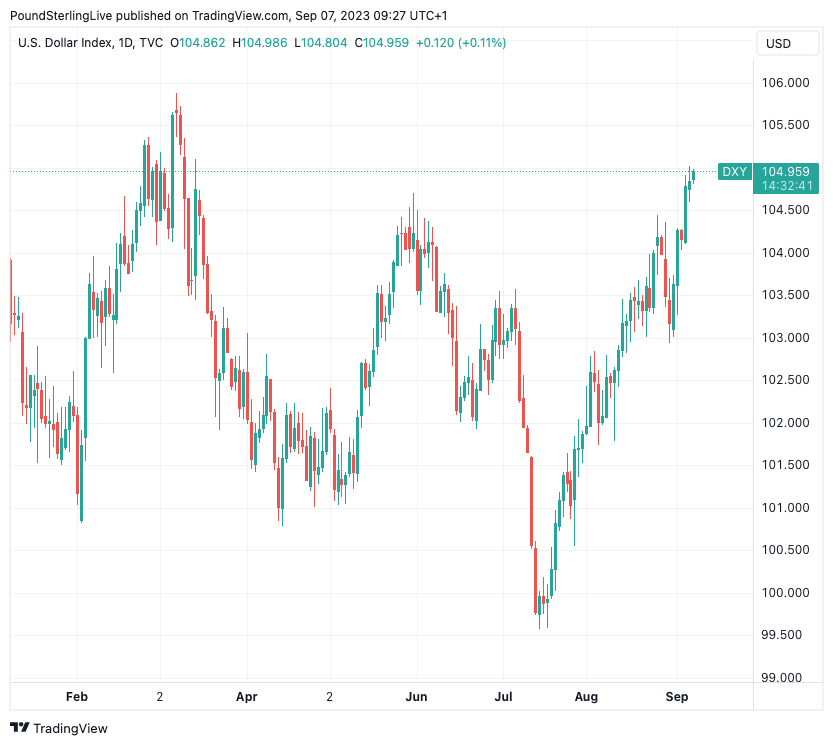

Such fundamental dynamics mean the U.S. Dollar index - a broad measure of the Dollar's performance - has reached 104.97, its highest level since March.

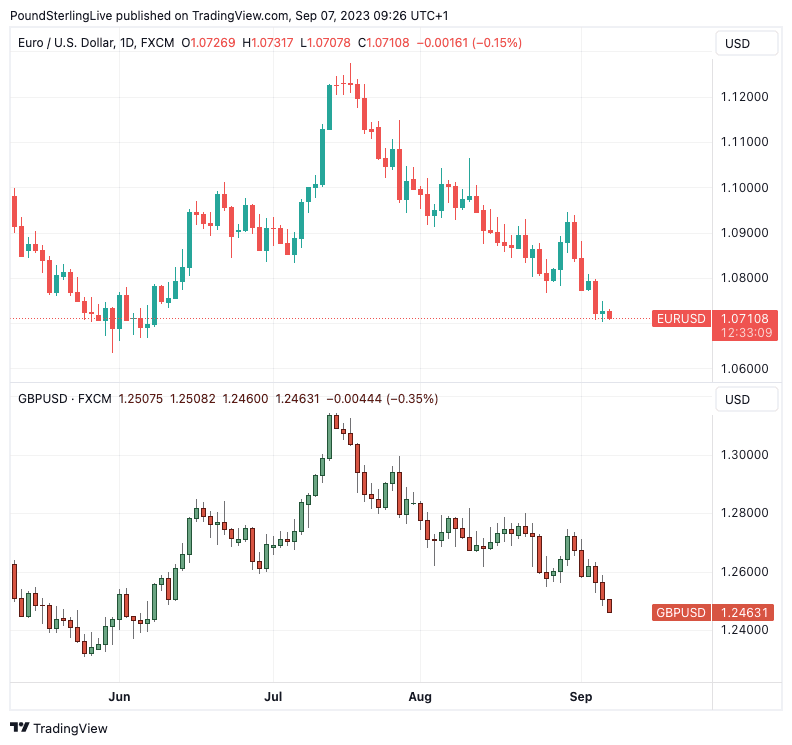

At the same time, the Pound to Dollar exchange rate has slid below 1.25 and the Euro to dollar exchange rate is now threatening a move below 1.07.

Above: The dollar index shown at daily intervals.

"The DXY index has now risen to its highest level since just prior to the when the regional bank turmoil started in March. While the data flow last week showed some signs of moderation in the US, the theme of US relative economic strength continues to dominate market narratives, particularly in the face of ongoing softness out of Europe and China," explains Cohen.

The rise in oil prices meanwhile looks set to renew upward pressure on headline inflation rates across the world at a time of slowing growth linked to elevated inflation and subsequent interest rate rises at global central banks.

The price of petrol in the UK surged by nearly 7p last month to an average of 152.25p a litre, while diesel shot up by 8p to 154.37p a litre, according to analysis by the RAC, which were some of the sharpest monthly hikes in the last 23 years.

"We expect that the oil price can stay high in the $US90s for now as Saudi Arabia restricts supply," says Joseph Capurso, an analyst at Commonwealth Bank.

Above: WTI (top) and brent crude prices shown at daily intervals.

With little indication oil prices will move lower, fears of stagflationary trends of low growth and high inflation are expected to prove supportive of the Dollar.

Beyond oil, expectations that the U.S. Federal Reserve is likely to keep interest rates elevated should also prove supportive of the Dollar, say Bank of America.

Markets are still open to the idea of another Fed rate hike before a true peak to the cycle is reached, but Cohen says "the magnitude and timing of expected rate cuts should matter more for the USD than, say, a +/- 25bp difference in the peak".

"It could very well be the case that a lower terminal could enhance the “higher for longer” policy outlook if the Fed isn’t forced to risk stressing the broader market by pushing rates higher. Should the US economy be able to rebalance with structurally higher neutral rates, this would be USD supportive," he adds.

Above: EUR/USD (top) and GBP/USD shown at daily intervals.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks