GBP Rally Against US Dollar Undone as Fed Turns Guns on Inflation

The pound to dollar exchange rate outlook improved mid-week thanks to hints that the US Federal Reserve is pushing back the timing of its first interest rate rise of 2015.

Signs that the US Federal Reserve is to focus on inflation - as opposed to the labour market - as a determinant on the first interest rate rise of 2015 hurt the US dollar exchange rate complex on Wednesday.

That said - the same dynamic proved to be a boon for the world's largest currency on Thursday following the release of US inflation data. For the full story please see here.

Interest rate levels - and expectations on future interest rate levels - are the single most important driver of exchange rates at the present time.

So what the Bank of England, the US Federal Reserve and the European Central Bank are thinking when it comes to policy is incredibly important.

The latest declines in US Treasury yields and the US dollar suggests that markets were positioned for more hawkish remarks from Fed Chair Janet Yellen's first day of testimony before Congress.

The wholesale rate in the pound - also known as the inter-bank rate - has broken back above 1.54 against the dollar following the testimony.

The moves represent a dogged fightback by sterling which is determined to reclaim the ground it lost at the start of the year:

NOTE: The above quotes and graphic representations are taken off the wholesale markets. Your bank will affix a spread at their discretion when passing on currency. However, an independent FX provider will seek to undercut your bank's offer, thereby delivering up to 5% more currency in some instances. Find out more.

Can the pound to dollar exchange rate extend gains further?

From a technical perspective we are certainly seeing a more positive outlook in the pound dollar rate establishing itself.

“GBP/USD has broken the resistance at 1.5486, confirming a short-term positive technical structure. Hourly supports can now be found at 1.5402 (24/02/2015 low) and 1.5317. A key resistance stands at 1.5620,” says Peter Rosenstreich, Chief FX Analyst at Swissquote Research.

While, “the decline in the dollar against the euro, Japanese Yen and other major currencies today indicates that dollar bulls hoped for more but at the end of the day, we still believe that buying dollars is the right trade because a 2015 rate hike remains on the table,” cautions Kathy Lien at BK Asset Management reminding us that the longer-term outlook continues to favour USD.

Why the US Dollar is Under Pressure

The fall in the USD appears to be a rare interruption to the well-established rally, in place since mid 2014.

Behind the falls is the observation that the Federal Reserve is in no rush to raise interest rates as communicated by Chairperson Yellen in her appearance before Congress.

“Objectively, she said relatively little that deviated from her press conference in December or the views of the majority as evidenced by the January FOMC statement and minutes. But Yellen did clarify two important aspects of Fed policy and communications that helped to feed the dovish market reactions, in our view,” says Michael S. Hanson, US Economist at Bank of America Merrill Lynch.

According to Hanson, Yellen shifted attention squarely onto inflation from the labor market as the main determinant of when liftoff occurs.

“In our view, given that Fed officials are more comfortable that employment and activity growth should continue, the question is when will they be "reasonably confident" in their inflation outlook,” says Hanson.

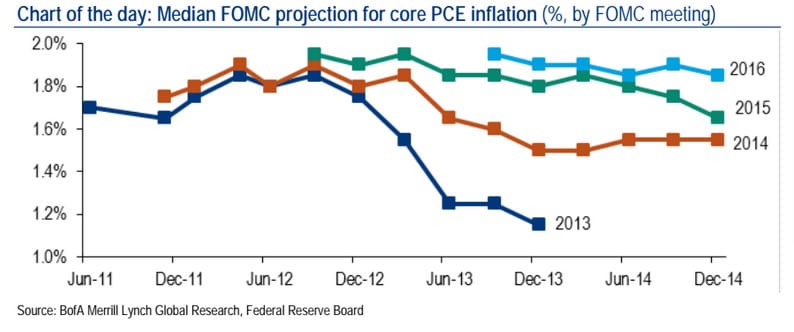

As the Chart of the day reveals, each year the FOMC has started out optimistic that near-2% inflation is just two years away, but then the inflation outlook gradually deteriorates.

Bank of America expect more of the same when the economic projections are updated again in March, which is why our base case has long been that liftoff will not happen before September.

The second issue picked up on by Hanson is the language used by Yellen.

Yellen explicitly decoupled changes in guidance from subsequent policy moves.

It essentially hinted at the Fed being in no rush to raise interest rates.

Dropping “patient” from the FOMC statement no longer signals that the Fed will necessarily increase rates a couple meetings later.

Rather, such a change in guidance “should be understood... that conditions have improved to the point where it soon will be the case that a change in the target range could be warranted at any meeting.”

“This shift gives the Fed maximum flexibility, leaving a possible June rate hike on the table, but placing more emphasis on later dates relative to pre-testimony market expectations,” says Hanson.

It also highlights that data dependence is inconsistent with clear forward guidance: things should get a little foggier from here on out.

In summary we see this as a sign that the US Fed will be determined to keep US interest rates at as low levels as possible for as long as possible.

There is therefore a huge risk that the US dollar will suffer as markets catch up with this reality.

The outlook is therefore looking softer in our view.