GBP/USD Week Ahead Forecast: Fed, BoE and UK GDP Pose Risk to GBP

- Written by: James Skinner

- GBP/USD at new one-year highs and still rising as event risk looms

- Setback likely if U.S. inflation upsets market's bets on Fed rate cuts

- BoE could weigh if inflation forecasts little changed from February's

- Sterling vulnerable to any other suggestions of rate cycle at an end

- Resistance could sap momentum around & above 1.2700 on charts

Above: King Charles III coronation procession travels along The Mall, London. Image © John-Parnell-Flickr,

The Pound to Dollar exchange rate climbed to a fresh one-year high to open the new week but shifting market expectations of the Federal Reserve (Fed) and new Bank of England (BoE) inflation forecasts are just two of the factors that could yet lead it to run aground in the days ahead.

Sterling came close to the 1.27 handle against the Dollar on Monday as it set itself on course for what would be a ninth week of gains if able to navigate around Wednesday's U.S. inflation figures and their possible implications for expectations of the Federal Reserve.

"This week there are several surveys, which should provide an insight into how much banks are tightening credit standards, while April CPI data should show inflation remains too hot," says Tom Kenny, a senior economist at ANZ.

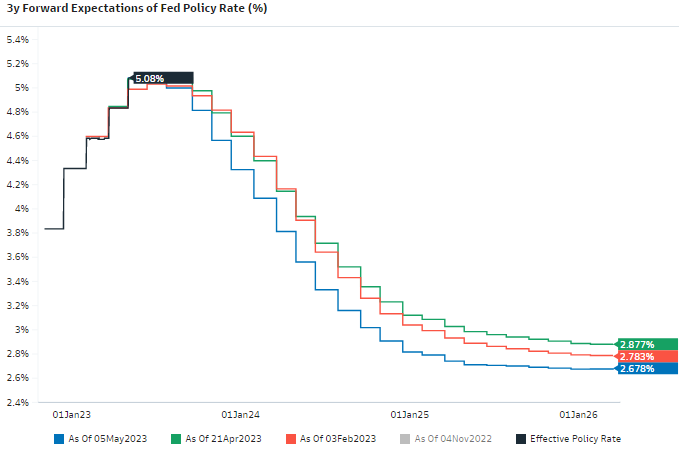

Markets have bet with greater confidence over the last fortnight that the Fed is likely to cut its interest rate as many as three times by year-end but these wagers would be more difficult to sustain, with upside implications for the Dollar, unless Wednesday's inflation data offers clear signs of a continued disinflation trend.

Above: Pound to Dollar rate shown at daily intervals with selected moving averages and EUR/USD.

Above: Pound to Dollar rate shown at daily intervals with selected moving averages and EUR/USD.

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

Annual inflation has fallen in each of the last nine months but the consensus among economists is that it likely came in unchanged at 5% for the month of April while the popular view that the more important core inflation rate also merely reversed its prior tick higher from 5.5% to 5.6% last month.

Given the market assumption of interest rate cuts by year-end, it's not clear that lower-than-expected inflation would lift the Pound any further but it's potentially very likely that a stronger-than-expected outcome would temporarily lift the Dollar and lead to a setback for Sterling.

Timeless words of wisdom;

"...But it is not the new inventions which are the difficulty. The trouble is caused by unthinking people who carelessly throw away ageless ideals as if they were old and outworn machinery.

They would have religion thrown aside, morality in personal and public life made meaningless, honesty counted as foolishness and self-interest set up in place of self-restraint.

At this critical moment in our history we will certainly lose the trust and respect of the world if we just abandon those fundamental principles which guided the men and women who built the greatness of this country and Commonwealth

Today we need a special kind of courage, not the kind needed in battle but a kind which makes us stand up for everything that we know is right, everything that is true and honest.

We need the kind of courage that can withstand the subtle corruption of the cynics so that we can show the world that we are not afraid of the future...,"

Queen Elizabeth II, Christmas Day Broadcast 1957

"It is now close to potential resistance zone of 1.2670/1.2750 representing a trend line drawn since 2021 and the 61.8% retracement of previous downtrend. In case the rebound peters out near this zone, a short-term pullback is not ruled out," says Kenneth Broux, a strategist at Societe Generale.

"December high of 1.2440 should provide support," Broux writes in Monday market commentary.

Above: Changes in market-implied expectations for the Federal Reserve interest rate between selected dates. Source: Goldman Sachs Marquee.

The Fed said last week that it doesn't yet know if it'll be able to stop raising rates from here and cited slowing progress in returning inflation to the 2% target as well as upside risks stemming from the resilient U.S. economy for discouraging market expectations of cuts to borrowing costs in the near future.

Since then official figures uggested on Friday that the labour market remained in rude health last month with employment growing further as underemployment fell and the number of unemployed persons remained relatively stable.

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

"You should not take the initial monthly payroll numbers seriously. What matters is the trend, and the trend is slowing. Moreover, the leading indicators suggest the trend will continue," says Ian Shepherdson, chief economist at Pantheon Macroeconomics.

"Core services prices ex-rents continue to rise too quickly for the Fed’s comfort, but the rate of increase is slowing," he adds in a Monday research briefing.

All of this is why the Pound to Dollar rate would do well to avoid a setback ahead of this Thursday's forecast update and interest rate decision from the Bank of England, which is also potentially a downside risk for Sterling; and particularly if the BoE is unperturbed by recent UK inflation figures.

"Our base case is that this will be the final hike in the cycle. However, the risks lie towards further tightening. We expect the post‑meeting communication to be less hawkish given the extent of the tightening already delivered by the BoE," says Carol Kong, an economist and strategist at Commonwealth Bank of Australia.

"Financial markets are currently pricing a further 25bp increase beyond this week’s meeting. A less hawkish BoE could pull down market pricing for rate hikes and weigh on the GBP/USD temporarily," Kong writes in a Monday briefing.

February's forecasts suggested a sharp second-quarter decline would lead inflation to fall back to around 4% by year-end but the declines seen in the UK over the first quarter were smaller than had been expected by economists and there is uncertainty over what the BoE will make of this.

Above: Pound to Dollar rate shown at weekly intervals with selected moving averages and Fibonacci retracements of 2021 downtrend indicating possible areas of technical resistance to any further recovery. Click image for closer inspection.

Above: Pound to Dollar rate shown at weekly intervals with selected moving averages and Fibonacci retracements of 2021 downtrend indicating possible areas of technical resistance to any further recovery. Click image for closer inspection.

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

"Although the bar is now too high for the MPC to take a more-hawkish position than the market, high and sticky domestic inflation along with strong wage growth are transforming the BoE into a less-dovish central bank versus G10 peers," says Sheryl Dong, an FX strategist at Barclays.

Economists and markets expect Bank Rate to be raised from 4.25% to 4.5% on Thursday but are also banking on it rising as far as 5% later in the year and the Pound to Dollar rate is likely to be sensitive to what, if anything, the BoE says or otherwise implies about these assumptions.

Any suggestion from the BoE that it is finished, or close to having finished raising interest rates would likely weigh heavily on the Pound to Dollar rate ahead of Friday's release of UK GDP data for March and the opening quarter where the consensus suggests the economy all but stalled in March.

"We are right at the last point of resistance in the pair, the May 2022 high, before we take a run at 1.3000. I initially suspected we would stall out around 1.2700/50 area, but maybe we have a chance to take a run at 1.3000 first," says Brad Bechtel, global head of FX at Jefferies.

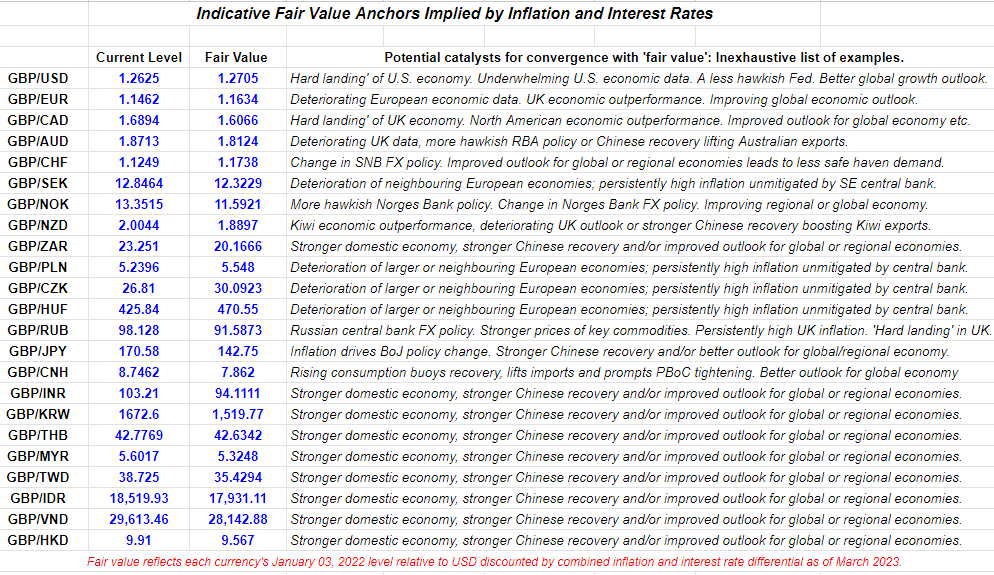

Above: Pound Sterling Live estimates of 'fair value.' Click the image for closer inspection.