GBPUSD Hits 1.26

- Written by: Gary Howes

Image © Adobe Images

The Pound to Dollar exchange rate (GBP/USD) reached its highest level in a year at 1.26 following fresh signs of banking sector stress in the U.S.

Pound Sterling advanced a third of a per cent to 1.2615 on Friday in the wake of renewed concerns about the U.S. regional banking sector. News reports suggested Western Alliance is exploring the potential sale of some assets while PacWest remains under pressure.

"After Silicon Valley Bank, Signature Bank, First Republic Bank and now potentially PacWest Bank, Western Alliance Bank and First Horizon Bank all having been subject to financial meltdowns, the proverbial cat will be very difficult to put back into the bag," says Pär Magnusson, Fixed Income Strategist at Swedbank.

The Pound rallied against the Dollar, Euro and the majority of its peers when Silicon Valley Bank failed in March.

Analysts at the time said the Pound appears to have benefited as the UK's banking sector is smaller, in better health and unlikely to throw up unwelcome surprises.

"Far larger banking sectors in the U.S. and Europe may be helping the pound in this environment with investors more confident of the UK banking sector avoiding any nasty surprises than in the U.S. or the euro-zone," says Derek Halpenny, Head of Research for Global Markets EMEA at MUFG Bank.

U.S. two-year government bond yields dropped below 3.70% and drove the curve steeper as investors sought safety.

"Continued focus on the health of the U.S. regional banks has seen levels of money market stress edge higher. U.S. policymakers will be looking at ways to patch things up, but the clear overall trend should be one of tighter credit conditions and weaker US growth," says Chris Turner, head of FX analysis and strategy at ING Bank.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Expectations for rate cuts at the Federal Reserve have increased as investors reckon that banking stresses mean U.S. lending conditions will become stricter, leading to an economic slowdown.

"It seems clear that tighter U.S. credit conditions will only exacerbate the 2023 US slowdown and disinflation process and we suspect there will be plenty of dollar sellers," says Turner.

In effect, the banking crisis does the Fed's bidding by making the cost of money dearer.

This takes the pressure off the Fed to hike further and allows it to consider cutting rates to shore up the economy in the future.

Rising rate cut expectations - forwards are now projecting almost 100bp of cuts by the end of the year - weigh on the Dollar.

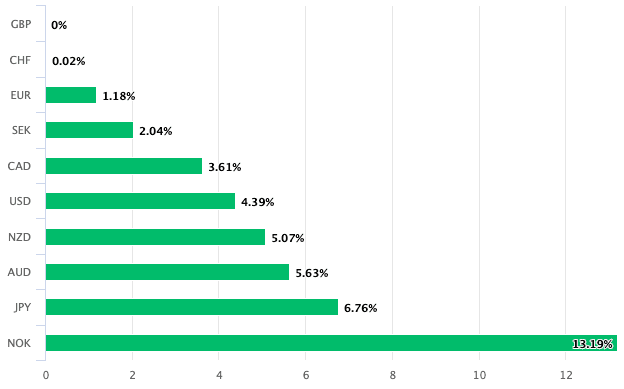

Above: GBP is 2023's best-performing currency once more.

"With the U.S. economy losing its growth advantage and the rate premium likely to narrow, we advise investors to hedge their dollar exposure, favouring the Australian dollar, the yen, and gold," says Mark Haefele Chief Investment Officer, UBS Global Wealth Management.

The GBPUSD exchange rate will meanwhile take further guidance ahead of the weekend from the release of U.S. employment data.

"The U.S. labour market report is always seen as a key bellwether of U.S. economic conditions but, of late, it has acquired even more importance with the Federal Reserve citing potential domestic inflationary pressures as a major reason why it has continued to raise US interest rates," says Rhys Herbert, an economist at Lloyds Bank.

The report follows Wednesday's hint from the Fed that, after ten consecutive moves, it intends to 'pause' its rate hiking from the next policy update in June.

A softer-than-expected jobs and wage report would likely ensure the Dollar remains under pressure.

But should the numbers beat expectations then the water is muddied further and the Dollar could fight back.

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |