GBP/USD Rate Hits 10-month Best, Dips to be Bought

- Written by: Gary Howes

Image © Adobe Images

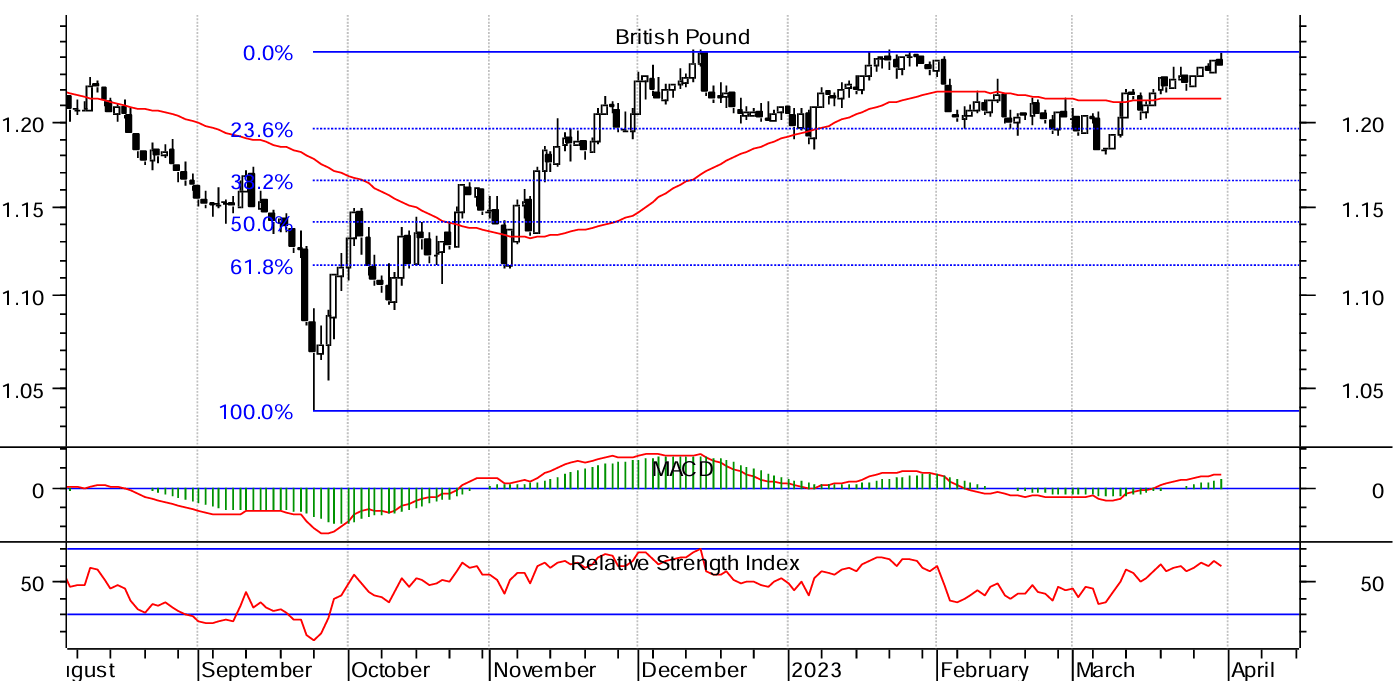

The Pound rallied to a fresh 10-month high against the Dollar on April 04 as the UK currency build on a solid start to 2023.

The outlook remains constructive as analysts assess April to be a historically strong month for the Pound, meanwhile, a positive technical setup suggests any setbacks would likely be shallow.

"We would view ongoing appetite to buy dips back to 1.2225/35," says Jeremy Stretch, G10 FX Strategist at CIBC Capital Markets.

The Pound to Dollar exchange rate (GBPUSD) rose to a high of 1.2481 on Tuesday, the best level for dollar buyers since June 2022.

The Pound has experienced a solid start to 2023 and has outperformed all its major peers in the first quarter, benefiting from a run of economic data that has proven stronger than analysts were expecting.

A pair of interest rate hikes at the Bank of England and a continuation of the Bank's data-lead approach to further policy moves have also fuelled the rally.

"The British pound clinched its biggest monthly rise since November last year versus the US dollar as narrowing US-UK rate differentials and better-than-expected UK economic data fuelled demand for the UK currency," says George Vessey, FX & Macro Strategist at Convera. "The pound was crowned the best-performing currency of the first quarter of 2023, rising an average of 3% against its G10 peers."

GBP/USD is now bumping into a formidable area of resistance which must be overcome before it can breathe fresh air. Failure to breach would meanwhile see GBP/USD slip back into the upper levels of the 2023 range.

"GBP/USD has rebounded towards last December / January high of 1.2450. This hurdle must be overcome to affirm extension in the up move," says Kenneth Broux, a strategist at Société Générale.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

He adds that last week's low of 1.2210/1.2190 is now an important support zone.

"As the daily chart below demonstrates, it has also pushed up towards the top end of a range that has been in place over the last four months, and where a degree of resistance has been apparent in the vicinity of $1.24," says Bill McNamara, chief analyst at The Technical Trader.

Image courtesy of The Technical Trader.

"We would view ongoing appetite to buy dips back to 1.2225/35, albeit we would expect overhead resistance in the 1.2423 area to contain the topside," says Stretch.

Although the Pound has seen some idiosyncratic outperformance, most analysts we follow maintain that any sustained uptrend in GBP/USD following a break of 1.24 would rely to a large degree on the USD side of the equation.

"What happens next is largely dependent on the price action for the dollar, which has been losing ground recently," says McNamara.

For the week ahead, he says all eyes will be on this Friday's Employment Report for signs of a slowdown in the US economy.

"Needless to say, a close above 1.24 will amount to a significant technical event," adds McNamara.

For the Pound, the first major domestic test comes with the release of labour and inflation data (18th & 19th, respectively), which should be met by a currency market reaction given these figures will determine the likelihood of another rate hike at the Bank of England in May.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks