GBP/USD Rate: Reaching the Limits as Fed to Return Focus on Inflation say Analysts

- Written by: Gary Howes

- USD has slumped as markets bet Fed to limit rate hikes

- Amidst fears for the U.S. Financial system

- But analysts say inflation to remain a priority

- Which could see USD make a rebound, limit GBP/USD upside

Image © Adobe Stock

Dollar exchange rates could recover over the coming days as some analysts say the Federal Reserve's fight against inflation won't be derailed by the recent failure of a number of smaller U.S. banks.

The Dollar has fallen as markets slash expectations of the scale of future rate hikes coming from the Fed as fears for the stability of the U.S. banking system increase.

But these risks might be contained by measures announced by authorities in the U.S. and around the world, potentially wrong-footing those who are betting on further declines in the Dollar.

"Tactically speaking, I think these are near-term buy the dip threads for the USD," says Stephen Gallo, Head of European FX Strategy at BMO Capital Markets.

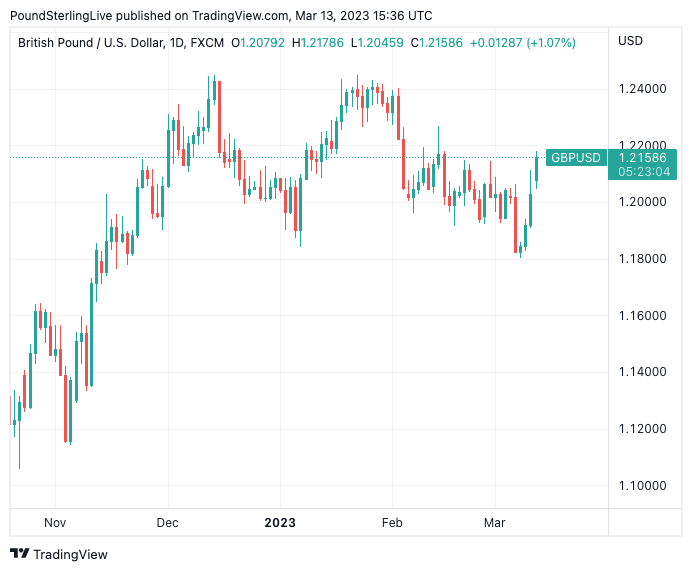

Above: GBP/USD at daily intervals showing the recent rebound. Consider setting a free FX rate alert here to better time your payment requirements.

The Dollar fell sharply late last week on news Silicon Valley Bank (SVB) had failed as it became the latest financial institution to buckle under the weight of rising U.S. interest rates.

The yield on U.S. two-year bonds collapsed alongside investor expectations for further Federal Reserve interest rate hikes as investors bet the Fed would have to show constraint in raising interest rates to avoid creating a new financial crisis.

The Pound to Dollar exchange rate rallied back above 1.21, having been as low as 1.18 just last week.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Analysts at TD Securities are however "wary" that the market "may have overplayed its hand".

Economists at the bank expect Tuesday's U.S. core CPI inflation to come in above expectations at 0.5% month-on-month, serving a timely reminder that the Federal Reserve still has an inflation 'problem' on its hands.

TD Securities expects the Fed to take its terminal interest rate to 5.75%, "which should prevent an extension of USD weakness."

The developments would put a cap on the GBP/USD exchange rate as the USD sell-off linked to expectations that the Fed would pull the handbrake on rate hikes would be questioned.

"The immediate price action in the USD has been driven by expectations for a shallower path of Fed rate hikes," says Gallo. "The rapid ring-fencing operation gives the Fed room to continue its inflation fight."

Gallo also warns the Dollar would be a beneficiary if the international financial system also begins showing signs of stress, underscoring the Dollar's classic safe-haven appeal.

Indeed, "severe USD weakness" is a "tail risk scenario," says Gallo, in "which financial contagion escalates as a US-only phenomenon".

Above: Two-year U.S. bond yields (top) and the Dollar index - a measure of broader USD performance - showing the impact of faded Fed hike expectations.

The Dollar had been riding high last week after Fed Chair Jerome Powell told Congress that interest rates in the U.S. might have to go to higher levels than previously expected.

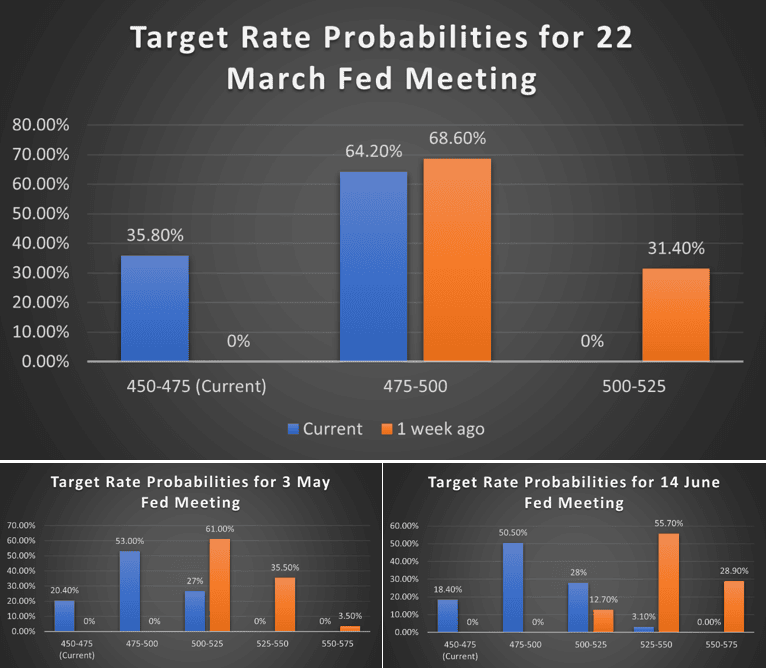

This saw markets increase bets for a 50bp hike at next week's FOMC.

Investors are however betting that the Fed's commitment to getting inflation lower will be shaken by fears it is destabilising the financial system.

This assumption assumes the Fed believes the targeted measures it has announced alongside the U.S. Treasury, aimed at supporting the banking system, are ineffective.

"If the Fed were to back away from its tightening cycle, it may have a credibility issue on its hands," says Jane Foley, Senior FX Strategist at Rabobank.

Foley reminds us that in his very first speech as Fed Governor, former Fed Chair Bernanke recommended using "the right tool for the job".

In a speech following his tenure in 2015, he stated that "I have argued that it’s better to rely on targeted measures to promote financial stability, such as financial regulation and supervision, rather than on monetary policy."

The Dollar would likely recover recently lost ground if Powell repeats such a belief next week.

"Given the announcement that the Fed has made over the weekend in conjunction with the Treasury to stop contagion risks from the SVB crisis, the FOMC may favour continuing to hike rates next week with a focus on the inflation risks," says Foley.

Above: Expectations for future Fed interest rate moves. Image courtesy of Fawad Razaqzada / City Index.

"SVB is a micro- and not a macro-story. It changes little about the trajectory of the US economy, which is the same as it was a week ago," says Robin Brooks, Chief Economist at the IIF.

But money markets show investors have increased pricing for a 'no change' decision next week to about 30%, while the odds for a rate cut by the end of 2023 have returned.

"If they really do feel they have 'solved' this bank run issue and that the dust settles on this then it will actually potentially embolden Powell to keep going on rate hikes," says W. Brad Bechtel, an analyst at Jefferies.

The release of U.S. inflation on Tuesday could be an important moment as a stronger-than-expected reading would potentially serve as a reminder that further hikes are needed, even if the days of 50bp moves are in the past.

"The Fed will think that if they can contain the fallout of SVB and broader issues in the bank space, then they can keep pressing on the gas pedal to fight inflation," says Bechtel.

The Jefferies analyst says he would prefer to "be short" the Pound and place stop losses above 1.22.

Strategists at Crédit Agricole assume the SVB failure should not distract the Fed from delivering on its inflation mandate, believing the U.S. inflation outlook will once again become the main driver of the USD in the near term.

"In that, potential positive surprises from the CPI data could reignite Fed rate hike expectations in a boost to the currency," says Valentin Marinov, Head of FX Strategy at Crédit Agricole.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks