GBP/USD Week Ahead Forecast: Resisting North Atlantic Headwinds

- Written by: James Skinner

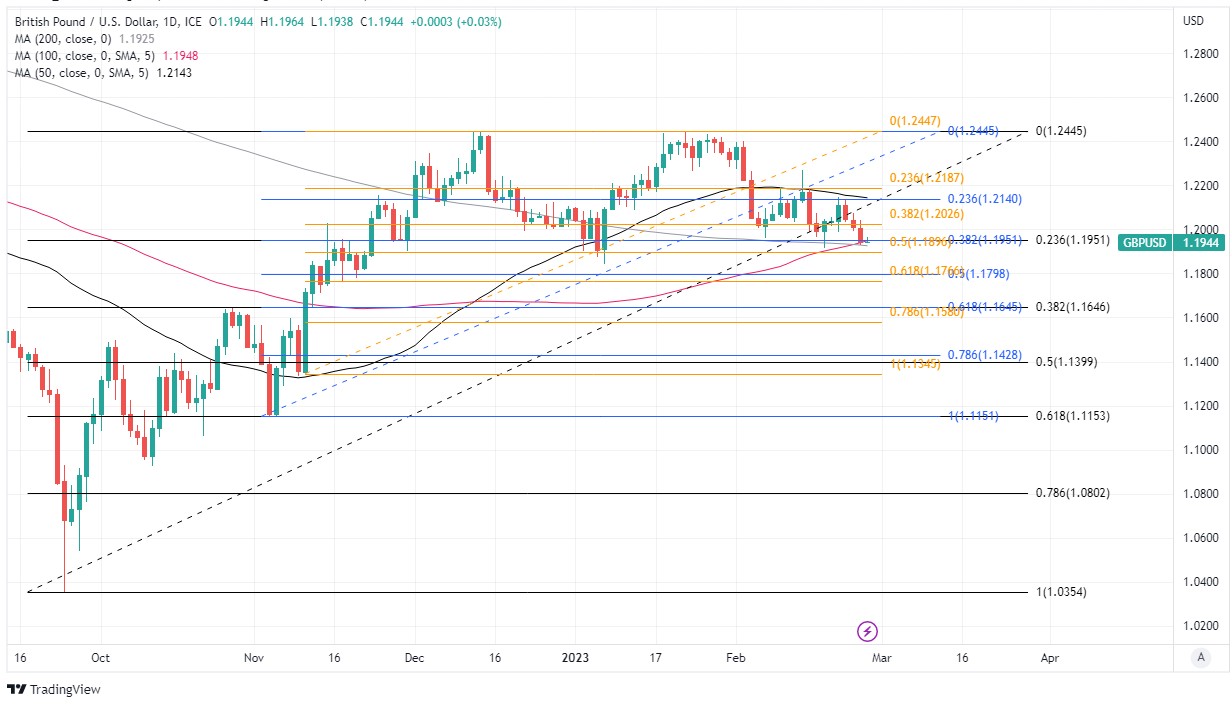

- GBP/USD looks to recover footing near & around 1.1925

- Scope for support around 1.1896 & 1.1799 further down

- Repricing of BoE outlook & risks for Bank Rate support

- U.S. economy resilience, inflation & Fed risks constrain

The Pound to Dollar exchange rate has most recently succumbed to a broad rebound by the greenback that could be likely to constrain any attempted recoveries this week even if Sterling does itself manage to defy any further headwinds blowing in from across the Atlantic over the coming days.

Sterling climbed against most other comparable currencies except the Dollar last week following a sharp bounce in S&P Global PMI survey indices for February as well as hawkish economic and monetary policy commentary from Catherine Mann at the Bank of England (BoE).

In addition, other data has indicated a less bleak outlook for UK public finances just weeks out from the March budget and at a point when inflation risks are still widely perceived to remain very much on the upside, with possible implications for Bank Rate up ahead.

But an increase in the preferred inflation measure of the Federal Reserve (Fed) on Friday and other generally resilient economic data coming from the U.S. has kept the market focused on upside risks to the Fed Funds rate and U.S. Dollar with adverse implications for GBP/USD in recent trade.

"SEK has had a hard time and is being helped by currency-positive central bank comments, while the market is already so bearish of GBP it can’t fall as fast as the others," says Kit Juckes, chief FX strategist at Societe Generale.

Above: Pound to Dollar rate shown at daily intervals with selected moving averages and Fibonacci retracements indicating possible areas of technical support. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"10 -year Note yields have risen 13bp on the week, and at the front end of the curve, the market’s pricing of peak rates for this cycle has risen from 5 ½% to 5.4%," Juckes writes in a Friday market commentary.

Better UK public finances may mean there is a risk of stimulatory giveaways in the March budget and make no quarrels with the notion of there being scope for interest rates to rise further in the short-term, although there may also be a threat of political tail risks re-emerging again in the near future.

This is because the prospect of newly negotiated post-Brexit administrative arrangements for Northern Ireland could lead to parliamentary controversy in the short-term, although appearances by multiple members of the Monetary Policy Committee and a busy U.S. economic calendar are the highlights of the week.

"GBP/USD will be driven by trends in the USD this week in our view. GBP can also be influenced by any new messages on the economic outlook or monetary policy from Bank of England officials, particularly Governor Bailey," says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

"Other BoE officials speak throughout the week. There is no important local UK economic data scheduled this week. GBP/USD is likely to test support at 1.1928 (200 day moving average)in the early part of the week," Capurso and colleagues write in Monday commentary.

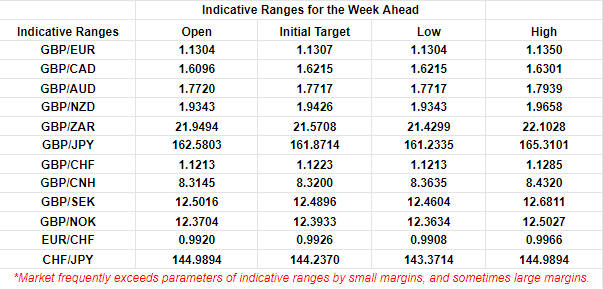

Above: Financial model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

With the BoE policy sphere and Sterling factors aside, the Pound to Dollar rate's week gets underway with Monday's release core durable goods orders data for January in the U.S. and a noon speech from Federal Reserve Board Governor Philip Jefferson covering "recent inflation and the dual mandate."

Mid-week highlights like January trade balance and February consumer confidence figures are followed with appearances by numerous Federal Open Market Committee members and the latest editions of the Institute for Supply Management PMI surveys.

Any surprise strength or resilience in either of these economic barometers would potentially encourage the recent advance in Dollar exchange rates and constrain any recoveries in Sterling should it attempt to climb much above the nearby 1.20 handle in the week ahead.

"Support at 1.1930/40, where the 100– and 200 -day MA signals converge is within reach," says Shaun Osborne, chief FX strategist at Scotiabank.

"Weakness below here will likely signal additional GBP losses towards key medium-term support at 1.1840," Osborne writes in Friday market commentary.

Above: Pound to Dollar rate shown at weekly intervals with selected moving averages denoting possible areas of technical resistance. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks