Analysts on Alert for GBP/USD Move Back Below 1.20

- Written by: Gary Howes

Image © Adobe Images

Foreign exchange analysts are considering the prospect of a near-term retreat in the Pound to Dollar exchange rate (GBP/USD) back below the psychologically significant 1.20 level as a recent three-month rebound is challenged.

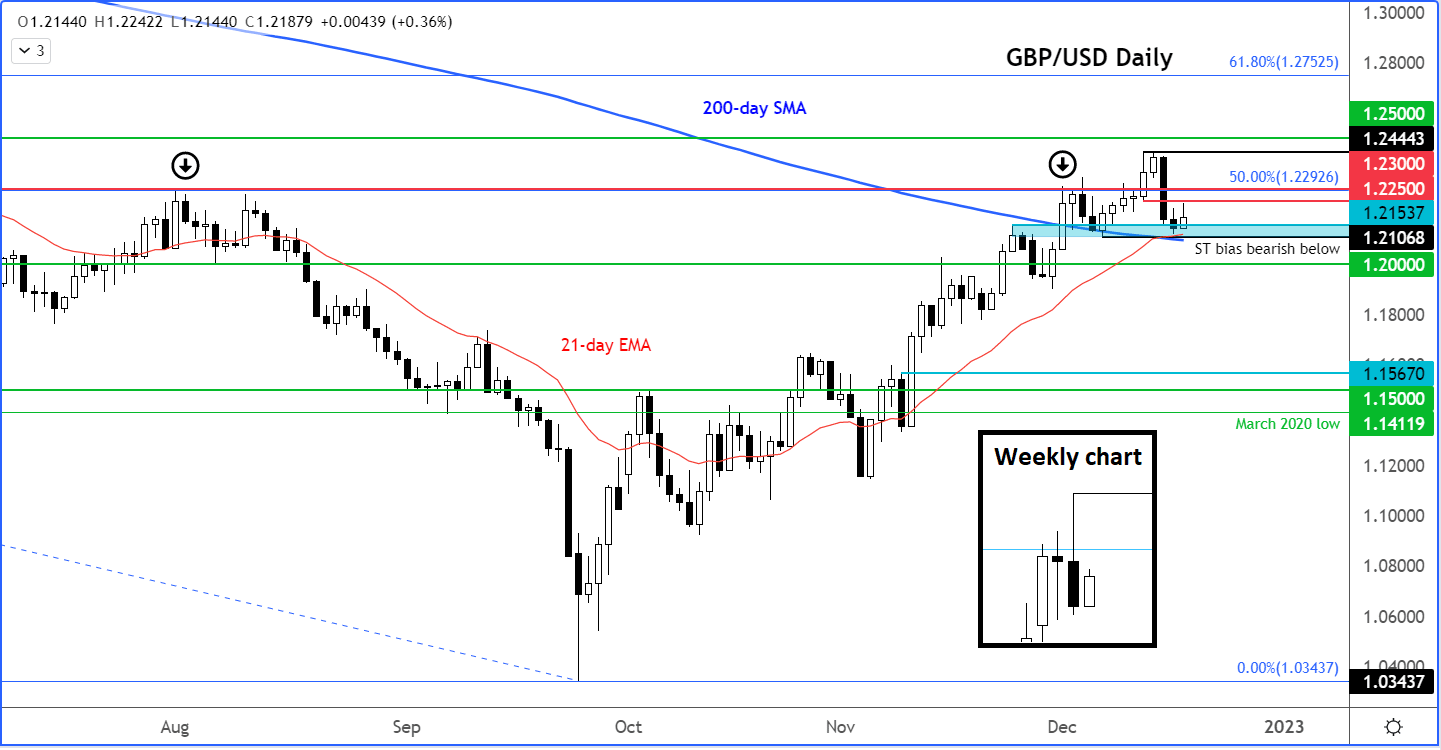

"GBP/USD has achieved the upside projections at 1.2450. A pullback has brought it back towards the 200-DMA at 1.2100. Failure to hold this could lead to a deeper down move towards 1.1900 and October peak of 1.1645," says Kenneth Broux, an analyst at Société Générale.

GBP/USD has trended higher since all-time lows were plumbed in September and is now up 8.85% over a three-month period.

The rally peaked at 1.2450 on December 14, but a near-2.0% fall on December 15 sounded the warning bell that the recovery might be in jeopardy.

"It is likely in my view that the GBP/USD could be heading lower again, possibly below $1.20 in the days and weeks ahead," says Fawad Razaqzada, analyst at City Index.

Above image is courtesy of City Index. Consider setting a free FX rate alert here to better time your payment requirements.

The Pound's rally has largely reflected its 'high beta' status that leaves it highly responsive to global investor sentiment.

The post-September rally by Sterling has coincided with a rise in global stock markets that has resulted from investors betting the Federal Reserve is approaching a point at which it would abandon its rate hiking cycle.

From a fundamental standpoint, therefore, how global markets behave over the coming days and weeks will be instrumental in determining the direction in Sterling.

"The dovish dissent by the BoE MPC last Thursday and pullback in equities following the ECB pegged GBP/USD back below 1.22 from a high of 1.2446. The correlation with equities and fading appeal of the dollar are helping sterling to defy weak domestic economic fundamentals. Cable must however defend the 200dm at 1.2094 to avoid a return below 1.20," says Broux.

Broux says GBP/USD's correlation with the S&P 500 now stands at 0.67.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Last week saw the GBP/USD record its second consecutive down week as a 1.0% drop was recorded.

Analysts have widely cited the Bank of England's interest rate hike and policy update as being behind the move, although there is evidence to suggest a 'dovish' Bank of England actually acts as a support for the Pound as a lower peak in Bank Rate is consistent with a shallower recession in 2023.

Rather, it was the hawkish surprise from the European Central Bank - which said more 50bp hikes were required - that spooked markets and therefore contributed to a lower Pound.

"The bears will clearly want to see the cable hold below the 1.23 handle going forward. There will be a lot of trapped long traders whose stops might be resting below last week’s range. Given the shape of this pattern, I wouldn’t be surprised if the GBP/USD drops to take out those orders, despite the cable starting the week on the front-foot," says Razaqzada.

On the daily time frame, the analyst notes the area around 1.2100 had been supporting in the past, where we also have the 200-day average converging.

"A potential break below this area would drive the cable back below the 200-day, which would be another bearish development in and of itself," says Razaqzada. "Let’s see if that happens now and whether we will see acceptance below it. If so, we should then see some follow-up technical selling towards and potentially below the 1.20 handle next."

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks