GBP/USD, EUR/USD: Technical Outlook as Fed Threatens a Dollar Rebound

- Written by: Karen Jones of the STA, editing by Gary Howes

Image © Adobe Images

Rate decisions by the Federal Reserve, Bank of England and European Central Bank make for a nervous week ahead for the GBP/USD and EUR/USD.

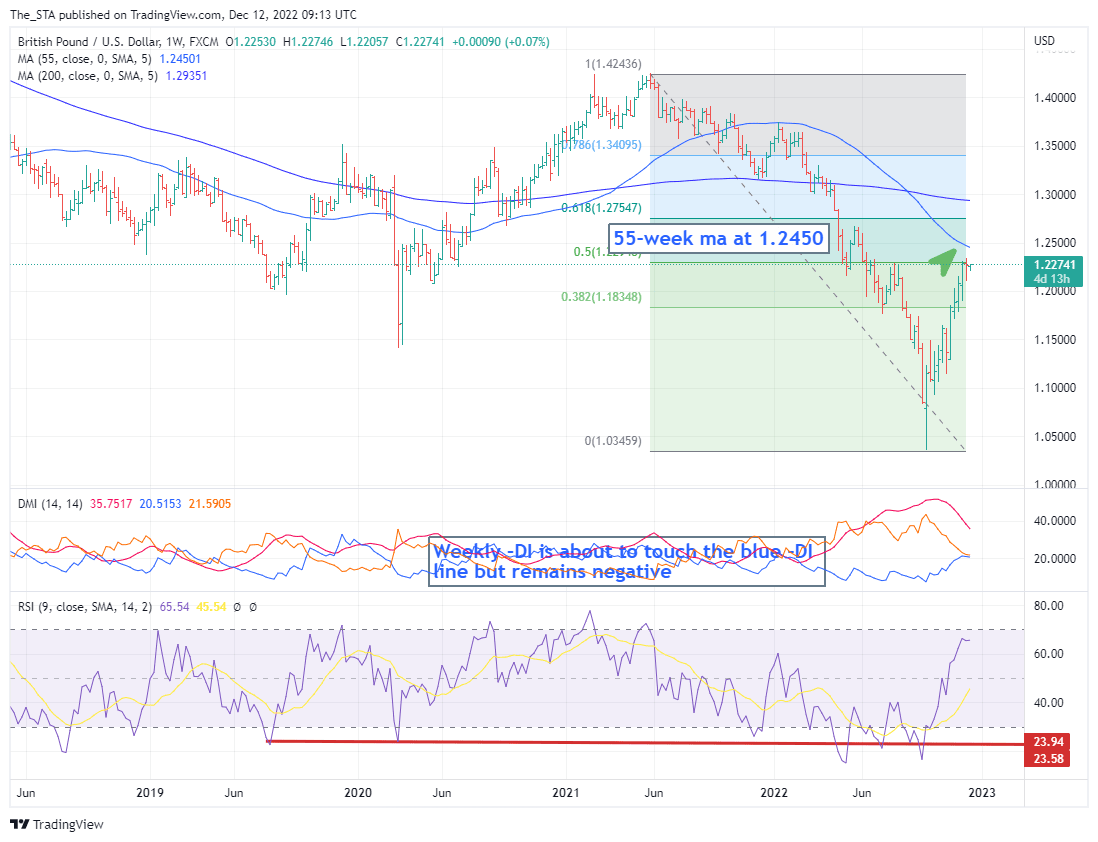

Technically GBP/USD peaked last week at 1.2344 and the market appears to be consolidating around the 50% retracement at 1.2295 of the entire move down from the May 2021 peak.

It has seen a solid rally throughout the 4th quarter but will shortly encounter the 55-week ma at 1.2450 and we suspect will struggle in this vicinity- above here lies the 1.2667 end-of-May peak.

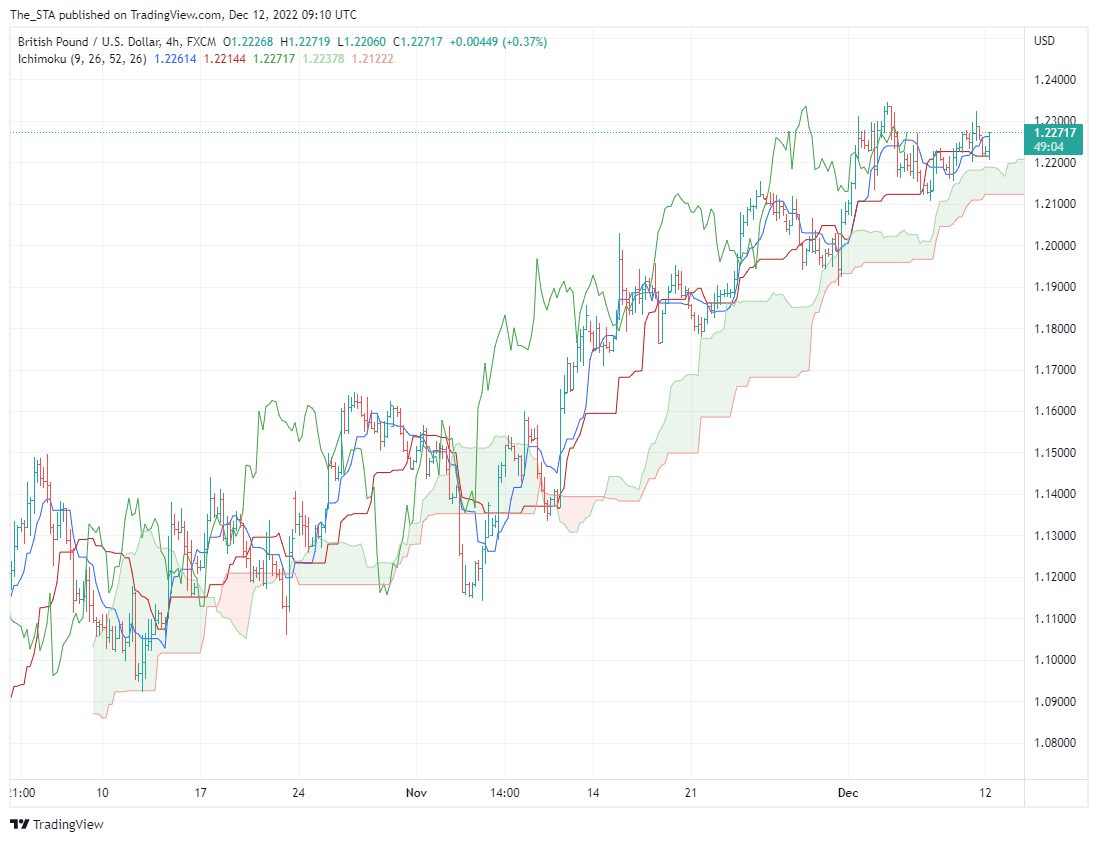

Uptrend support is some distance away at 1.1800, but cloud support on the 4-hourly chart between 1.2180 and 1.2120 offer the near-term support levels to watch.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The Fed is expected to give a 50bps rate hike on Wednesday which could provoke some recovery in the dollar. What the ECB is likely to do – 50 or 75bps is less clear.

There have been a number of data releases recently that suggest that the rate of Eurozone inflation is decreasing, but with wage inflation within the Eurozone still raising its ugly head, the markets cannot rule out a 75bps on Wednesday.

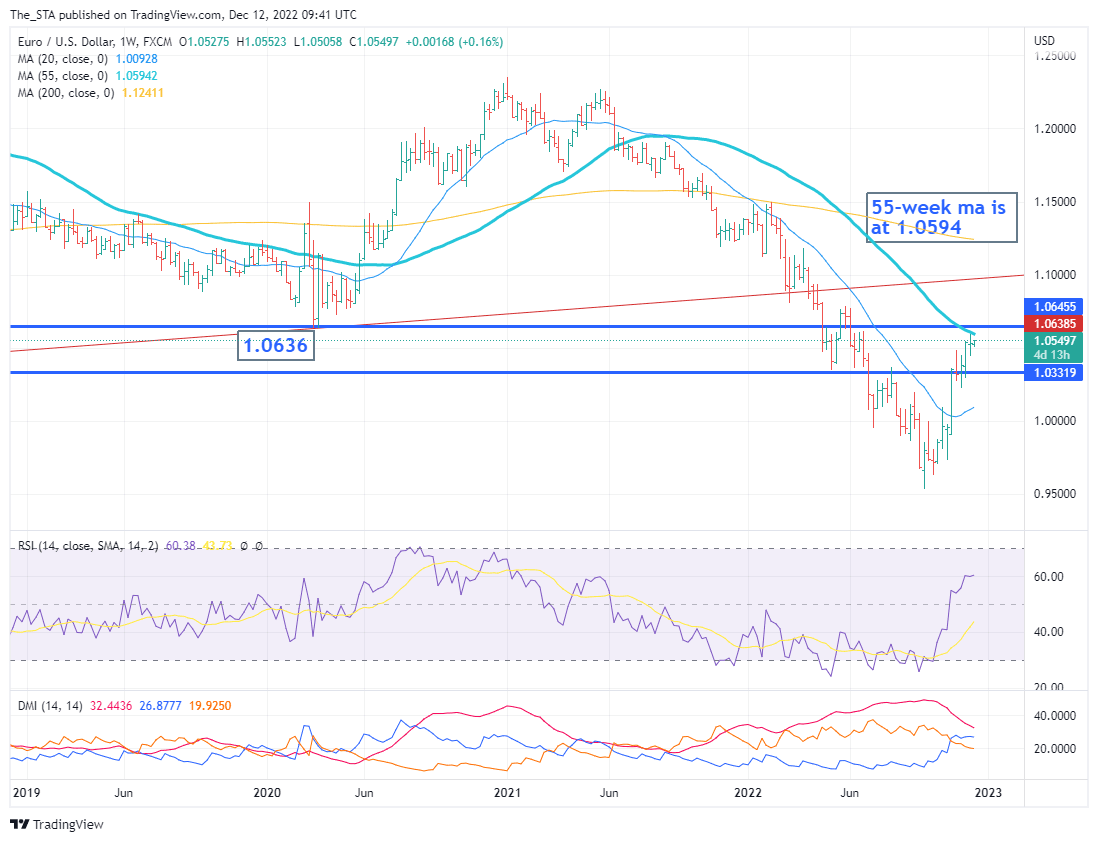

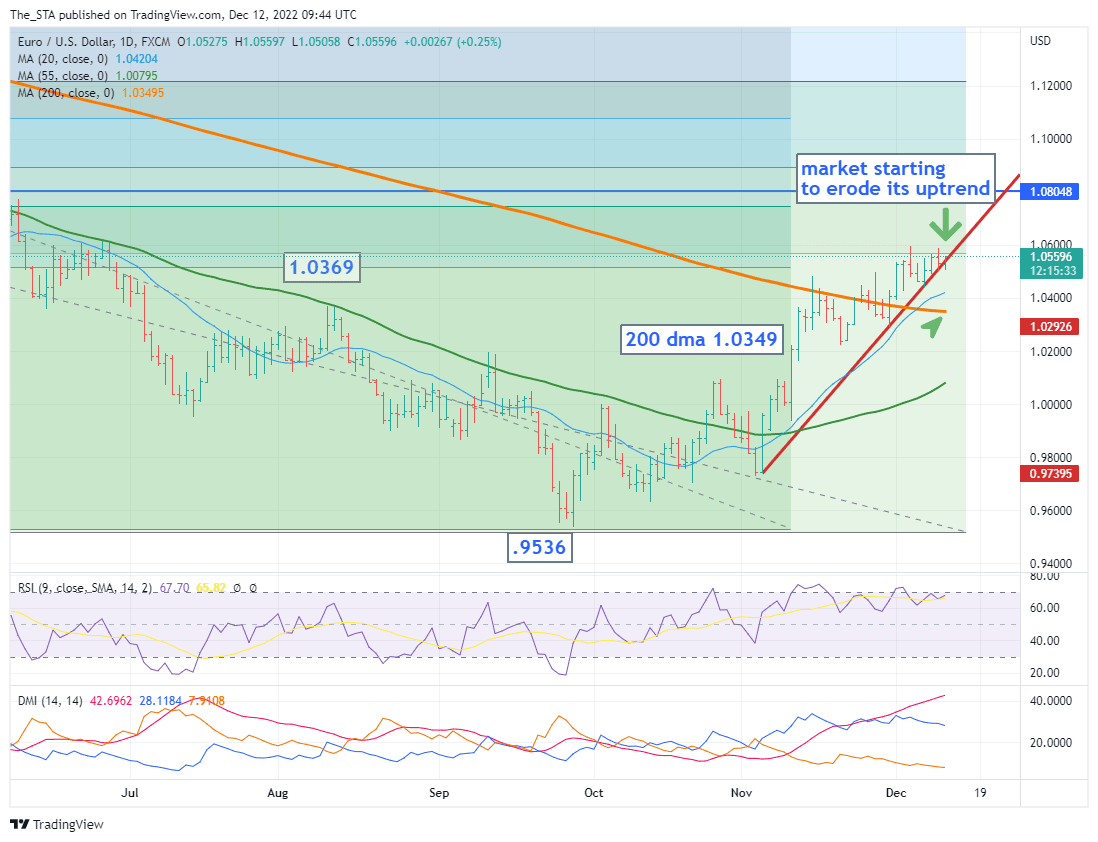

Likewise, the EURUSD chart is suggesting that the up move, which has been in evidence since the end of September is starting to struggle. The market has been unable to clear the twin perils offered by the 55-week ma at 1.0594 and the 2020 low at 1.0636.

Consider setting a free FX rate alert here to better time your payment requirements.

These are currently acting as an effective barrier on the topside and the 6-week uptrend is being eroded. This leaves attention on the supports offered by the 20-day ma at 1.0420 and the 200-day ma at 1.0349. We also have cloud support reinforcing this support, which is available down to 1.0440 on the 4-hourly chart. Above the 1.0636 level lies the end of May peak at 1.0787.

About the Author

Karen Jones is the former Managing Director and Head of FICC Technical Analysis Research at Commerzbank Corporates and Markets. She has extensive experience of technical analysis spanning 30+ years. She has been voted top 3 in the world in the FX Euromoney Survey for over a decade and has won this category several times.

She is now the Treasurer of the Society of Technical Analysts (STA). The STA Diploma Part 2 course will start on 11 th January 2022. More details can be found here: STA Courses - Society of Technical Analysts.

Disclaimer

The information posted on Trading View/Instagram is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only.

All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for

compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks