GBP/USD Rate Pushes Fresh Three-Month Best Aided by PPI Inflation Surprise

- Written by: Gary Howes

Image © Adobe Images

The Pound has rallied to a new three-month best against the Dollar as the major unwind of the U.S. currency sparked by last week's U.S. inflation data was given a fresh impetus by another inflation release.

The Dollar's decline accelerated at 13:30 GMT following the release of U.S. PPI inflation data which came in lower than expected, reinforcing a message set by last week's CPI inflation that the cycle of rising prices is peaking.

PPI inflation rose 0.2% in the month to October, unchanged on September's reading, but coming in at half of what the market had expected at 0.4%.

PPI measures the inflation facing domestic producers of goods and services and is therefore considered to be up the pipeline for consumer-facing inflation (CPI).

"Today’s report should still be viewed as favorable," says Michael Moran, an analyst at Daiwa Capital Markets. "Prices of consumer goods other than food and energy have increased only 0.2 percent in each of the past two months, down from an average of 0.8 percent in the first half of the year".

The Dollar lost 0.70% against the Pound in the 15-minute window following the release, but it has since pared these losses.

The Pound to Dollar exchange rate (GBP/USD) is now seen at 1.1950, levels last seen on August 19.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The three-month best for GBP/USD extends the strong market reaction to last week's U.S. inflation reading, which saw CPI come in below market expectations and signalled a turning point for both inflation and the Federal Reserve rate hiking cycle might have been reached.

"Dollar bulls are feeling the squeeze," says Kit Juckes, Chief FX Strategist at Société Générale. "While there are still some nasty tail risks out there, we are in the process of seeing inflation peak".

GBP/USD's recent rally takes dollar payment rates on a typical Sterling bank account to around 1.1680, meanwhile, rates on offer at competitive payment providers are closer to 1.1875, according to our data.

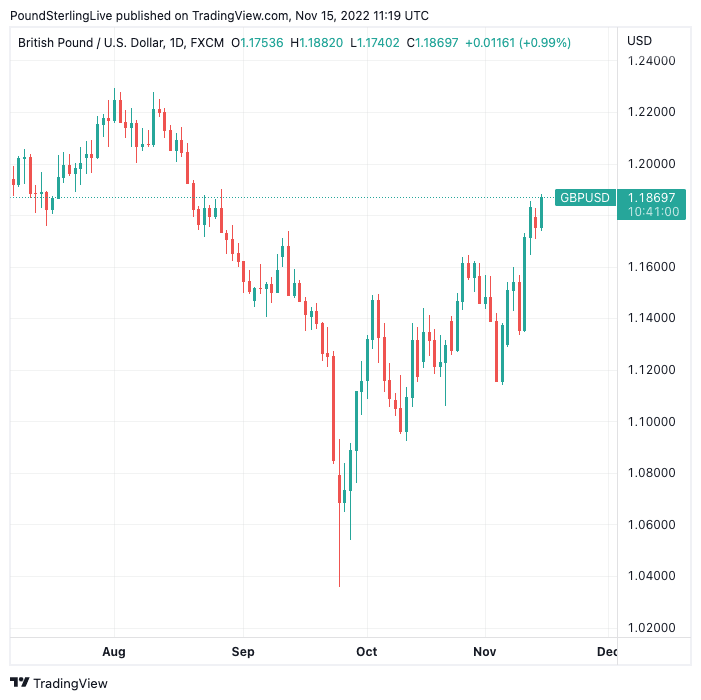

Above: GBP/USD at daily intervals. To better time your payment requirements, consider setting a free FX rate alert here.

The main impulse of the Dollar's decline is being provided by a clear-out of 'long' dollar positions held by investors betting on the further upside in the world's de facto reserve currency.

Given that the overwhelming consensus in the FX market over the past year has been to bet on further dollar strength, the inevitable clear-out has proven significant.

But Juckes says the Dollar decline has a more fundamental foundation that means the peak of the recent cycle is now in.

"Fed rate hikes are priced in, the high has been for bond yields; the Chinese authorities will support the housing sector and slowly reopen the economy; emerging markets are turning a corner and offer attractive entry levels in currencies and bonds. And so on..." says Juckes.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The U.S. Dollar Index - a broader measure of Dollar performance - posted a multi-year peak of 114.1 near the end of September, "and although its price action became somewhat choppy after that there was still little in the chart outlook to suggest that it was on the verge of a major reversal," says Bill McNamara, analyst at The Technical Trader.

"However, that’s what we got last week as the U.S. currency slumped on the back of the inflation data: it closed with a loss of 3.8%, and that was its largest weekly drop since March 2020," he adds.

McNamara has looked at the weekly chart (above) and says "it's hard to imagine that this doesn't mark the end of the rally".

For Pound-Dollar watchers, this would therefore imply the nadir has been reached.

"Even GBP may hold up reasonably well in the face of tighter fiscal policy, still-rising inflation and growth fears, simply because the consensus view of the economic outlook is already so dire," says Juckes.

For the Pound, domestic issues could become of greater importance with the release of UK inflation on Wednesday and the Autumn statement on Thursday.

Headline CPI inflation is forecast to report at 10.6% year-on-year for October, up on September's 10.1%.

The core CPI reading is seen at 6.4%, well ahead of the Bank of England's 2.0% target and consistent with further interest rate rises.

The reaction of the Pound to this data is hard to predict: does it rally on a weaker inflation print, as this suggests the economic pain wrought by inflation will be less severe?

Or does it fall as a weaker inflation print implies that the Bank of England can end its rate hiking cycle soon?

The big event for the Pound comes on Thursday when Chancellor Jeremy Hunt lays out his tax and spending plans for the coming months and years as he endeavours to regain the market's confidence and convince investors the UK's debt position remains sustainable.

Media reports suggest he is seeking to fill a 'black hole' of around £55BN and will do so by cutting spending and raising taxes.

However, the cost of Hunt's plans will be lower economic growth, which is a natural headwind to Pound Sterling's appreciation potential.

"Attention turns to the UK with the budget announcement on 17th November. We continue to expect GBP under-performance against most of the non-USD G10 currencies going forward," says Derek Halpenny, Head of Research for Global Markets EMEA at MUFG.

"Tightening fiscal policy into a recession to weigh on GBP," he adds.

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks